Wide Economic Moat and Cost Optimisation Efforts On Track To Improve Margin Gains

With the largest network of waste management facilities in North America, WM’s extensive infrastructure is a key cost advantage. The company operates over 300 landfills, more than 140 recycling facilities, and numerous transfer stations. This wide economic moat enables WM to achieve operational efficiencies, lower costs, and provide reliable services across a broad geographic area.

Additionally, WM’s investment in automation and technology enhances the efficiency and effectiveness of its operations, improving margin gains. By implementing routing optimization tools and automating residential routes, WM has been able to streamline its operations and reduce operating costs. These efforts have led to reductions in labour costs and repair expenses, particularly in its collection lines. By embracing technology and automation, WM has been able to improve the efficiency of its waste management processes, lowering costs while maintaining high service standards. The result of WM's cost optimization efforts is demonstrated by its revenue growth of 5.5% in Q1 2024, which was driven by improved operational efficiency and cost savings achieved through technology-driven initiatives.

Thus, WM's economic moat and commitment to cost optimization through technology and automation is a key driver of its margin gains. By focusing on operational efficiencies and reducing costs, WM can improve its profitability and deliver value to its shareholders.

Valuation

Discounted Cash Flow Model

This report employs the DCF model as its primary valuation methodology. Based on the DCF model, the 3-year and 5-year target prices of WM are USD $238.33 and $269.84 respectively. The inputs used in the DCF model are described below:

Beta: A beta of 0.71 was used for WM in the DCF model. This beta is calculated by dividing the product of the covariance of the security's returns and the market's returns by the variance of the market's returns over 5 years. The market selected is the NYSE Composite Index (^NYA). WM’s historical stock price data and NYSE Composite Index price data were retrieved from Capital IQ.

Cost of Equity: The cost of equity of 6.4% was derived based on the Capital Asset Pricing Model. The risk free rate of 4.52% was computed using the USA 10-year treasury yield. The equity risk premium is 2.66%.

Cost of Debt: A corporate yield curve rate of 5.21% is used. An after-tax Cost of Debt of 4.0% was derived after accounting for a tax shield from a tax rate of 22.43%.

Weighted Average Cost of Capital: A WACC of 6.04% was computed using the WACC formula - WACC=(E/V×R(e))+(D/V ×R(d)×(1−T(c))).

Projected Revenue Growth: The revenue growth was projected under 3 scenarios - (a) Bull, (b) Base and (c) Bear. The bull, base and bear scenarios project revenue at 7.00%, 5.00% and 3.00% respectively till 2026. The revenue growth rates are then projected at 4.00%, 3.00% and 2.00% respectively from 2026 to 2028.

Terminal Growth Rate: A terminal/perpetuity growth rate of 3% is assumed.

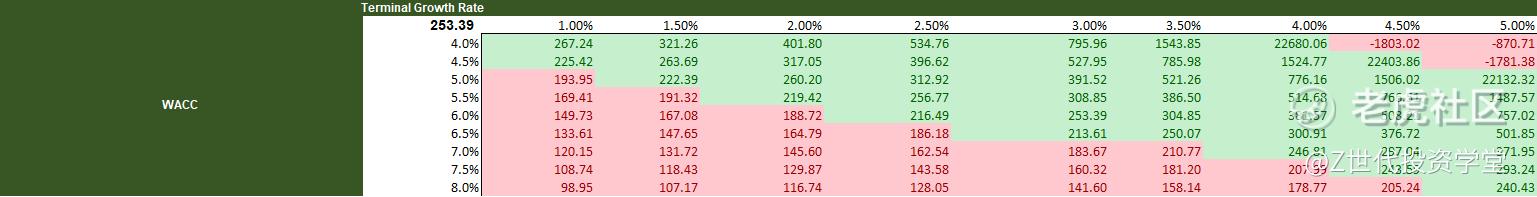

Sensitivity Analysis: A sensitivity analysis on the WACC and terminal growth rate was conducted to stress-test the valuations.

Scenario Analysis: Three scenarios - (a) Bull, (b) Base and (c) Bear - were created to stress test the DCF model. Based on the analysis, the 3-year target price of WM is $228.30 to $248.56 while the 5 year target price ranges from $253.39 to $286.96.

Relative Valuation Method

A company-comparable analysis is also performed when evaluating WM. This encompasses the Total Enterprise Value Multiples and Pricing Multiples. The Total Enterprise Value multiples computed are TEV/Revenue, TEV/EBITDA, and TEV/EBIT, while Pricing Multiples consist of the P/E ratio. The results of the analysis are shown below:

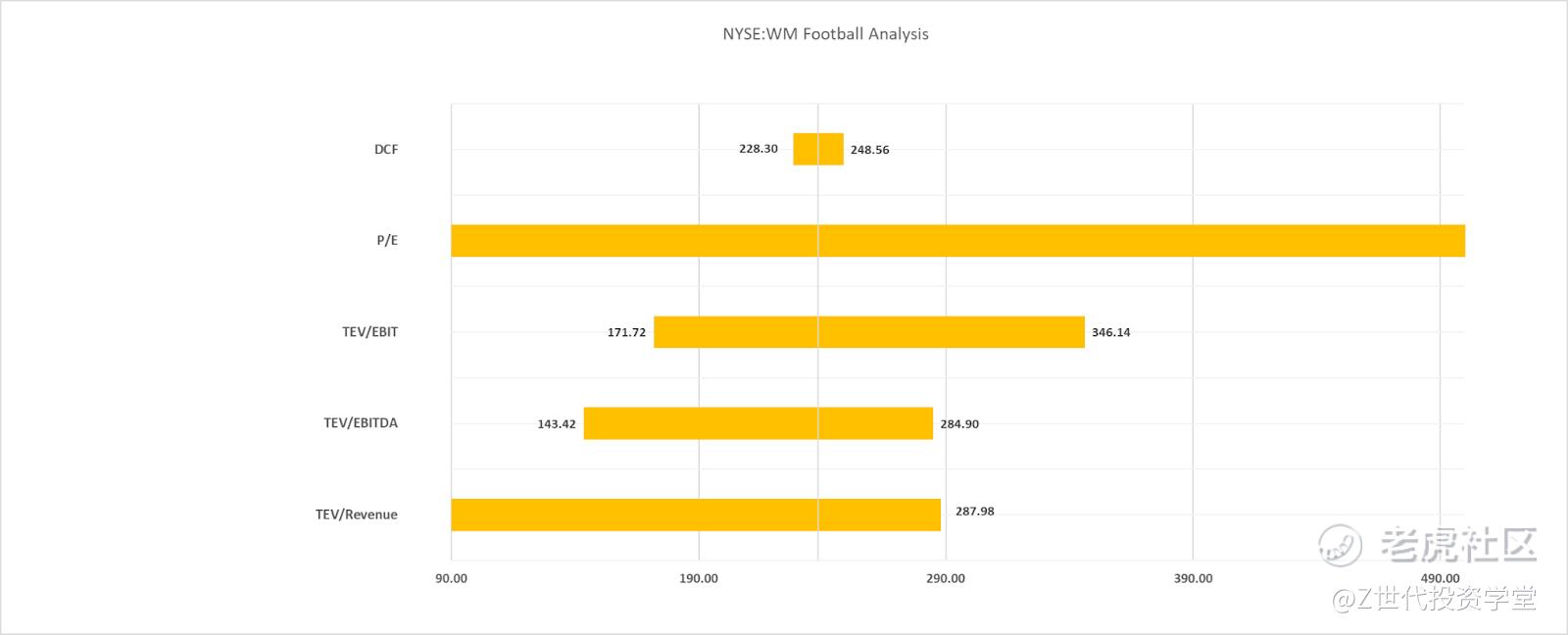

Football Field Analysis

The Football Field Analysis shows the 3-year target prices for WM using different valuation methods.

Investment Risks & Mitigation

Regulatory Changes and Compliance Cost: The waste industry is subjected to extensive regulations and oversight. WM and its competitors are subjected to several federal, state, provincial, and local regulations in the U.S. and Canada. These regulations impact almost every aspect of the companies' operations, including environmental regulations, health and safety rules, transportation laws, and zoning and land-use matters.

Shifts in (environmental and workplace safety) regulatory policies may significantly impact the company's operational and financial performance. For instance, regulatory changes may mandate new practices or technologies, leading to increased capital expenditures and operational complexities. Such regulatory development introduces an element of uncertainty and underscores the importance of closely monitoring regulatory developments that could directly affect WM's operations.

Mitigation: WM invests in advanced technology and infrastructure to stay ahead of regulatory requirements. For instance, WM’s connected Landfill™ technology is automated with telematics that offers their technicians and operations managers with real-time data in a dashboard format that can be viewed remotely. By proactively monitoring emerging regulatory trends and developments, WM can also anticipate changes and adapt its operations accordingly. For instance, WM is seeking ways to capture and recycle more material to meet consumer demand for recycled content in the years to come as states are passing laws requiring companies to use recycled content in new products and packaging.

Labour Unions: North American companies, such as WM, are often subjected to collective bargaining agreements by employees through labour unions. For instance, 450 employees of WM, who are members of the International Brotherhood of Teamsters union, negotiated for a five-year agreement that contains “numerous improvements to benefits, contract language and working conditions.” Employees' demands for higher wages and employment benefits, or resistance to the introduction of new technology and other initiatives could result in increased operating expenses and lower net income. Failure to negotiate acceptable collective bargaining agreements also increases operating expenses through work stoppages, including strikes. Additionally, WM is highly susceptible to such risks as a large portion of its workforce are hourly personnel, and many of these individuals, particularly in its recycling business, are paid at rates related to federal and state minimum wages.

Mitigating Factor: WM is able to bring in workers from other plants for their operations in the event of a strike. Such arrangements could ameliorate some pain for WM should there be a significant disruption to any area.

ESG Ratings Across Rating Agencies

This report reviews the ESG scores given by multiple rating agencies to provide a comprehensive view of WM’s ESG performance. Overall, WM is performing well in terms of ESG relative to its industrial peers.

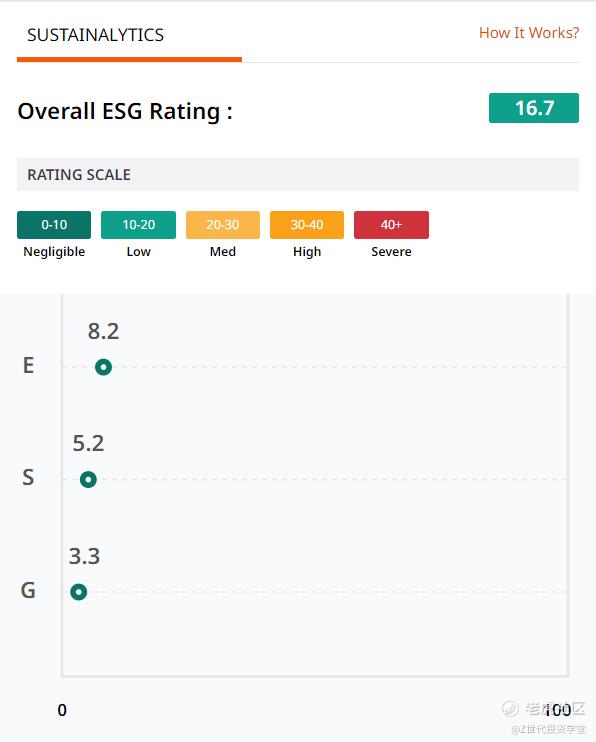

Sustainalytics Risk Rating

Sustainalytics’ ESG risk ratings assess the degree to which a company’s enterprise value is at risk driven by environmental, social and governance issues. WM is given a low total ESG risk score of 16.7, which places the company at 16th percentile.

S&P Global ESG Score

The S&P Global ESG Score assesses a company's performance on and management of material ESG risks, opportunities, and impacts through various sources, including company disclosures, media and stakeholder analysis, modelling approaches, and in-depth company engagement via the S&P Global Corporate Sustainability Assessment (CSA). The rating agency gave WM a score of 62/100 in October 2023, well above the industry average score.

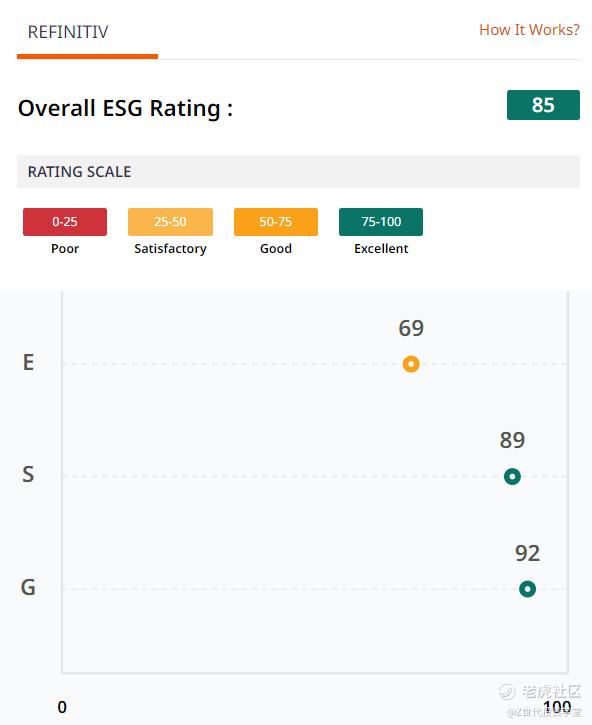

Refinitiv

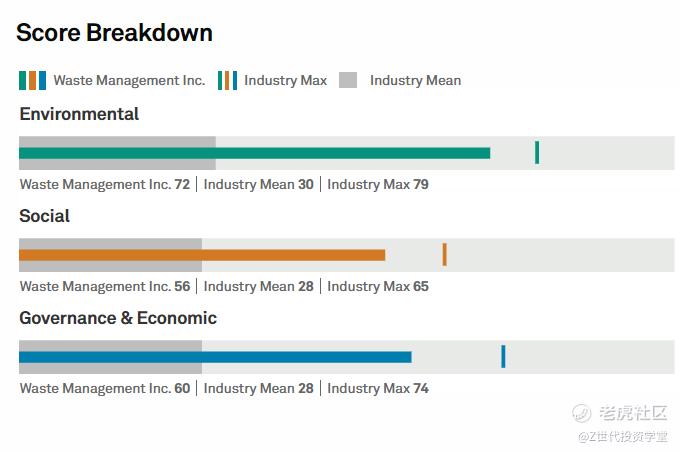

ESG scores from Refinitiv measure a company's relative ESG performance, commitment and effectiveness across 10 main themes (emissions, resource use, innovation, human rights, product liability, workforce, community, management, shareholders and CSR strategy) based on publicly-disclosed data. WM is rated an ESG score of 85/100 from Refinitiv. A detailed breakdown of the specific ESG category scores is shown below:

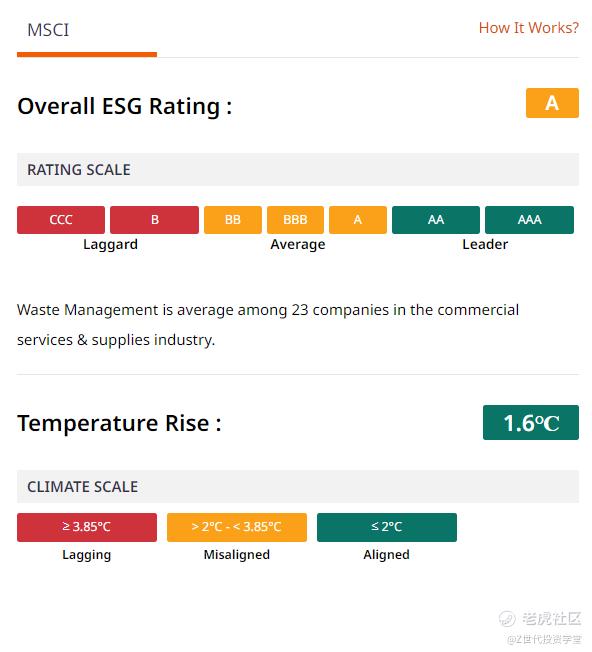

MSCI ESG Rating

MSCI ESG Ratings are industry-relative assessments and are determined at the company level. Ratings are on a global seven-band scale from AAA (the highest ESG Rating) to CCC (the lowest ESG Rating). WM is rated a score of “A”, placing the company in the average range. On the climate scale, WM is also well aligned with the Paris Agreement goal of limited temperature rising to below 2.0 Degree Celsius.

Conclusion

Overall, this report recommends a “Buy” on Waste Management Inc. (NYSE:WM). The 3Y and 5Y target prices based on a DCF analysis are $238.33 and 269.84. In terms of ESG, WM is also performing better than its peers, as shown by its better ESG ratings from various rating agencies.

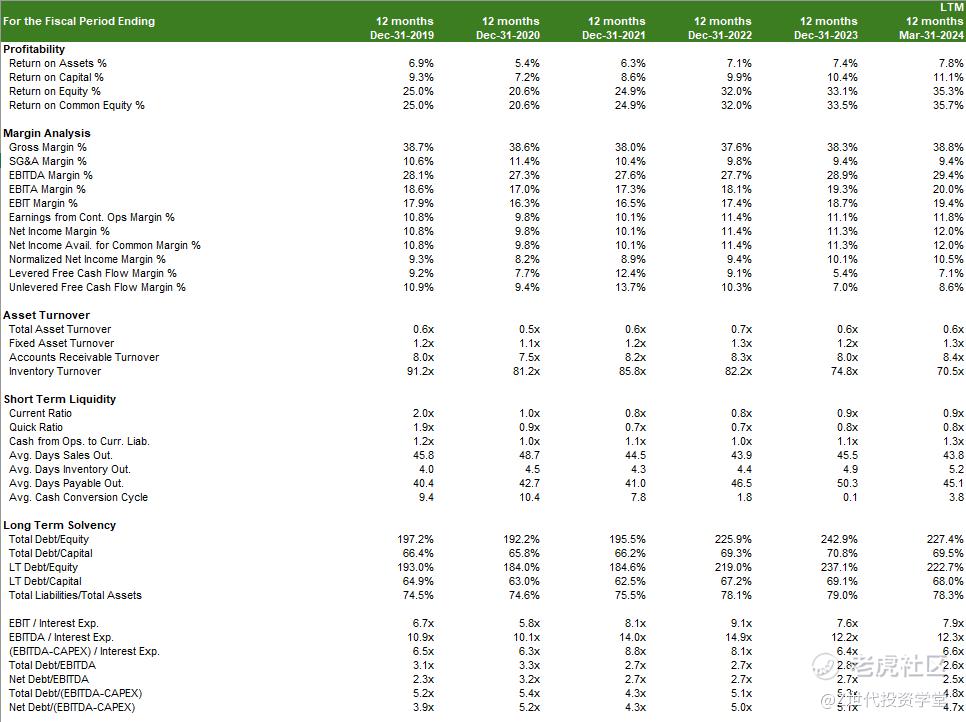

Appendix

Financial Ratios

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.

如果你想了解有哪些前沿科技的投资机会,想学习真投资大佬们的投资秘籍,想投资自己的人生,那就快来购买《大赢家》漫画吧!漫画中采访了许多职业投资人和上市企业,通过有趣的故事传达投资理念,我们相信在阅读的过程,你一定会有所收获。https://product.dangdang.com/29564921.html#ddclick_reco_reco_relate

精彩评论