The Fed announced on Thursday that it would not raise interest rates, but the market still expects another rate hike in Q4 2023.

Gold closed down 0.2% on Thursday and was now at $1,947.9.

Analysts at ANZ said they remain optimistic about gold's mid- to long-term prospects. The bank currently predicts that the average price of gold will be around $2,050 per ounce before Q4 2023, and it is expected to reach a new high before the end of Q1 2024, with the average price being approximately $2,100 per ounce.

Daniel Hynes, senior commodities strategist and lead author of the latest report, said in the report: "We believe that the Fed's interest rate hike cycle is nearing the end, the dollar is still in a structural downward trend, and tightening credit conditions may pose economic risks. These are all for Gold provided support."

The main reason why gold prices still lack momentum in the short term is that strong economic data shows that the U.S. economy is still resilient. Slowing inflation and strong labor force data point to an ideal macroeconomic outlook. The $USD Index(USDindex.FOREX)$ has rebounded since July. As a result, the market ruled out the possibility of a hard landing for the U.S. economy, which reduced safe-haven flows to gold.

As inflation continues to slow from last year's 40-year high, ANZ expects Fed interest rates to have peaked. He added that $Gold - main 2312(GCmain)$ should not be spooked by the possibility of one last rate hike.

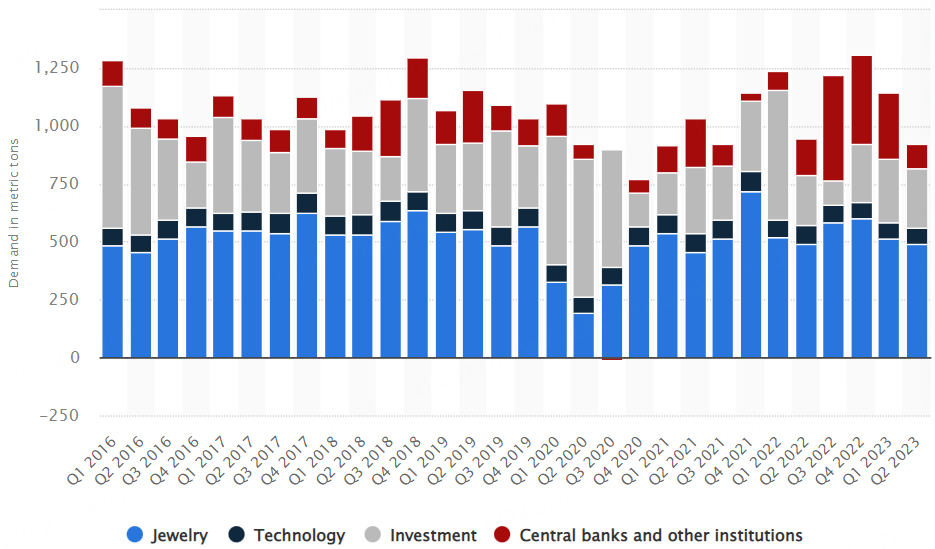

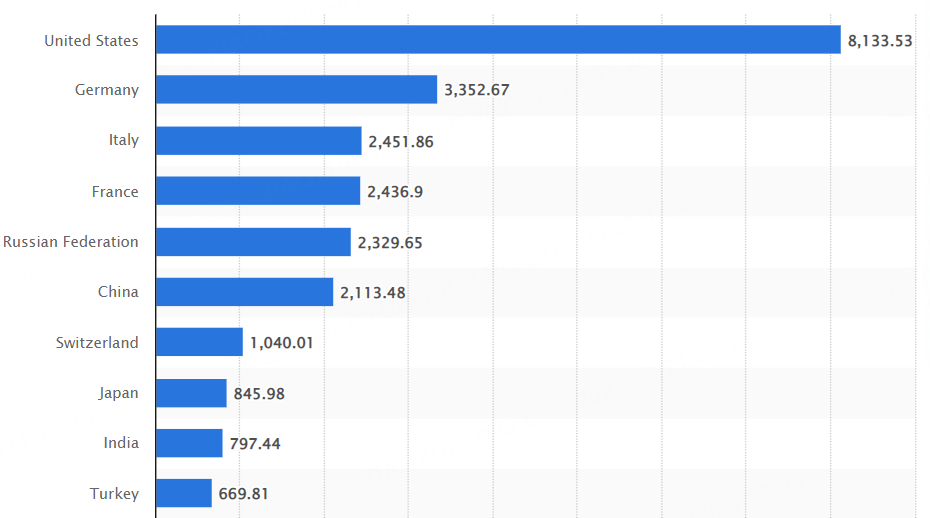

Here are some macro data from www.statista.com:

Demand for gold worldwide from 1st quarter of 2016 to 2nd quarter of 2023, by purpose(in metric tons):

Gold reserves of largest gold holding countries worldwide as of 2nd quarter 2023(in metric tons):

What’s your expectation on Gold price?

精彩评论