New housing business

There is great room for growth in the penetration rate of new housing business, and future growth mainly depends on the penetration rate. Currently, it is expected that the penetration rate of brokers in China's new housing transactions will be less than 40%, and the penetration rate in 2026 will only reach 45%, which is significantly lower than the expected penetration rate of 90.5% for existing houses, and there is obvious growth space. Based on the deep development of urbanization and the high and scarce land area in the city center, most real estate developers tend to choose locations in the suburbs or new development areas, and the customer visit rate is naturally low. For future customer acquisition needs, the position of brokers in new housing transactions will become increasingly important, and we expect the penetration rate to continue to rise.

The market share of new housing business is expected to grow slowly. Compared with the market share of existing housing, the market share of Beike's new housing GTV is less than 10%. In recent years, due to market factors, the GTV of Beike's new housing business has declined. However, due to the channel advantage of the Beike platform, we expect the market share to slowly increase in the future.

The commission income from new houses has not changed its long-term growth trend. Affected by short-term market fluctuations, the commission income from Beike's new house business in 2022 decreased by 38% year-on-year to 28.70 billion yuan. Considering the later relaxation of policies such as "guaranteeing the delivery of buildings" and the recovery of prosperity, it is expected that the commission income from Beike's new house business will continue to rise in previous years.

Beike has strong bargaining power, and the commission rate for new house business is steadily increasing. In 2020, the commission rate for new houses (Beike's commission income/Beike's new house GTV) was 2.75%, and in 2022, it exceeded 3%, reaching 3.05%, reflecting Beike's bargaining power as a strong intermediary. As the main broker for new house business transactions, Beike has better channel and platform advantages than its competitors, and its bargaining power is higher than the industry average. However, the real estate industry, as the basic guarantee for people's living and working conditions, is greatly affected by the national macro-control. We expect that the commission rate will have little room for future growth, and the focus will be on maintaining the rate advantage.

Home decoration business

The scale of the home decoration industry is large, and Beike is expected to expand accordingly. According to Beike Research Institute, the neutral value of China's home decoration market in 2022 is 3.69 trillion yuan, with an expected annual growth rate of over 7%, and the scale will reach 7.06 trillion yuan in 2030. In the same year, the unit price of housing decoration in China is 1040 yuan/square meter, and it is expected to rise to 1536.55 yuan/square meter in 2030. Combined with the 10-15 year usage cycle of housing decoration, it is expected that the demand for second-hand housing decoration will continue to emerge, and the linkage between second-hand housing, new housing transactions, and the home decoration industry will continue to increase.

Currently, the CR5 of the home decoration industry is less than 5%. For platforms like Beike, which have significant integrated advantages in real estate brokerage transactions, there is a great opportunity.

Competition moat

The core competitiveness of Beike lies in the infrastructure based on Agent Cooperate Network (ACN) and the "real estate dictionary" that records real estate listings. Before Beike launched ACN and "real estate dictionary", there were many pain points in the domestic residential industry, such as information islands, group competition, and malicious price gouging. Brokers could not survive independently in the chaos. Beike creatively launched ACN and "real estate dictionary" to standardize information sharing and real estate listings.

ACN has a significant effect on the listing and transaction conversion of existing houses. According to the prospectus and financial report of Beike, more than 75% of the existing house transactions completed through Beike and its platforms in 2021 and 2022 have been incubated by ACN, and more than 86% of its listing information has been released through ACN's cross-brand release. The "real estate dictionary" helps Beike's real estate proportion exceed the industry average. As of 2022, Beike's platform's "real estate dictionary" has included 2.67 trillion sets of real housing, with a real housing proportion of 95%, far exceeding the industry average. At the same time, the "real estate dictionary" has covered more than 300 cities across the country, 500,000 communities, including 4.36 million building information and 9.33 million unit information, and more than 200 cooperative brokerage brands.

Domestic

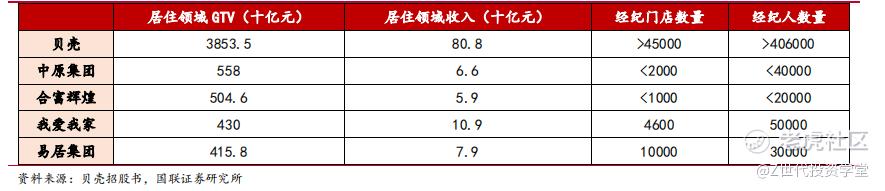

The real estate brokerage industry is scattered, showing a trend of one superpower and multiple strengths, with Beike leading the market share. In 2021, the top five companies in China's residential industry accounted for a total market share of 14.6%. According to the prospectus, Beike is the largest real estate trading platform, with leading GTV and revenue. Calculated by transaction scale, in 2021, Beike's transaction volume in the residential field (second-hand + first-hand) reached 3.85 trillion yuan, with a market share of 9.7%, ranking first. Zhongyuan Group, Hefu Brilliant, Wo Ai Wo Jia, and E-Ju Group have market shares of 1.4%, 1.3%, 1.1%, and 1.1% respectively.

In addition, within the residential industry, Beike's GTV and brokerage active level have formed barriers, far exceeding competitors in terms of revenue, number of stores, and number of brokers. In 2021, Beike's GTV in the residential field exceeded 3.80 trillion yuan, and the number of active brokerage stores and active brokers were greater than 45,000 and 406,000 people respectively, far exceeding competitors.

Beike has significant advantages in both transaction commissions and information integration, covering the entire field of online and offline, new and second-hand housing

精彩评论