Sustainability & ESG Considerations

Sustainability Strategy & Targets

WM’s sustainability strategy is centred on three core ambitions:

Material is repurposed

Under this ambition, the Company seeks to reimage a circular economy. WM strives to operate innovative recycling and waste solutions that help fuel the continuous reuse of materials. Using 2021 as a baseline, WM sets a target to increase recovery of materials by 60% to 25 million tons per year by 2030, including an interim milestone of a 25% increase by 2025.

Energy is renewable

Under this ambition, WM aims to innovate for climate progress. The Company leverages advanced technologies to turn waste into energy that powers communities and reduces GHG emissions. It aims to reduce absolute Scope 1 and 2 GHG emissions to 42% by 2031 (science-based target) and target beneficial use of 65% of captured landfill gas by 2026.

Communities are thriving

Under this ambition, WM focuses on empowering people to live sustainably. It collaborates to strengthen the resilience of the diverse places where we live and work. This includes increasing the representation of communities WM serve by increasing female representation from frontline to leadership roles and minority representation in manager and above roles. The Company also aims to reduce Total Recordable Incident Rate (TRIR) by 3% annually, targeting 2.0 by 2030 and continued focus on prevention of serious injuries. Moreover, WM strives to drive positive social impact for 10 million people in their communities through targeted social impact programs by 2030.

Sustainability Achievements

WM's commitment to sustainability is manifested by its numerous accolades and recognitions. The Company has consistently earned prestigious awards, underscoring its commitment to environmental responsibility and ethical business practices. WM was named as one of America’s Most Responsible Companies by Newsweek for four consecutive years. Additionally, it received recognition as one of the World’s Most Ethical Companies by Ethisphere from 2008 to 2023, showcasing its steadfast adherence to ethical standards. Furthermore, WM was recognized to be among the 100 Best Corporate Citizens by Corporate Social Responsibility Magazine, 3BL Media, spanning from 2015 to 2022, highlighting its dedication to corporate social responsibility. Moreover, the company is among CDP's “A” list for Climate Change from 2016 to 2020, which underscores its proactive efforts in combating climate change. These accolades serve as a testament to WM's unwavering commitment to sustainability and environmental stewardship.

Management Analysis

President & CEO

Mr James C. Fish Jr. currently serves as the president and chief executive officer for WM. He is also a member of the Board of Directors.

Mr. Fish's tenure at WM spans over 2 decades, during which he has held several key positions within the company. Notably, he served as the CFO in 2012, before his promotion to the role of President in July 2016. Prior to these executive roles, Mr. Fish held several significant positions within WM, showcasing his depth of experience and expertise in the waste management industry.

Prior to his role of CFO, Mr. Fish held positions of increasing responsibility within the company. He served as the Senior Vice President for WM's Eastern Group, overseeing operations in a crucial region for the company's business. Additionally, he held the position of Area Vice President for Pennsylvania and West Virginia, demonstrating his leadership capabilities in managing operations across multiple states.

Mr. Fish's extensive experience and track record make him a highly capable leader for WM. His strategic vision, financial acumen, and operational expertise have been instrumental in driving the company's growth and success. As President and CEO, Mr. Fish is expected to lead WM with a focus on innovation, sustainability, and delivering value to shareholders.

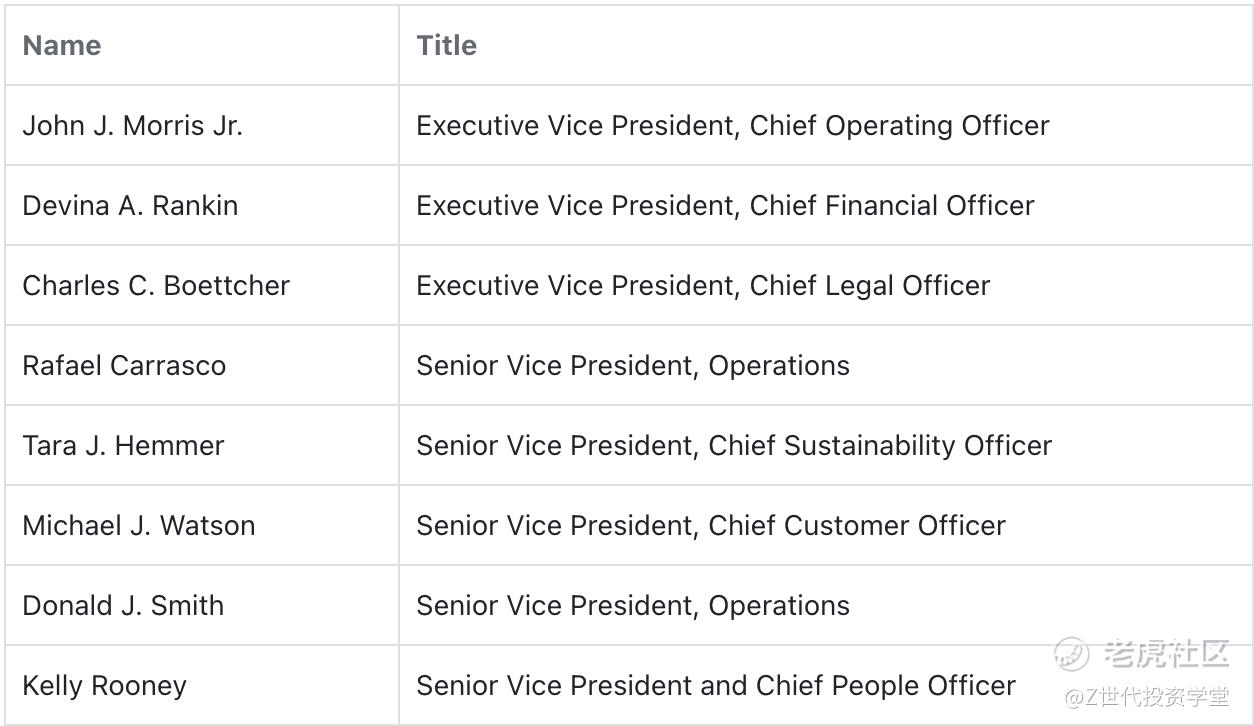

Other Key Executives

The average tenure of the key executives is 3.1 years. The WM’s executive team are shown below:

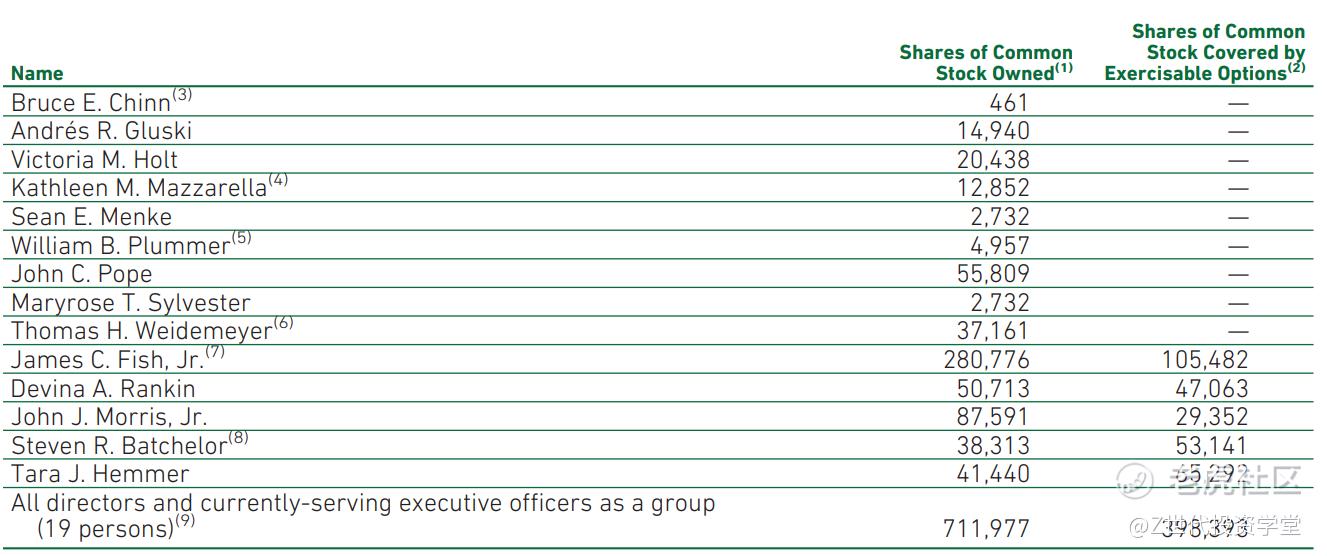

Alignment - Inside Ownership

The directors and currently-serving executive officers collectively owned 711,977 shares of common stock, constituting approximately 0.2% of inside ownership. This insider ownership underscores the alignment of interests between directors and members of the management team and confidence in WM. A breakdown of ownership is shown below:

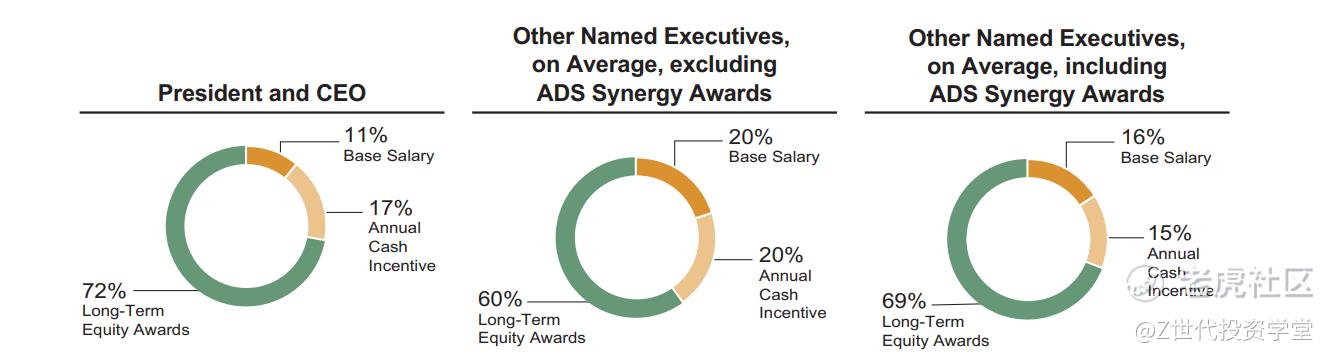

Alignment - Executive Compensation

WM’s executive compensation program encompasses 4 elements: (a) Base Salary, (b) Short-term Performance Incentives - Annual Cash Incentive, (c) Long-Term Performance Incentives - Performance Share Units, (d) Long-term Incentives - Stock Options and (e) Long-term incentives - Restricted Stock Units.

Currently, 72% of total compensation of WM President and Chief Executive Officer was linked to long-term equity awards, and a majority of total compensation of other named executives, on average, was tied to long-term equity awards, which aligns executives’ interests with those of stockholders.

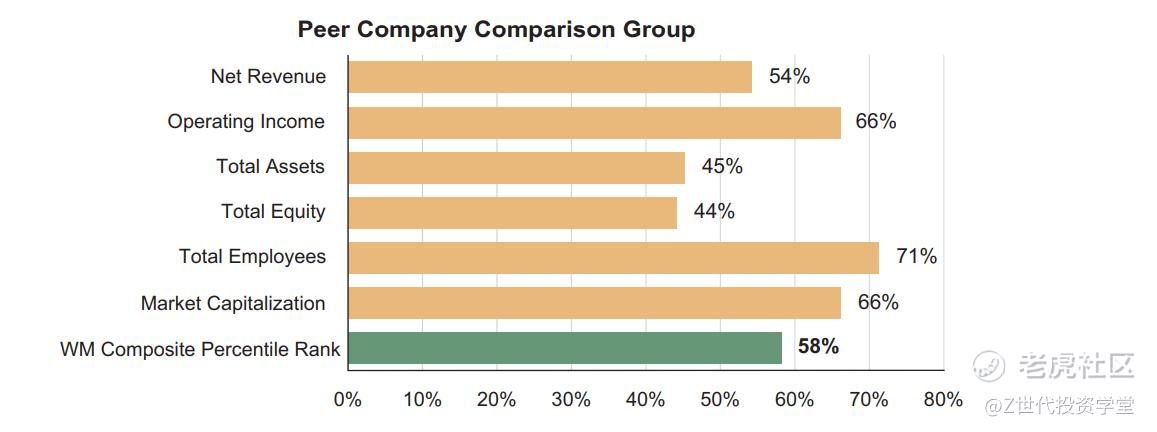

Accountability - Executive Compensation Structure

The MD&C Committee employs compensation data from comparison groups of companies to remain competitive, ensuring the attraction and retention of key talent. This information is sourced from:

-

Size-adjusted median compensation data from two general industry surveys in which management annually participates; the Aon Hewitt 2020 Total Compensation Measurement Survey and the Willis Towers Watson 2021 Executive Compensation Database Survey.

-

Median compensation data from a comparison group of 20 publicly traded U.S. companies, described below.

The following metrics are also utilised to determine WM executive compensation benefits

Industry Analysis

WM mainly operates in two main markets: (a) Canada and (b) the United States of America (U.S).

Canada Market Size & Structure

The Canada waste management market size was valued at USD$34.5 billion in 2023 and is expected to grow to USD 49.16 billion by 2023, with a CAGR of 5.2% from 2024 to 2030. This market growth is driven partly by rising demand for eco-friendly waste management solutions as well as more stringent environmental regulations by governments.

In Canada's waste management industry, market share concentration remains relatively low. Waste Connections Inc., Waste Management Inc. and Secure Energy Services Inc. have been identified as the largest three waste management operators in the Canadian market.

U.S. Market Size & Structure

The U.S. waste management market size was valued at USD 342.7 million in 2023 and is expected to reach a compound annual growth rate (CAGR) of 5.2% from 2024 to 2030. The growth of the US waste management market is driven by several factors. The expanding population and increased globalisation have led to an increase in waste generation volume. This, coupled with mounting environmental concerns and the adoption of sustainable waste management practices across industries. The proliferation of illegal dumping and increased pollution have also contributed to the strong growth of the market.

WM maintains a virtual duopoly over the garbage industry in the U.S. along with Republic Services. The company leads with a market share of 53%. Collectively, the two companies collect more than half of all garbage in the U.S.Competitor Analysis

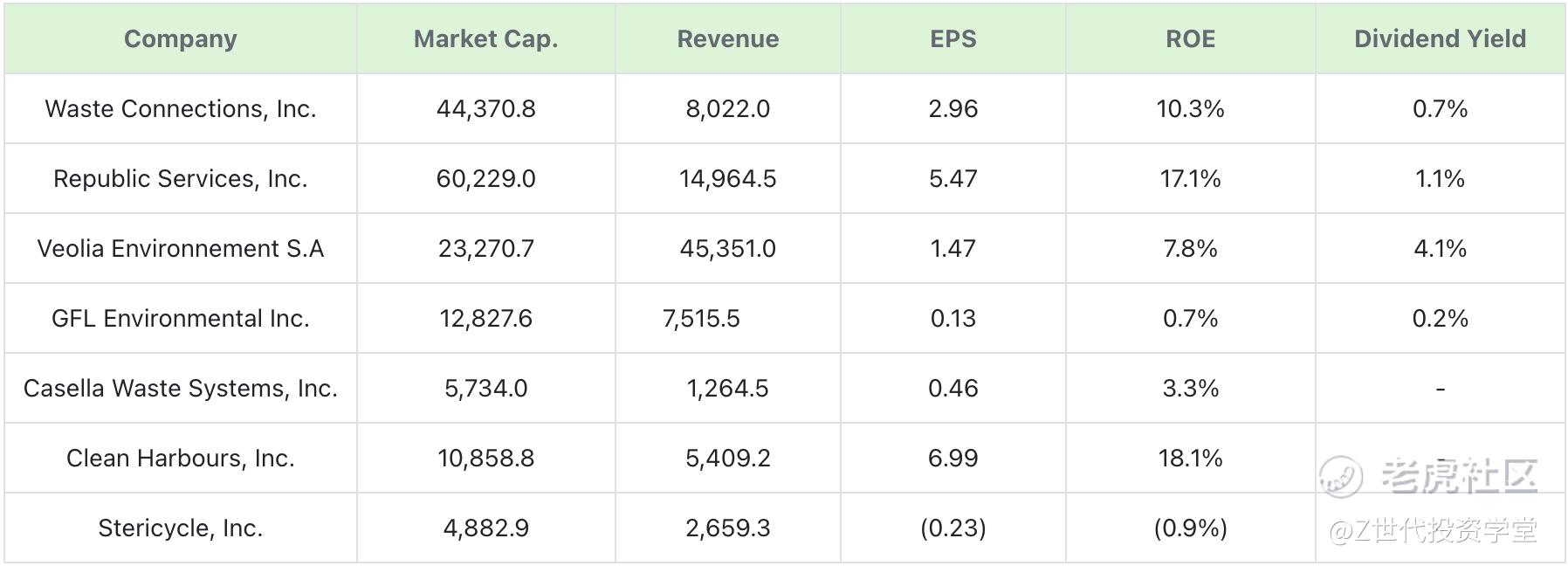

North American Waste Management Companies

-

Waste Connections, Inc. - Headquartered in Woodbridge, Canada, Waste Connections provides non-hazardous waste collection, transfer, disposal, and recycling services in the United States and Canada.

-

Republic Services, Inc. - Based in Phoenix, Arizona, Republic Services, Inc. offers environmental services in the United States and Canada.

-

Veolia Environnement S.A - Headquartered in Paris, France, Veolia Environnement SA designs and provides water, waste, and energy management solutions worldwide, focusing on resource management and environmental services.

-

GFL Environmental Inc. - Headquartered in Vaughan, Canada, GFL Environmental Inc. Offers solid waste management and environmental services in Canada and the United States, including collection, transportation, recycling, and disposal.

-

Casella Waste Systems, Inc. - Headquartered in Rutland, Vermont, Casella Waste Systems, Inc. Operates as a vertically integrated solid waste services company in the United States, providing collection, transfer, recycling, and disposal services.

-

Clean Harbours, Inc. - Based in Norwell, Massachusetts, Clean Harbors, Inc. Provides environmental and industrial services, including hazardous waste disposal, industrial maintenance, and specialty services in the United States and internationally.

-

Stericycle, Inc. - Based in Bannockburn, Illinois, Stericycle, Inc. specialises in regulated waste and compliance services, including medical waste disposal, secure information destruction, and compliance solutions in the United States, Europe, and internationally.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.

精彩评论