6. Competitors

1) Fat-burning energy drinks grab the market

Celsius (CELH), as a challenger to Monster, focuses on the healthy concept of "0 sugar, 0 calories, 0 fat", emphasizing more natural nutrients and claiming to help burn fat. This "fat-burning healthy drink" positioning has opened up a unique market path for Celsius and caters to current consumer trends. In the past two years, Celsius has received investment and distribution support from Pepsi, seemingly replicating Monster's development path.

In the field of fat-burning beverages, Monster successfully acquired Bang in 2023. Bang focuses on the fitness and fat-burning niche market, and its different positioning and pricing strategy from Monster enriches Monster's product portfolio while resisting Celsius' attacks on the fat-burning beverage market. It is expected that this will bring greater brand growth space to Monster.

In the energy drink track where Monster is in (strongly tied to extreme sports), it maintains a monopoly position, making it difficult for competitors to enter its core customer base. Other brands mainly offer similar niche sports energy recovery drinks, with serious product homogenization and little difference in brand value. Therefore, I believe that emerging competitors will not pose a substantial threat to Monster.

At the same time, sponsoring major extreme events, music festivals, and E-sports competitions is an extremely expensive brand building project. The investment in these expenses and the first-hand advantage in consumer stickiness have set a relatively large threshold for potential entrants.

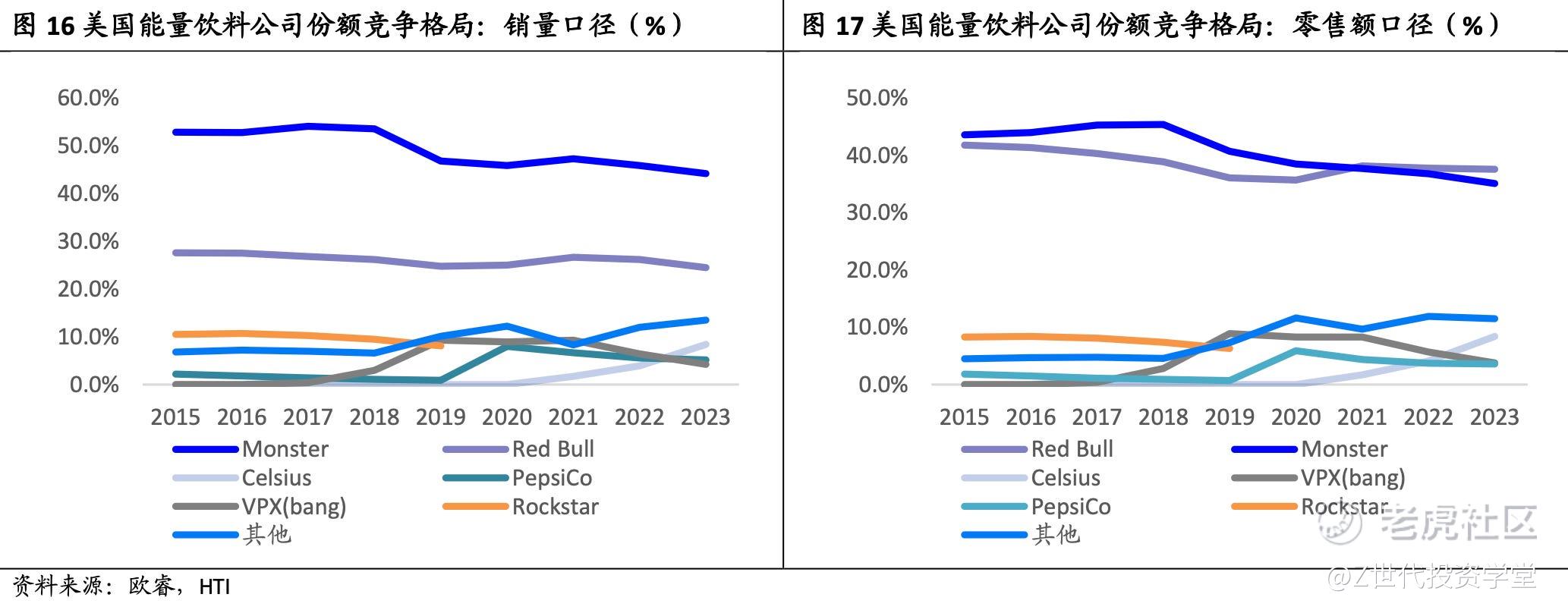

2)Monster and Red Bull are the US energy drink duopoly

-

In terms of volume, Monster held a 44.2% market share in 2023, significantly higher than Red Bull's 24.5%.

-

In terms of retail revenue, Red Bull and Monster had market shares of 37.6% and 35.1% respectively in 2023. The difference between the two is small, and both are much higher than other energy drink brands.

-

Between 2015 and 2020, Red Bull's market share declined each year. However, in 2021, Red Bull's market share rebounded, primarily due to the flexibility of its independent distribution system during the pandemic, which allowed for agile personnel management and adjustments in channel layout. Conversely, Monster’s market share decreased because many Coca-Cola bottlers faced labor shortages during inflationary periods. Red Bull’s own distribution network provided greater flexibility and resilience.

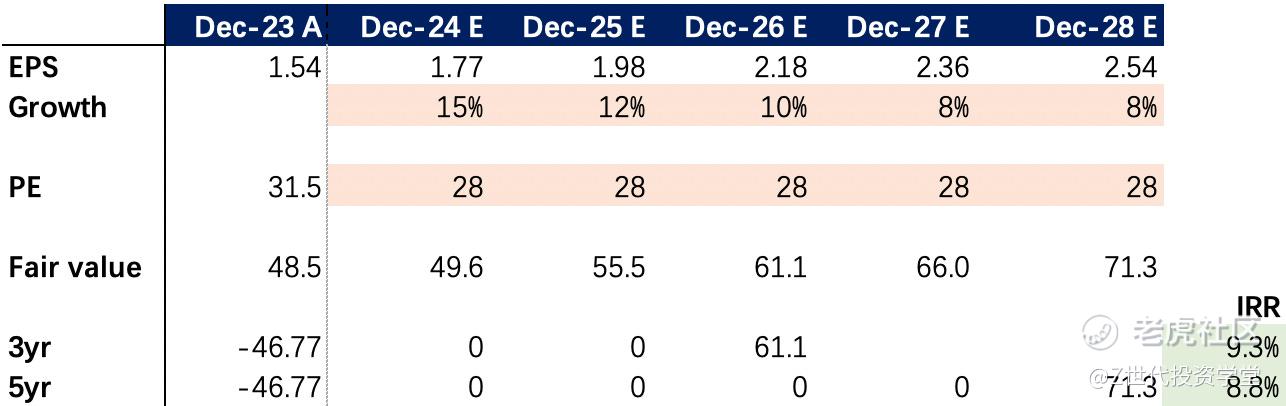

7. Valuation & Target Price

PE bands:

Target price:

Setting a growth rate for the next 5 years at 15%, gradually decreasing to 8%, averaging a 2% decrease per year until it stabilizes at 8%.

As of December 31, 2023, with a PE ratio of 31.5x, Monster is relatively overvalued, so setting the expected PE ratio for the next five years at 28x.

Based on these, Monster's target price after 3 years is approximately $61.1, and after 5 years, it is expected to be $71.3.

8. Risks

1)Profits are easily affected by economic cycles, causing fluctuations

Monster needs to procure raw materials such as aluminum cans, fruit juice, sugar, and additives, and transport them to third-party factories—its Co-packers. This dependence makes the company susceptible to periodic supply chain disruptions. For instance, the rising costs of packaging materials like aluminum cans, as well as increased freight and fuel expenses, have an impact.

Due to the inflation and war in 2021, the prices of various commodities surged rapidly, including oil prices. Consequently, Monster was affected by the rising costs of aluminum, fuel, and freight. To address issues like aluminum can shortages, labor shortages, low freight efficiency, container shortages, and port congestion during 2021-2022, the company resorted to costly air freight to meet consumer demand, which further increased costs.

To mitigate these adverse impacts, Monster expanded its supplier base and managed raw material inventories more effectively.

2)Distribution channels rely on Coca-Cola distribution system, but are also limited by this

Red Bull’s independent distribution system proved more flexible during the pandemic, allowing for agile personnel management and adjustments in channel layout. In contrast, Monster's market share declined as many Coca-Cola bottlers experienced labor shortages during inflationary periods.

Labor shortages among Coca-Cola bottlers directly affected Monster’s market share. Insufficient labor led to reduced production and distribution efficiency, hindering the timely supply of products.

Coca-Cola may prioritize distributing its own branded products, potentially affecting Monster’s distribution priority within their channels. This could result in Monster being overlooked or receiving fewer promotional resources in certain markets and channels.

In dealing with rising costs (such as transportation and fuel expenses), Coca-Cola's distribution system might pass these increased costs onto Monster, leading to higher operational expenses for Monster. This further impacts Monster's price competitiveness and market performance.

9. Recommendation

Monster has entered a mature stage of corporate development, and currently, there are no significant growth drivers visible for the future. Monster heavily relies on Coca-Cola's bottling and distribution system, posing supply chain and cost risks.

If Monster begins to invest heavily in both the U.S. and international markets to establish its own distribution network, it might address these issues. However, expanding its distribution channels will increase CapEx, potentially affecting stock price volatility, but it will also lay the groundwork for penetrating more potential markets in the future.

Currently, Monster’s stock price remains relatively high, making it an unsuitable time to buy. It may be wise to wait for a more opportune moment to invest.

10. Summary

As a company that mainly sells ready-to-drink energy drinks to bottlers and distributors, Monster expands its scale and seizes market share by cooperating with Coca-Cola's leading companies through price differentiation, product diversification, and light asset allocation. It is also strongly bound to extreme sports events and continuously marketed, constantly appearing in the public eye to refresh memories.

Monster’s shift in its business strategy has been highly successful. Based on Monster’s experience, achieving growth requires first selecting a large market where the company can capture a substantial share, and having a unique entry point. Following this, the company should gradually expand its product lines and then move towards global market expansion.

However, there is an undeniable issue that Monster entered Capital Markets early on. Capital Markets witnessed Monster's growth from revenue of hundreds of millions to billions and market value from hundreds of millions to tens of billions. If it had not entered the market when the product was just starting out, or even before the development direction and core product were determined, we might not have seen this hundreds of times growth.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.

如果你想了解有哪些前沿科技的投资机会,想学习真投资大佬们的投资秘籍,想投资自己的人生,那就快来购买《大赢家》漫画吧!漫画中采访了许多职业投资人和上市企业,通过有趣的故事传达投资理念,我们相信在阅读的过程,你一定会有所收获。https://product.dangdang.com/29564921.html#ddclick_reco_reco_relate

精彩评论