Core Value:

Value investing in the best growth opportunities and share with our investors on the way.

What we are looking for:

1, Those with strong competition advantages, especially coming from economy of scale and customer captivity;

2, Those still have great potential to grow;

3, Those with honest, capable management;

4, Those who have not been overly priced for their future opportunities;

In short: BEDROCK seeks out undervalued stocks of growing companies we understand with honest, capable management.

Recent Thoughts:

1, In a low and even negative interest rate environment, everybody is urgently cashing out future stories, making our way of value investing in growth even more difficult.

2, The interest in HongKong market suddently surged during the first month of 2021 with massive inflow from mainland as investors miraculously (as this is the case for years) noticed that HK market is remarkably cheaper than the A share market. Even though, we share some of the views with the marekt, we should understand that most of the sectors and stocks the inflowed mainland capital are chasing at are those hyped growth areas with heightened valuations which might not guarantee satisfactory future returns.

3, The biggest opportunities, as we see, are in those areas the market now choose to left behind as it busy chasing after good future stories with no matter how high the valuation. For us, our strategy is not to anticipate how the market wind will turn, but to analyze the future possible return with how much risk we take and whats the price we pay.

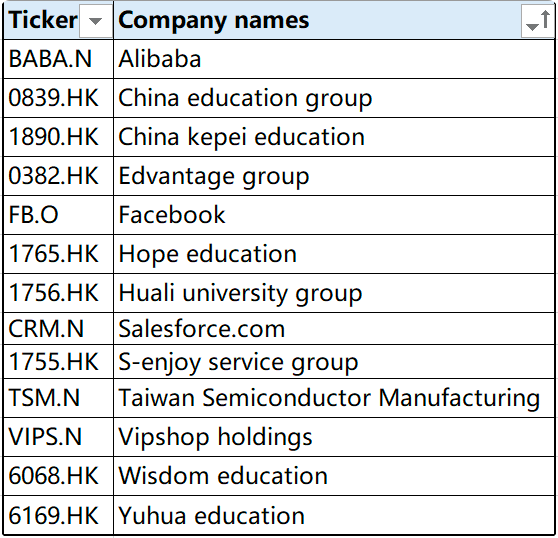

4, All in all, we believe that the tech giants are mostly with feasible though not cheap price tag, probably people are feared of anti-trust movements, and that’s why we still hold some positions in those areas including FB, CRM, TSM, BABA, etc. And we also hold many positions in the modern service providers, for example property management, education, etc, as we believe the market is still greatly under-appreciate their solid future growth opportunities.

5, As for the recent fear that the inflation could come back and drive up the yield, thus cause the market to go down, we believe that the reason the yield being so low is the result of the difficulties that the pandemic brought, not the way around. That’s why we believe the yield should rebound to a more normalized level as soon as we keep the pandemic under-control and the economy gaining momentum again. However, we do not believe that the inflation and yield can go up forever, given globally sufficient productivity ability and the long term growth still in the process of decelerating. The market stumble could be triggered by this fear, but it also a result of overly crowded trading, expecations too high and valuation too rich, etc. The market may adjust a little though still a long way to go. Our thoughts and understanding of the market has not materially changed.

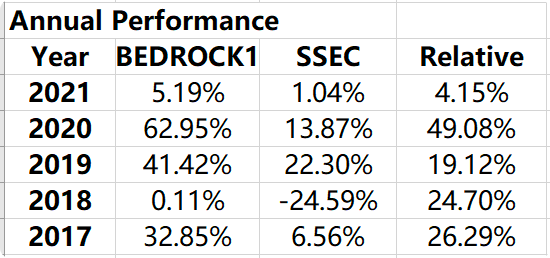

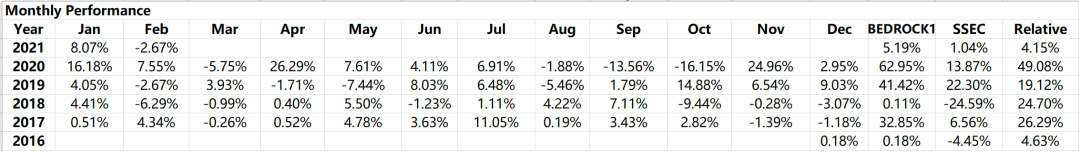

Past performance:

Recent net value/share: 3.22

Focusing on best opportunies in tech and consumer sectors only:

BEDROCK chooses investment opportunties only based on the companies themselves and will not rely on the speculations on the market overall. BEDROCK continued to invest opportunies from those who can generate economy of scale (many in internet, cloud, payment, etc), who with strong brand and customer capativity, and who can achieve localized monopolies.

Major holdings (aphabetical order):

Past trades and capital allocation tactics:

In this month we gradually increased our position in VIPS and reduced some weight in CRM, given our adjustment of the future cash flow models.

VIPS(Vipshop holdings):

Competition Analysis: Even though the E-commerce market is still full of competition and innovation, the major trend and value proposition we believe have already set. Given the fact that nobody has a dominating control over the E-commerce infrastucture, mainly payment and delivery, as the Amazon has in the states, the difference in traffic, value proposition, efficiency will set the cause of different E-commerce platforms.

Our basic summary of the valuation propostions of the major platforms are:

Taobao of BABA: cheap+ massive SKU; Tmall: authentic and quality, standard price; PDD: cheap (which means many times againt OEMs); JD: 3C+quality+standard price, very few female consumers; Live streaming commerce: new+popular+KOL, which means fewer SKU and high transaction fees, and too many commerce will dilute the parent entertainment platforms; Community group-buying: fewer SKU+ high price sensitivity.

Even though we have so many E-commerce platforms we found that VIPS’s offering still quite unique: authentic and quality+ off price. We believe that value proposition could cater many consumers’needs that can not efficiently satisfied by other platforms.

After VIPS spin off its own delievery and work with SF in late 2019, its satifactory rate improved and the saved money could be better used to attract new customers and increase customer LTV by appealing them to spend more on its platform.

Runway Analysis (growth potential): Analyzing VIPS pricing power is relatively simply that unlike other platforms which aim to reach profitability only after they are mature and big enough, VIPS’s target of high value added products (apparel, cosmetics, etc) and its ability to sell un-popular and off the season products both make VIPS can book a gross margin over 20%. After spined off delivery branch and outsourced to SF, VIPS now reached a net margin 7% and free cash flow margin of 8%, even after it spent more on marketing and customer acquisition. We believe that level of net margin can sustain and even go higher in the future as operating leverage continues to improve. We believe better customer satisfactions and wise capital allocation could unlock a brighter future of potentially 200m annual customer and 2000 ARPU vs current 83m and 1200. A number still dwarfed by BABA’s 800m and 10000, however could be quite significant for VIPS.

Pricing Analysis: VIPS now priced at 25b usd, 2021 19x PE, 12EV/FCF. Considering our projection of 2021-2024 compounding growth of 30%, its valuation is still quite cheap though already appreciated a lot during 2020. The huge expectation turn around probably because the market previously believed that VIPS’s fate is doomed as it was surrounded by other giants and now the market still neet time to digest its potential. We believe as long as its customer acquisition, satifaction, recurring consumption stay on track, its long-term valuation could reach 100b usd and offering an attractive 30% IRR opportunity.

CRM(Salesforce):

Even though we have no questions on CRM’s competitive advantage and the fact that its valuation still quite cheap, we cut its IRR projection to 15% from 15-20% after adjusting our models.

Currently, CRM’s guidance is to reach 50b revenue by 2025, doubling its 2021 25b revenue, which means a compounding growth rate of 19%. However, we believe to achieve that goal CRM needs constantly acquisitions, given its internal growth we believe can only generate a much moderate 16% growth rate in the future years. Under current market situation, CRM can never easily acquire a quality target under 20x ps, meaning to dilute shareholders equity as CRM trading around only 7.7 ps. Furthermore, 3% revenue equals nearly 1 b revenue and 20b market cap which cannot be matched by the 4b free cash flow CRM generates. As for the internal improvements, which are quite disappointing, CRM still struggle with acquisition integration and the cross-selling opportunities turned out to make slowly progresses.

In the coming months, BEDROCK will remain largely conservative, be watchful for the “irrational exuberance”and look for long-term opportunities still within resonable valuations.

Further worlds for our investors and partners

1, Our investment choices might be very different from the trending sectors or names the market chooses, because we do not make investment decisions based on anticipating the market preference, thus our results might be siginificant lag behind the market, at least in the short term.

2, Our past performance can never guarantee our future success. The reason that we generated around 38% compounding returns in the past 3.5 years while our criterion of choosing targets is 15% plus compounding returns is mostly from luck that market has been quite volatile in this period that provided good opportunies of buy low and sell high. Therefore, in a market where everybody is so hyped up or the market makes no mistake, we will be difficult to generate a comparable return in the future.

3, As always, we will less focus on the market itself, as the market is so complex and full of variables, making it almost impossible to predict accurately and with the enough certainty we ask for. The path we choose is rather slow and ingenious that we only make investment decisions based on long term valuation creation. Even though we can never isolation ourselves from the influence of the market and other investors, we should keep in mind where the foundations are.

Always stay with the best

It is very easy to be enticed by opportunties as short term sepulations, however BEDROCK believes that not many investors, certainly not us, can always win in a zero sum game. BEDROCK continously chooses to focus on the opportunities of potential great value creation by the best companies. What BEDROCK wants are stocks with satisfactory valuation that are also high quality and growing, with a high degree of certainty about the long-term outlook.

BEDROCK believes that value investing in the best growth opportunities, with a global horizon, would achieve great results.

Thanks for the trust and support!

Happy New Year! And wish you make great progress in 2021!

BEDROCK

2021/03/01

精彩评论