$GameStop(GME)$Gamestop confirms

Short position exceed available shares.

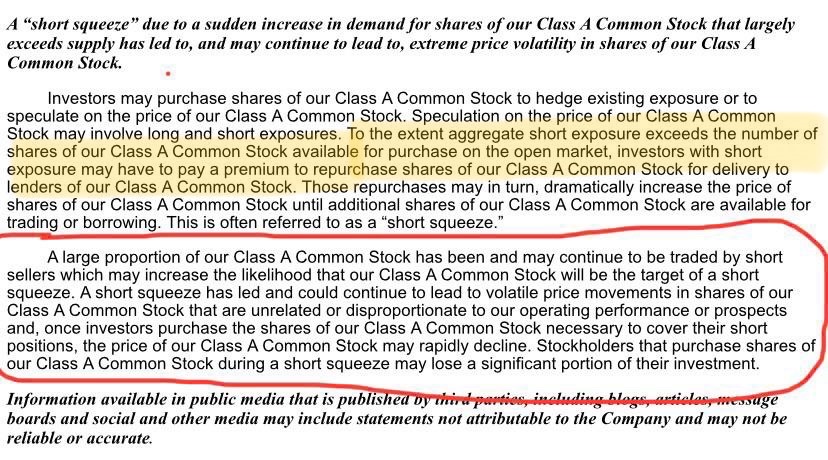

A “short squeeze” due to a sudden increase in demand for shares of our Class A Common Stock that largely exceeds supply has led to, and may continue to lead to, extreme price volatility in shares of our Class A Common Stock.

Investors may purchase shares of our Class A Common Stock to hedge existing exposure or to speculate on the price of our Class A Common Stock. Speculation on the price of our Class A Common Stock may involve long and short exposures.

To the extent aggregate short exposure exceeds the number of shares of our Class A Common Stock available for purchase on the open market,

(here they're saying there is more than a 100% shorted)

investors with short exposure may have to pay a premium to repurchase shares of our Class A Common Stock for delivery to lenders of our Class A Common Stock. Those repurchases may in turn, dramatically increase the price of shares of our Class A Common Stock until additional shares of our Class A Common Stock are available for trading or borrowing. This is often referred to as a “short squeeze.”

精彩评论