这是我们2023年9月25日发表的《洪灏 | 谁是最大的熊?》的英文原版报告Hao Hong | Fundamental Differences

Chinese stocks are plunging with US treasuries. Yet no one seems to blame surging US yields for the bane in Chinese stocks.

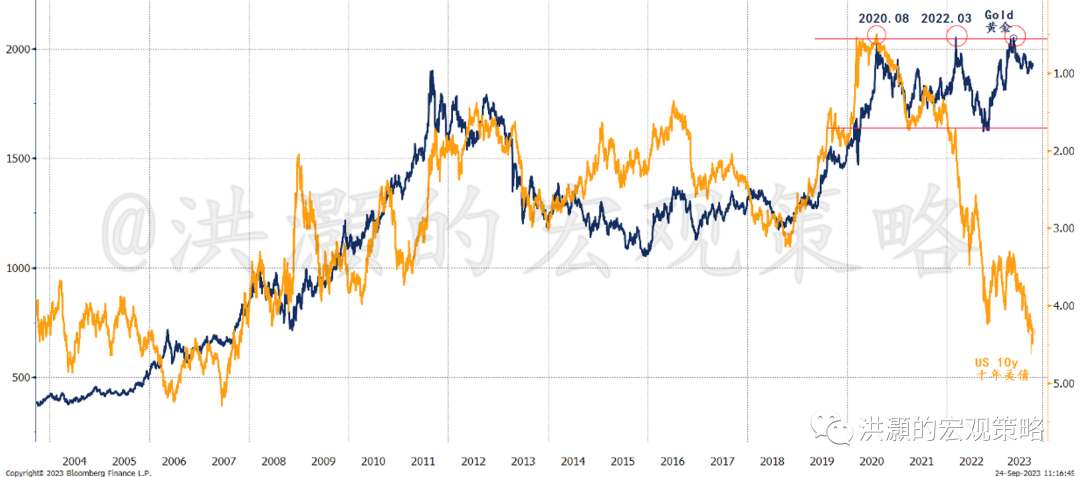

Gold’s historical correlation with US yields is breaking down. Safety in gold, and no longer in US treasuries.

For now, iron ore and oil are more direct bets than stocks on improving Chinese growth. More potent policy shots are needed to resurrect stocks.

Why Chinese stocks are so weak?

My firm’s Changsha office grand-opened two weeks ago. And I was honored to attend the opening ceremony, together with my friends, some of China’s most prominent economists. The crowd seized this opportunity to pose some challenging questions. After all, it is not every day that four of us get together. And it was a tough audience.

One question really highlighted the crux of confusion in today’s market – why Chinese stocks continued to struggle, despite a flurry of policies since July? Each of us offered our perspectives without reaching a consensus. Policies were not potent enough to offset growth decline, or the recovery was transient. The discussion raised even more questions than answers.

If we plot Chinese stock index together with the US treasury yield, we will see that these two assets are falling in tandem. While ailing Chinese stock performance has grabbed global headlines, the US treasuries are actually the bigger bear (Figure 1). And US treasuries are supposed to be a risk-free asset. It is perplexing.

Figure 1: Chinese stocks are highly correlated with US treasury yield. Is the Fed the culprit then?

If one mistakes correlation with causation, one could easily conclude that the Fed’s tightening campaign has led to the Chinese bear market. Of course, rising US interest rates have increased global discount rate and compressed the valuation of risk assets globally, including that of Chinese stocks. But it is still surprising to see such tight correlation. After all, Chinese stocks are risk asset, but US treasuries are supposed to be risk-free. Chinese stocks have so far failed to respond to the PBoC’s easing, but rather to the Fed’s tightening.

Meanwhile, gold price diverges significantly from surging US treasury yields. It appears that the tight correlation observed in the past two decades has broken (Figure 2). Surging yield adds to the funding costs of the US debt problems, and the US government is on the verge of shutting down again.

It was not long ago that the Republicans and Democrats reached the debt deal to increase debt ceiling. The US credibility is now on the line, so people opt for gold. The Dollar’s recent strength says little about the safety of the Dollar hegemony, but more about the scarcity of safe assets globally.

Figure 2: Gold is splitting from US 10y.

Here, we have spotted some fundamental differences between how two asset classes that used to correlate closely together, namely, gold and Chinese stocks, start to respond differently to surging US yields. Gold is a hard asset that is a haven during tumultuous times, while Chinese stocks are a paper asset beset by risks both from domestic and abroad.

It could well be for this reason that Chinese stocks have been struggling, despite PBoC easing.

The Chinese economy starts to

improve on the margin.

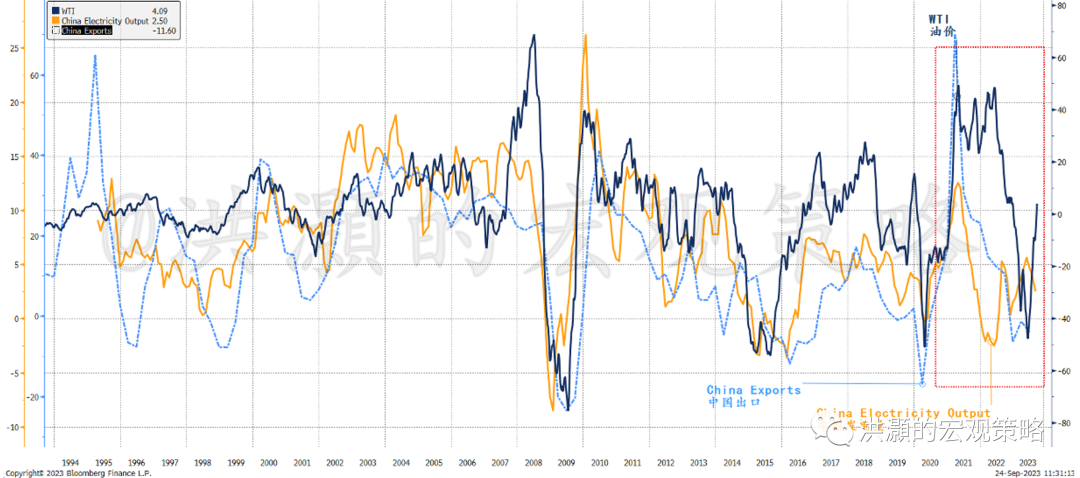

Recent economic data from China actually seem to have improved on the margin – amid all the doom and gloom: export growth decline is narrowing, consumption is better than expected, investment growth seems to be stabilizing and the CNY is finding some footing at around 7.3 to 7.4 with the PBoC’s help. All these marginal improvements are reflected in oil’s recent strength (Figure 3).

Figure 3: Oil is responding to Chinese fundamentals.

Obviously, the production cut by Saudi and the continuing Ukraine war, as well as seasonality, have all contributed to the recent oil surge. But given the tight historical correlation between oil price, Chinese exports and electricity output, the improving Chinese economic data, however elusive they may be, must have made their contribution as well.

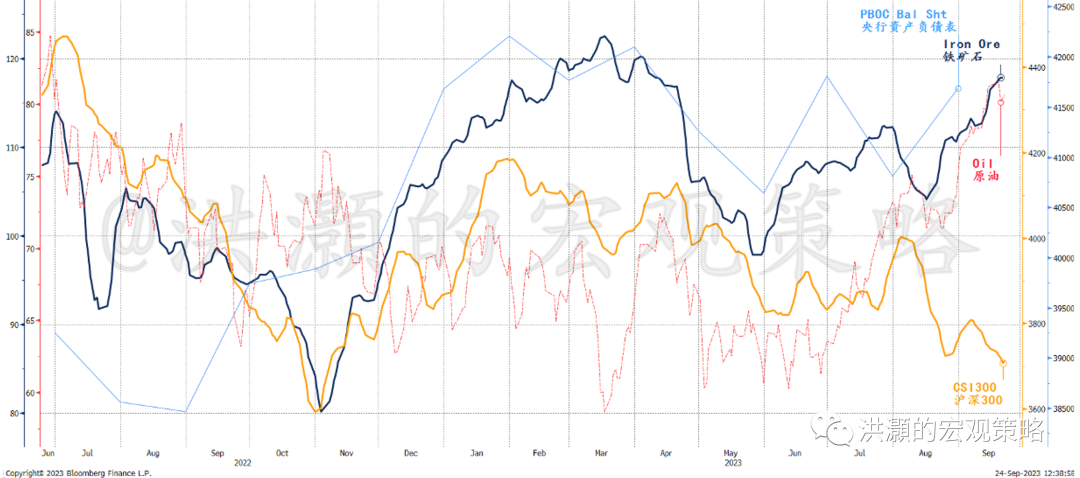

And iron ore continues pushing upward, and has attracted the NDRC’s attention. Note that how dramatic the recent split has been between iron ore and Chinese stocks (Figure 4). The PBoC’s balance sheet is re-expanding again, lifting iron ore and oil. But Chinese stocks continue to languish. Indeed, last week the Chinese stock indices saw its lowest level year to date before the news about China and the US setting up economic and financial workgroup broke.

As such, two asset classes that used to correlate closely together and both are supposedly responsive to the PBoC’s monetary stance are diverging significantly. If we think commodities such as iron ore, oil and gold represent the reality now, while Chinese stocks as a paper asset represent future expectation, then the split is really about reality and the hope. The market seems to think that monetary easing can improve the economy in the near term, but the longer-term outlook remains murky and thus makes it difficult for investors to commit capital. For now, hard assets are more direct bets on the Chinese economy.

Figure 4: Iron ore and oil appear more responsive to policy, while Chinese stocks struggle.

Conclusion

Chinese stocks are falling in tandem with US treasuries. Indeed, US treasuries are a bigger bear than the plummeting Chinese stocks. Chinese stocks appear to be more correlated with the Fed hikes than to the PBoC easing.

Meanwhile, we observe significant breakdown in historical correlation between US yields and the price of commodities such as gold, iron ore and oil. Further, these commodities seem to be rising with the PBoC balance sheet expansion while splitting from Chinese stocks.

If real assets stand for the reality now, while Chinese stocks are for the future, then it would appear that commodities are more direct bets on Chinese growth for now. To resurrect Chinese stocks, however, it will take a much stronger shot in the confidence.

Hao Hong,CFA

TWT:@HAOHONG_CFA

精彩评论