周末一边阅读《What It Takes》(非常精彩,推荐),一边修改我们的网站(www.bedrock-invest.com) ,突然翻到去年写的一篇小作文,想到当时正刚刚从创业以来各种危机中逐渐看到隧道的光亮。。。就觉得真是不容易。。。

当然,直到今天我们依然处于创业的早期阶段,还远远谈不上成功,不过这个过程本身就已经充满收获和开心了。。。

Bad luck?

It is quite obvious that the timing of our establishment couldn’t have been worse. We resigned from our original company in the second half of 2021 to establish BEDROCK, and by the end of the year, we had set up a dual-currency fund in RMB and USD. In fact, we didn’t cherry-pick this timing. Although our investment style has always been long-term value investing, we believed at the time that as long as our global strategy (mainly focusing on China and the US) could find enough companies that were sufficiently cheap, even though it was quite difficult in that environment, we shouldn’t make choices based on timing.

Moreover, starting a business is a long-term career choice for us (perhaps for the next 30 years?). So, if we are lucky enough to find operating partners (my operating partner used to be the COO of the largest private wealth management firm in China, and has long been tracking and studying my performance in previous investment institutions) and cornerstone investors who support us in the long term, what more can I expect?

Of course, what actually happened later in 2022 was far beyond our expectations. Whether it was the Russia-Ukraine War, the Federal Reserve's crazy interest rate hikes to levels far beyond our expectations (the expecation of the terminal rate hike went from about 2% at the beginning of the year to near 6%), the lockdowns due to the covid in China, the collapse of China's real estate market, the terrible political leaders reshuffle in China, or the severe impact of conflicts between China and the US on the market, all were far, far beyond what we imagined at the end of 2021 and the beginning of 2022... And our previous investment strategy was more company-centric, so the reality was that stock prices were always falling ahead of our expected adjustments, leaving us constantly in the dilemma of "it’s already very cheap, why do we need to sell?"..."

Global Systematic Value Investing Growth

I probably started using these four words to express investment strategy and direction when I was still managing at HSAM (Sequia China affiliated secondary platform). The core concept behind this is that compared to focusing on a single market (such as A-shares, H-shares, etc.) and then selecting stocks, I hope that our investment strategy is not developed around the market, but around a long-term more effective investment philosophy that we believe in. To figure out what kind of long-term strategy we should establish, we have conducted years of investment practice, industry research, and read a large number of more fundamental basic science books, including but not limited to mathematics, physics, biology, history, anthropology, psychology, etc., trying to understand the meaning of the Lattice theory mentioned by Charlie Munger...

(In previous pitches, there was feedback that these four words have been overused... they are "buzz words"... well... I think it is necessary to explain a bit more here.)

Anyway, the first and last words among these four represent where we mainly look for investment opportunities:

Global: We are truly facing global opportunities, of course, the core is still opportunities in the United States and China, and we also look at some opportunities in Europe and other regions, but the proportion is relatively small. Therefore, our strategy is significantly different from those focused on a single region.

Growth: Although we consider ourselves to be staunch value investors, we believe that the opportunity to generate compound interest lies more in future opportunities, rather than simply low PE, low PB static valuation pricing. Therefore, although we are broader at the country level compared to general funds, we are more focused on industries (although, we are not purely industry funds) - we mainly focus on technology and consumer sectors.

Value: Without saying more, we believe that the underlying nature of value is mathematics based, a mathematical problem of long-term cash flow discounting. Because of this, we believe that its logical foundation is the most solid, and we are most convinced of it ourselves.

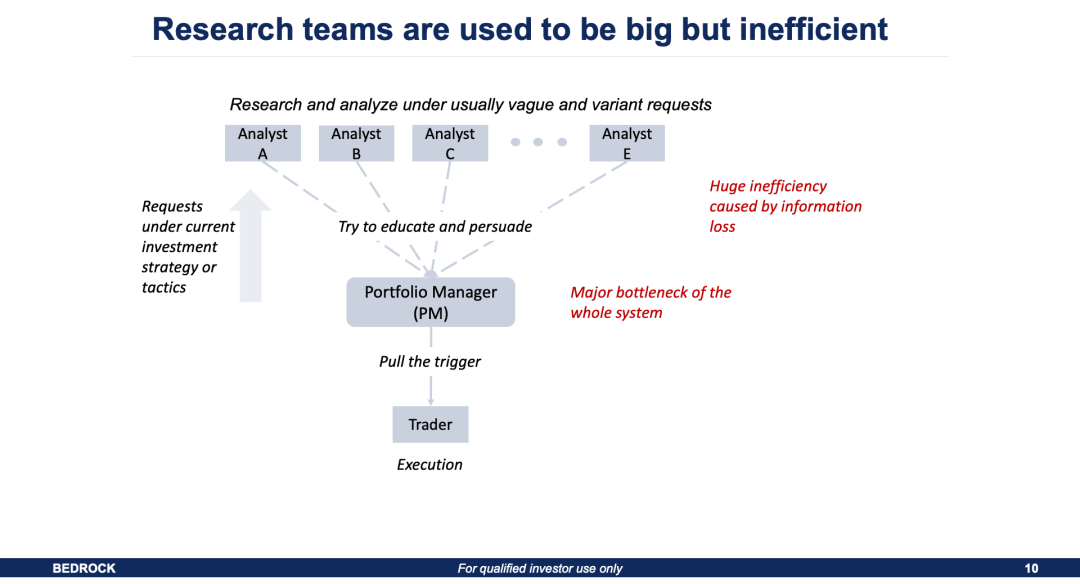

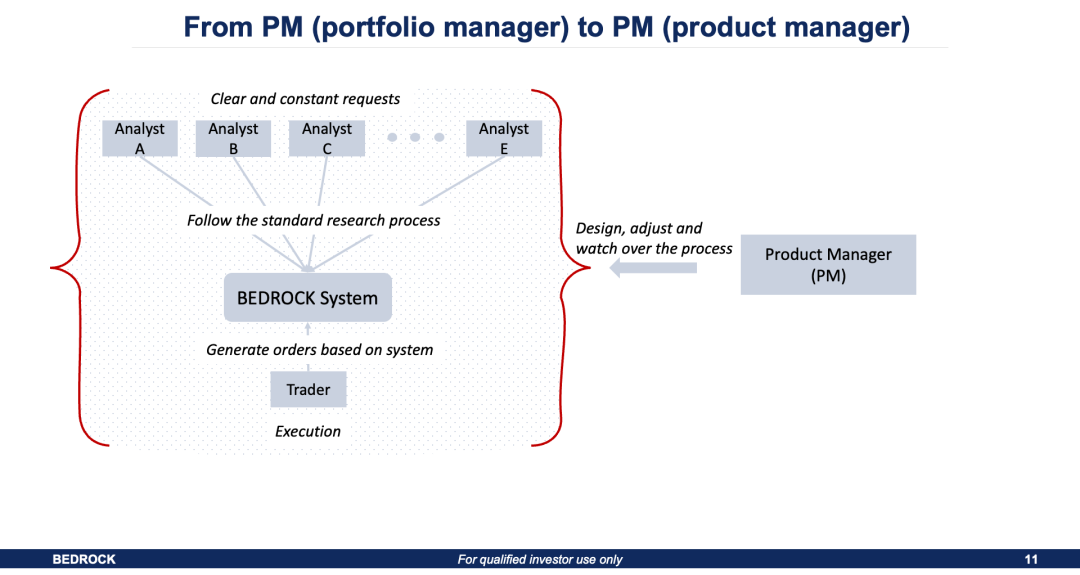

Systematic: This word is the easiest to be misunderstood, obviously maybe too many institutions mention this word, but we are probably more serious about it than most institutions. In fact, in the various institutions I have been in, including Morgan Stanley Asset Management, China Universal (one of China's largest equity investment funds), HSAM (Sequia China affiliated secondary platform), due to the actual short-term performance pressure, and the need to integrate many investment style elements, numerous details in investment, and the popularity of so-called "artistic" approaches, the actual investment decision-making process is far less systematic than imagined, and there is almost no synergy between investment research and investment managers. We have done a lot of work hoping that after clarifying investment philosophy, process, and a lot of running-in, our investment research work is more systematic and engineered.

So essentially we hope to build a system to look for companies with protected growth opportunities globally, and pick those possible to generate more than 15% IRR, so essentially we are asingle-strategy fund. This uniformity makes us more unified internally and clearer and more transparent externally.

How is it going?

The dismal year of 2022 was a heavy burden on our annual performance (around -20%), especially since all the global technology and consumer sectors, where our primary investments are, were hit hard. This put us under significant pressure in terms of fundraising.

However, the silver lining is that we have made substantial strides in team building, process and system development, and personnel training. As we are centered around a single-strategy methodology, we don't need to constantly change based on market preferences, which allows us more time and energy to discuss and continuously refine our strategy. We can make ongoing fine-tuning adjustments to the underlying methodology, steering it towards a more scientific direction. For instance, we have added some elements in macro and policy aspects that could have long-term impacts, and the diversification of our portfolio has become more balanced...

Our capabilities have also seen significant improvement. Our research scope essentially covers the most competitive advantage and growing industries and stocks in the technology and consumer sectors in China and the US (though not all), and we are continuously deepening our understanding of core companies and expanding our horizons...

The entire team operates like gears, may start slow, but meshing more closely, and the rotations are gradually gaining momentum, becoming faster and more efficient. As we have high standards for systematization, our entire investment research team (currently 5 people) shares a single model, which covers over 200 companies. We categorize them into three levels and continuously update and maintain their models and industry databases according to different requirements. This approach was difficult to initiate because it requires everyone to conduct company research and modeling according to an unified standard (even down to the format), and anyone who modifies the model needs to write a log to facilitate better maintenance by others. We have now iterated to over 1000 versions...

All in all,

In the long run, we believe that starting at a terrible time and paying a lot of 'tuition fees' right from the beginning may not be a bad thing... At least we realize many of our shortcomings and weaknesses, and we are striving to optimize and improve them... And we still have unwavering faith in the underlying values of real investment...

Thank you very much for reading. I have rambled on and written some of our stories. Of course, more details about the fund and more Q&A are included in a PPT in the appendix.

Looking forward totalking to you in person.

Cong

2023/07/05

for illustration only:

精彩评论