Universe Pharmaceuticals, a Chinese medicine manufacturer, updated its S-1 on SEC website, planning to go public on Nasdaq under the ticker symbol “UPC” next week.

The Jiangxi, China-based company aims to raise $30 million by offering 5 million shares at a price range of $5 to $7. At the midpoint of the proposed range, Universe Pharmaceuticals would command a market value of approximately $126 million.

Founded in 1998, the company specializes in the manufacturing, marketing, sales and distribution of traditional Chinese medicine derivatives (“TCMD”) products targeting the elderly with the goal of addressing their physical conditions in the aging process and promoting their general well-being. Universe Pharmaceuticals says in its prospectus that its products are sold in approximately 261 cities of 30 provinces in China.

According to a research report released by insightSLICE last month, traditional Chinese medicine (“TCM”) accounted for 40% of China’s pharmaceutical market in 2019, and the TCM market is seeing prominent growth avenues on account of the increased acceptance from various developed and developing countries. The outbreak of Covid-19 also presents growth opportunities for TCMD products, with the rapidly growing health and wellness market in China.

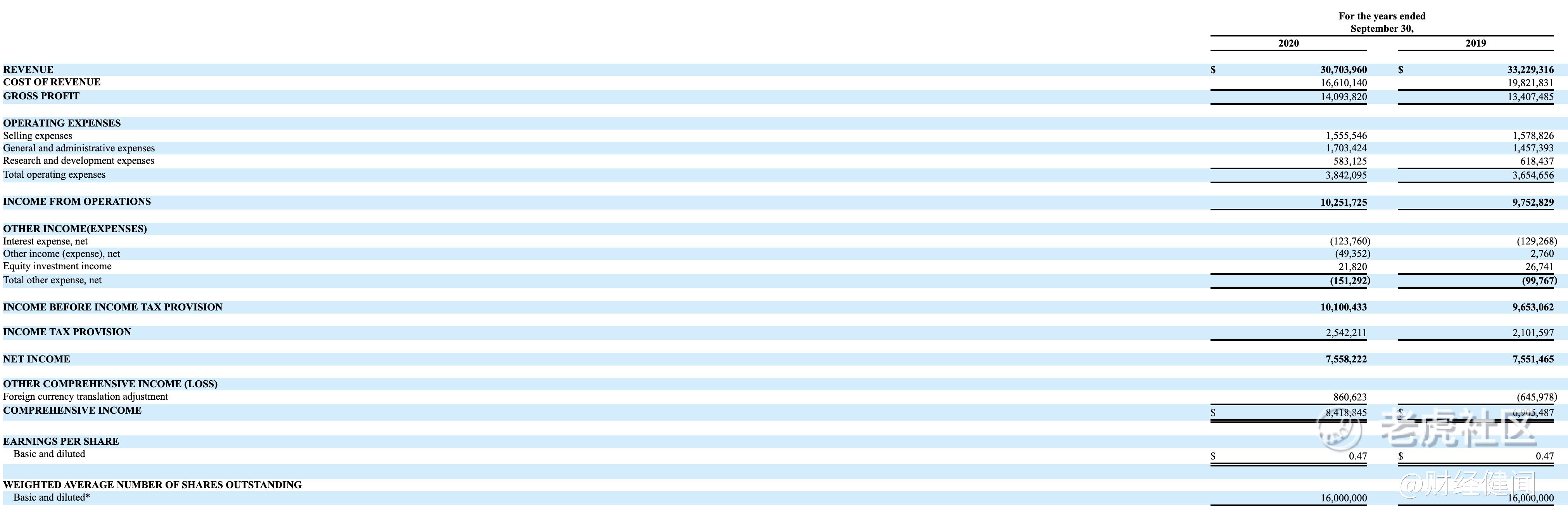

According to Universe Pharmaceuticals’ SEC filing, the company made $7.56 million in net income on revenues of $30.70 million in revenue for the years ended September 30, 2020. The gross profit margin and net income margin are 45.9% and 24.6% respectively in the fiscal year 2020.

In 2021, Chinese companies have held 15 IPOs so far. Four of them are Biotech and pharmaceutical-related companies, including QLI, GRCL, ADAG, and TERN. Universe Pharmaceuticals would join them, and be the first US-listed Chinese company that is focusing on the traditional Chinese medicine derivatives market.

精彩评论