13 March 2021

Topsy Turvy week for the Technologies but gradual growth for the rest.

Nasdaq started the week with a (-2.48%) decline on Monday but went to as high as (+3.97%) during the midweek before closing +3.09% higher from last week’s close (5 March 2021). Comparing with the Dow Jones, it was up the whole week with the lowest point +0.05% higher than last week’s closing price and the highest point was up +4.12%. Both the Dow Jones and S&P 500 also closed at an All-Time-High this week.

It seems from the charts, regardless High Bond Yield or Low Bond Yield, the Dow still shines. Comparatively, the Nasdaq index is more prone to interest rates movements. Now for a long-term investor, which would you prefer to hold?

It seems as though if I want to know if Nasdaq will move up or down, all I have to do is monitor the US 10-year treasury yield. And interestingly, when I went to look at the chart for US 10-year treasury, I found out that the rates are actually almost back to pre-covid period at 1.6%.

So, why are interest levels so high?

Fundamental economics tells us that when government spending inceases, it would result in a shift in the IS curve, resulting a new equilibrium at a higher interest rates. This would then shift the AD curve as well due to ample liquidity. Demand > Supply would result in an increase in price level (aka inflation) which is ultimately what the US government is striving to achieve.

So do we really see more demand than supply?

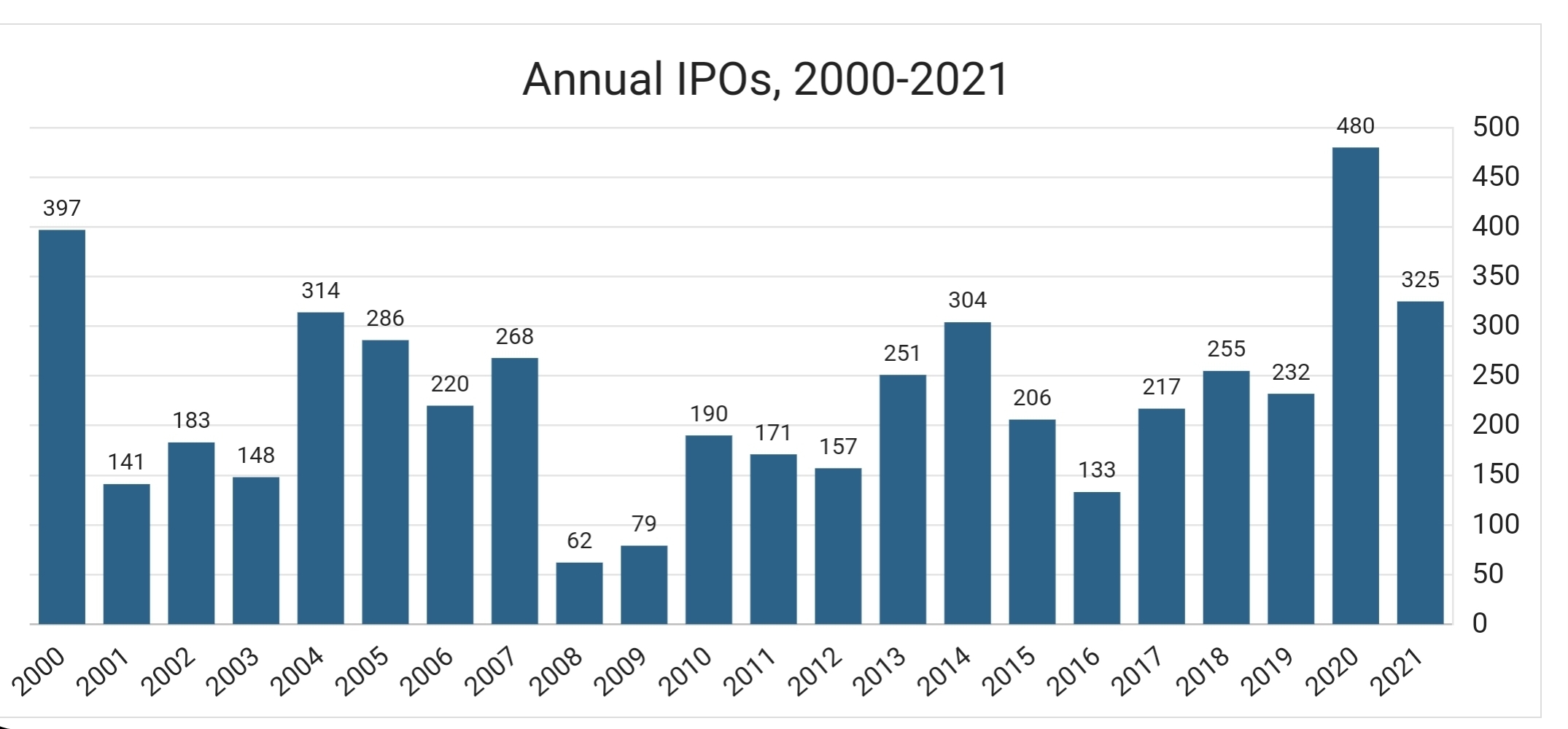

Over the past few days, my news feed has been filled with countless topics relating to IPO and stocks hitting All-Time-High prices. Could this be a result of ample liquidity/cash but with limited usage (inability to travel, unattractive interest rates on deposits, etc..). Many institutions have picked up on this and I do think that this year 2021, IPO records would hit the highest.

Taking from Stock Analysis.com, there have been 325 IPOs on the US stock market this year, as of March 13, 2021. That is +778.4% more than the same time in 2020, which had 37 IPOs by this date.

1. E-commerce giant $Coupang, Inc.(CPNG)$ delivered the biggest US initial public offering since #Uber. The stock jumped 97% on the day of its debut

2. #Grab to go public via a SPAC that could val ue nearly US$40 billion making it the largest ever blank-cheque deal.

3. $Roblox Corporation(RBLX)$ Soars in Debut as IPO Market Surge Resumes. The stock hit a high of 77.78 (up 73%) on Thursday.

4. #AZTECH Global received applications from retail investors for 18.4 times the number of shares available in the public portion of its initial public offering (IPO) Search engine giant

5. $Baidu(BIDU)$ is seeking to raise as much as HK$28 billion (S$4.8 billion) in a second listing in Hong Kong,

And on other news, we also have

6. #Bitcoin back to its USD58,150 level

7. #Beeple sold an NFT (Non-Fungible Token) for $69 million. Until October, the most Mike Winkelmann, the digital artist known as Beeple, had ever sold a print for was $100.

And if that is not all,

8. CNBC reported that the housing market stands at a tipping point after a stunningly successful year during the pandemic. Home prices are overheated, mortgage rates are rising, the supply of homes for sale is anaemic and consumer confidence in the housing market is falling.

9. Closer to my home (Singapore), Million-dollar price tags on a record number of Singapore's public housing sales are a sign the city-state is joining the frenzy gripping property markets from Hong Kong to Toronto.

So where are all these liquidities coming from?

CNBC reported that an online survey by Deutsche Bank surveyed some 430 investors who uses online broker platforms and found that half of respondents between 25 and 34 years old plan to spend 50% of their stimulus payments on stocks. Meanwhile, 18 to 24-years old retail investors involved in the survey planned to use 40% of any stimulus checks on stocks. And 35- to 54-year-old retail investors surveyed planned to use 37% of their checks on stock market investment.

So, will interest rates continue to rise?

Yes i do think so. Markets are very forward looking. As such, in my opinion, in the weeks to come, i would expect more measures to curb these liquidities further fueling the rise in interest rates.

Just 2 days ago, we saw the European Central bank announcing plans to purchase bonds at a “significantly higher pace” over the next quarter. The decision was motivated by the recent rise in yields and concerns that “headline inflation is likely to increase in the coming months,” according to central bank President Christine Lagarde.

Another contributing factor is due to the recovery of the economy. Vaccines being rolled out, unemployment rate shrinking and countries starting to open up for travelling. We might just see a recovery faster than anticipated, which could mean an inflation target of 2% faster than expected and hence a reduction in fiscal/monetary support earlier.

So, what does this mean for the stock market?

I do believe cyclical stocks would continue to grow but at a slightly moderate rate. Tech stocks would have a lot more volatility going forward. But volatility does not neccessarily mean its bad. The past few days I've been actively taking advantage of the volatility to do some intra-day trades so as to hit my ACE tier which is an ongoing promotion #TigerBroker is running. Yes im a long term investor and i generally fo not engage in intra-day trades. But since opportunities appears itself, i thought why not? ![[得意]](https://c1.itigergrowtha.com/community/assets/media/emoji_005_deyi.481846cc.png)

In addition, I also see properties as another sector to pay attention to. Over the last year, low interest has spurred interest in property buying. Property prices have risen to record highs and together with the sudden spike in interest, it could lead to a pop in the bubble. Hence, I am monitoring some of the Reits i have in my portfolio. Lastly, the rising interest could also cause investors to weigh the returns of a dividend stock paying 1.6% in dividends vs a 10-year bond which also pays 1.6% in coupons, which may further pressure Reits.

Disclaimer: The above message is solely my opinion and does not constitute as any form of investment advice.

精彩评论