Last week, I discuss about the possibility of profiting with option. With the market still not having a clear direction, I will look to selling put whenever market open down or invest in shares outside my current tech heavy portfolio.

1. $Skillz Inc(SKLZ)$affected by the offering, price open lower ytd but manage to climb back up. They offer a interesting model of e-sport gaming with some form of “gambling“ element. Already in Cathie Wood Ark portfolio, I will be looking at around $25 or $22.5 strike for my sell put.

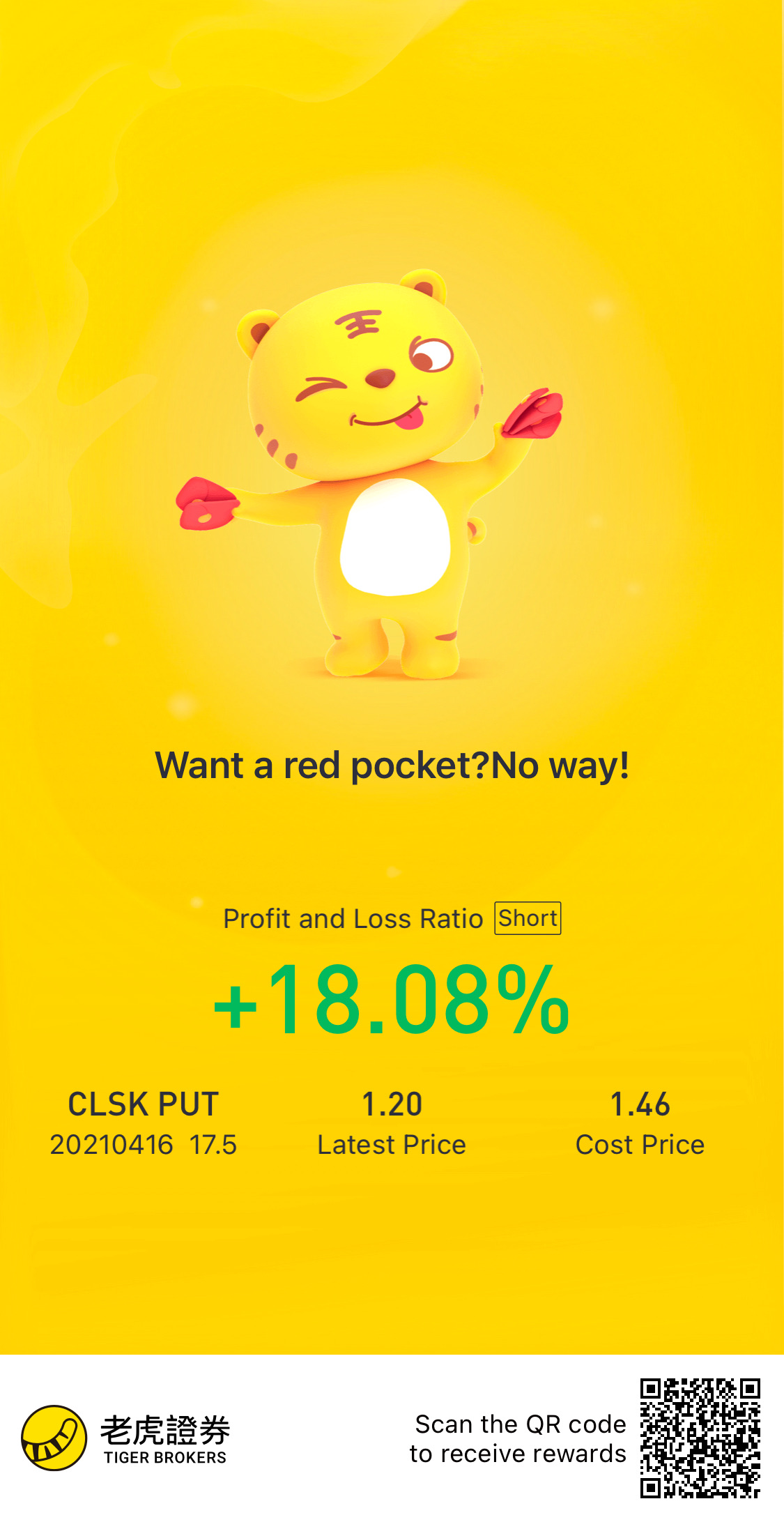

2. $CleanSpark, Inc.(CLSK)$also affected by offering, the price has fallen 2 days ago. Yesterday, it manage to close greener. Already got in yesterday at 17.5. Will look at around 80% plus profit before closing if possible.

3. $Rocket Companies(RKT)$rocketed afterearning but back to the 24-25$ range. This stocks had been steady before earning and is of totally different sector than the current tech or energy wooha. If it open lower, selling put or even holding it for a long run will bea good choice. It has strong earning and looking to venture into more than mortgage. But it might be affected if rate hike.

PS: Don’t bindly follow a GreenHorse 🐎. Please do your own DD

精彩评论