Executive summary

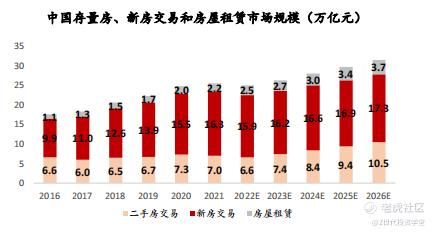

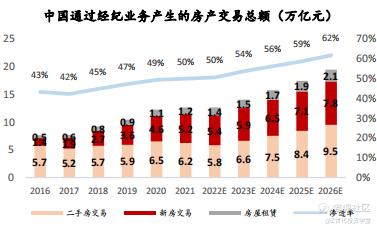

Industry: Despite fluctuations in real estate policies, the overall market size of the three major residential businesses (stock, new housing transactions, and housing leasing) is still steadily growing, and the penetration rate of real estate brokerage services is also continuing to rise

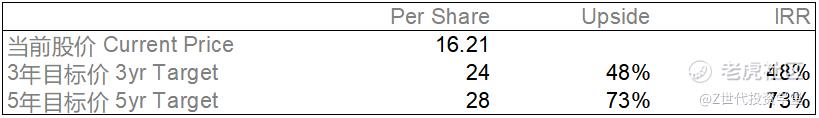

Competition: China's largest online and offline integrated housing transaction and service platform, with significant competitive advantages. In 2021, Beike's transaction volume in the residential field (second-hand + first-hand) reached 3.85 trillion yuan, with a market share of 9.7%, ranking first, exceeding the sum of the second and fifth places combined

Based on overseas experience, Beike has integrated the three elements of housing, customers, and agents in China, with very prominent competitive barriers

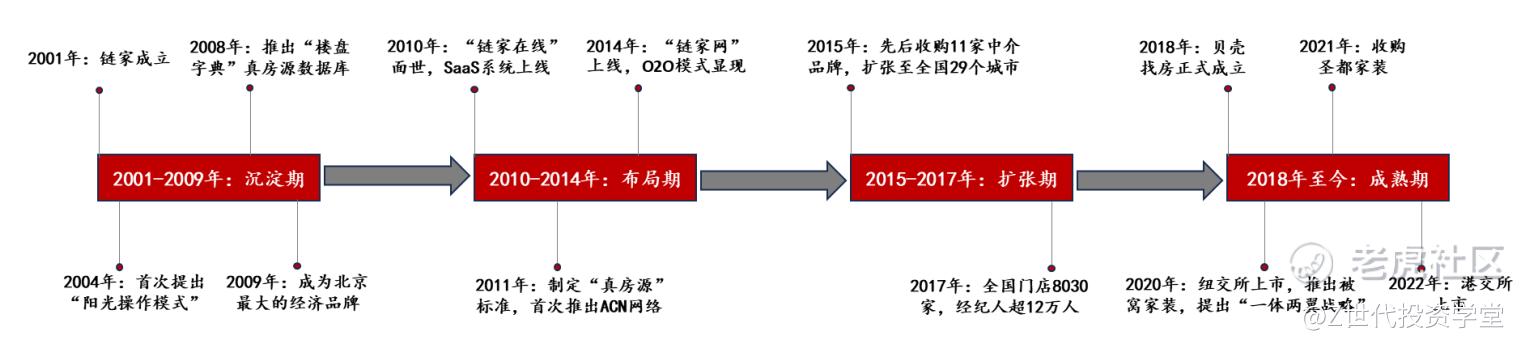

Management and company culture: doing "difficult but right things" for a long time, promoting the development of the entire Chinese real estate brokerage market, establishing a real estate dictionary to ensure "genuine housing resources".

Risk Warning: Real estate recovery falls short of expectations, etc

Company overview

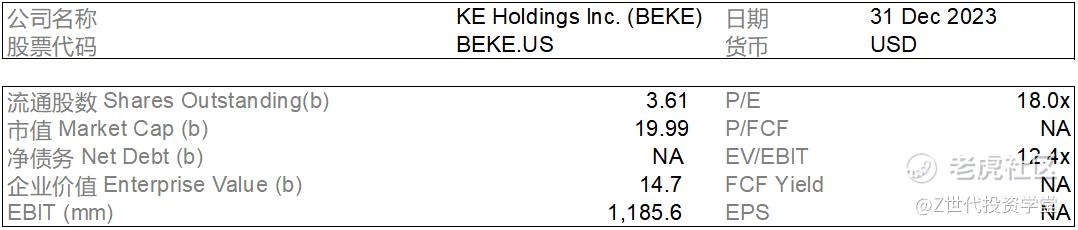

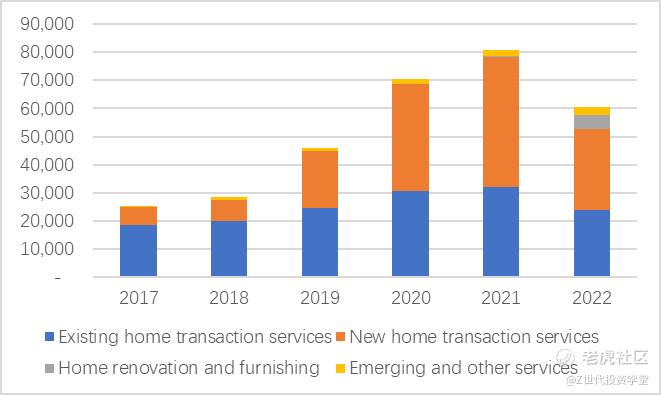

Beike is the largest online and offline integrated housing transaction and service platform in China. Main Business is divided into four parts: existing housing business, new housing business, home decoration and furniture business, emerging business and others. The revenue volume in 2022 was 60.70 billion yuan, of which existing housing transactions accounted for 40%, new housing transactions accounted for 47%, housing renovation and decoration accounted for 8%, and other emerging businesses accounted for 5%.

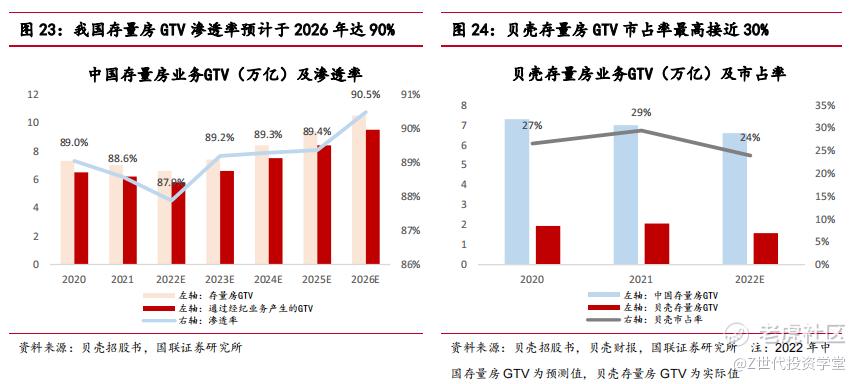

As of Q1 2023, Beike has a total of 41,257 stores and 434,000 brokers. In 2022, the company's new and second-hand business achieved a total GTV of 2.52 trillion yuan, far higher than the second-tier level in the industry. Among them, the new GTV is 940.40 billion yuan, with a market share of about 8.1%, and the second-hand GTV is 1.58 trillion yuan, with a market share of about 33%. In 2022, the market share fell to 24% due to industry decline.

The development process is mainly divided into four parts.

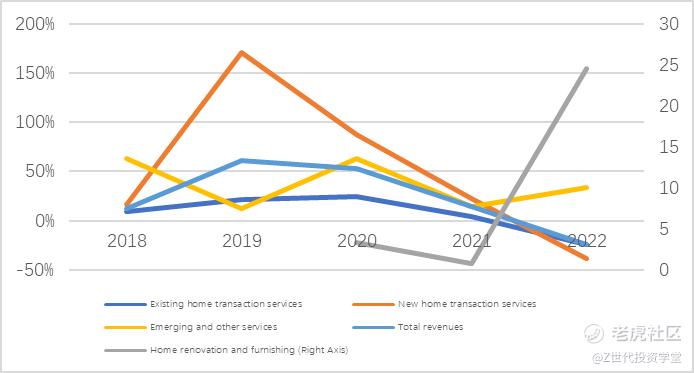

In terms of revenue growth rate, due to the suppression of negative beta in the industry, revenue in 2022 decreased by 25% YoY. Except for the high growth of home decoration businesses (the high-speed growth of home decoration and home furnishing businesses is mainly due to the acquisition of Shengdu Home Decoration), both new and existing housing businesses have declined significantly.

In 22 years, China's stock housing market 7.30 trillion, and new housing sales 11.70 trillion, both of which fell sharply year-on-year. However, other housing-related service markets rose to 14.90 trillion yuan year-on-year. Under the strategy of reducing costs and increasing efficiency, Beike's market share in both stock and new housing transactions has declined slightly.

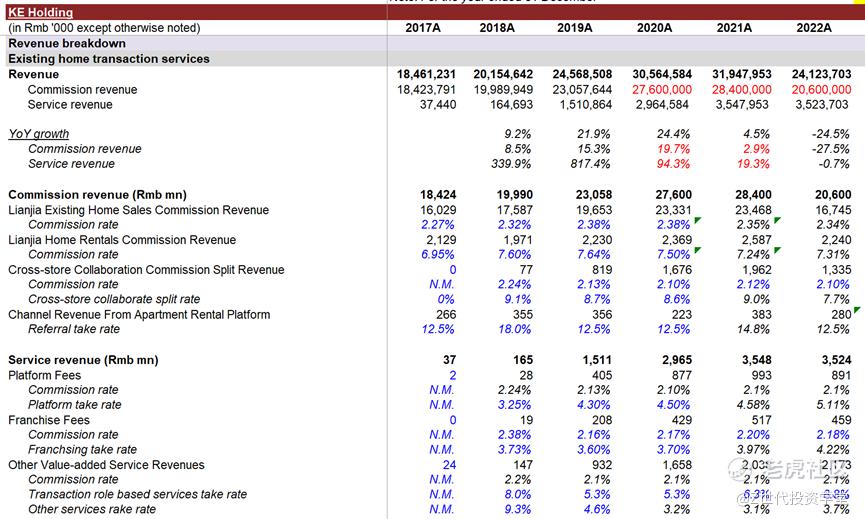

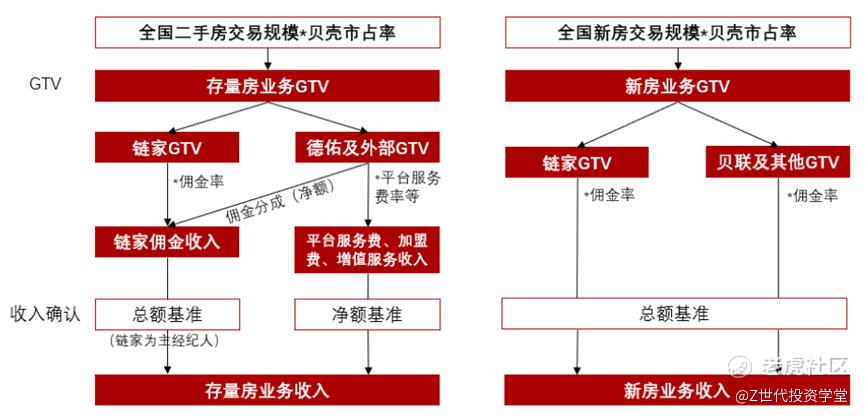

The revenue creation model of existing housing businesses mainly includes 1) transaction commissions for second-hand housing transactions and rentals under the self-operated Lianjia brand, as well as the share of Lianjia and other brand intermediaries in Beike cooperation and matching transactions; 2) commission fees for transactions on the Beike platform, as well as franchise fees for other franchise brands; 3) other value-added services, such as transfer fees, on-site verification fees, recruitment fees, etc.

In terms of new houses, income includes fees charged to developers. Beike gives commissions to intermediary companies and agents, which are directly reflected in the report as the overall GTV and a commission rate.

Industry scale

The market size of the three major residential businesses (stock, new housing transactions, and housing leasing) is still steadily growing. It rose from 9.90 trillion yuan in 2016 to 16.30 trillion yuan in 2021, with a compound annual growth rate (CAGR) of 10.5%; it is expected to reach 17.30 trillion yuan in 2026, with a CAGR of 1.2%. Despite the pressure on the real estate industry in the short term, the industry is expected to continue to grow slowly in the long term.

The penetration rate of brokerage services in China has increased from 43% in 2016 to 50% in 2021 and is expected to reach 62% in 2026. While the GTV of existing housing transactions through brokerage business in China is greater than that of new housing transactions, the GTV penetration rate of new housing transactions has significantly increased.

In terms of long-term market size, according to the forecast of the Shell Research Institute,

It is expected that the average annual GMV from 2021 to 2035 will be about 24 trillion yuan, and the total GMV will reach 29.20 trillion yuan in 2035, with an average annual growth rate of 1.8% in 2015. Among them, it is expected that there will be an annual demand release of 201-24.70 billion square meters, and an annual average of 1.48 billion square meters in a neutral scenario. It is expected that the total housing demand will drop to 1.33 billion square meters by 2035, with an average annual growth rate of 2.5% in 2015.

In terms of the split between the stock market and the new housing market, the average annual GMV of the new housing market under neutral circumstances is 15.10 trillion yuan. The average annual GMV of the second-hand housing market is 9.10 trillion yuan, and it is expected to approach 14 trillion yuan by 2035, accounting for 47% of the total GMV.

Revenue driver

Shell platform business revenue can be summarized as follows: transaction volume * single transaction amount * penetration rate * market share * commission rate.

Stock housing business:

Under the policy of "housing is for living, not for speculation", China's housing market has entered the era of living and rigid demand. The dividend of existing houses will be greater than that of new houses. It is expected that the growth of commission income in the later period of Beike will mainly be driven by the business of existing houses.

The penetration rate of existing houses has approached 90%, with limited growth. It is expected that long-term income growth will be driven by market share expansion. According to the shell income formula, its income = (transaction amount of existing houses + rental amount of houses) * penetration rate * market share * commission rate. In the transaction of existing houses, under the background of rigid demand from brokers, it is expected that the penetration rate of brokerage business will reach more than 90% in 2026, and the future income is expected to be considerable.

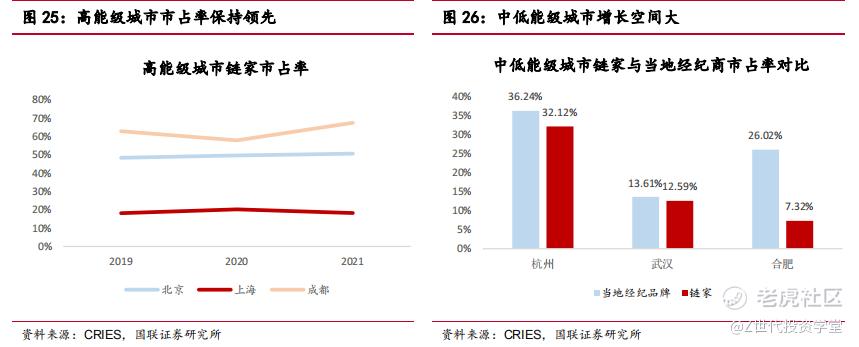

Beike maintains its leading market share in high-energy cities, while the market share of medium and low-energy cities needs to be strengthened According to Beike's prospectus, Lianjia maintains an absolute advantage in market penetration rate in Beijing and Shanghai. For medium and low-energy cities, local brokerage brands have more operational advantages, such as Hefei Delian Baoye, Wuhan Century Hongtu, Hangzhou Wo Wo Wo Wo Jia, etc. After Beike's national layout is further improved, and Beike's ACN platform strategy and joint offline Deyou cooperation franchise model are rolled out in medium and low-energy cities, we believe that Lianjia's market share has greater growth space and amplitude in medium and low-energy cities.

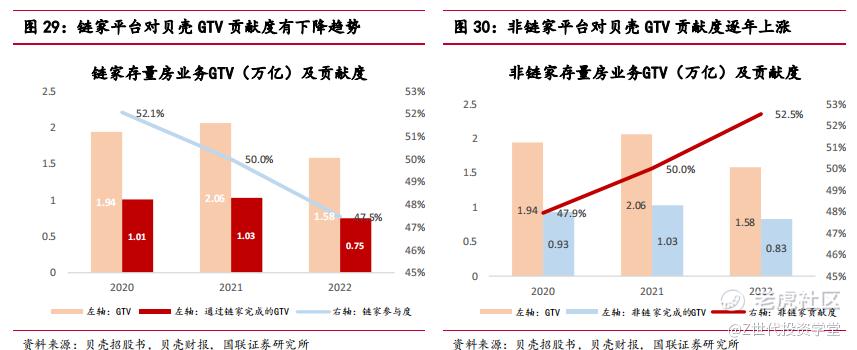

The contribution rate of non-Lianjia platforms to Beike GTV is gradually increasing and becoming the main force . Lianjia's contribution to Beike GTV decreased from 52.1% in 2020 to 47.5% in 2022, while non-Lianjia's contribution increased to 52.5% during the same period. Based on the superiority of ACN, non-Lianjia brands can join offline through Deyou or online through Beike; under the consensus of expanding customer sources and exposure, we expect more brokerage brand merchants to settle in Beike, both online and offline; Beike will further seize market share and obtain expected commission and non-commission income.

精彩评论