A Diamond or a Fraud?

Executive Summary:

This company is a great example of something that looks shiny on the outside which may also provide real value to customers but remain uninvestable in the lens of ESG. From a fundamental investment POV, it is a great franchise quality and possibly this stock could be a multi-bagger. However, there are many several things that I have seen that make me want to stay far away from it: (1) Possible Fraudulent Management (2) Equipment Ineffectiveness. I would provide a fundamental view and then end off with my perspective on ESG.

Company Overview:

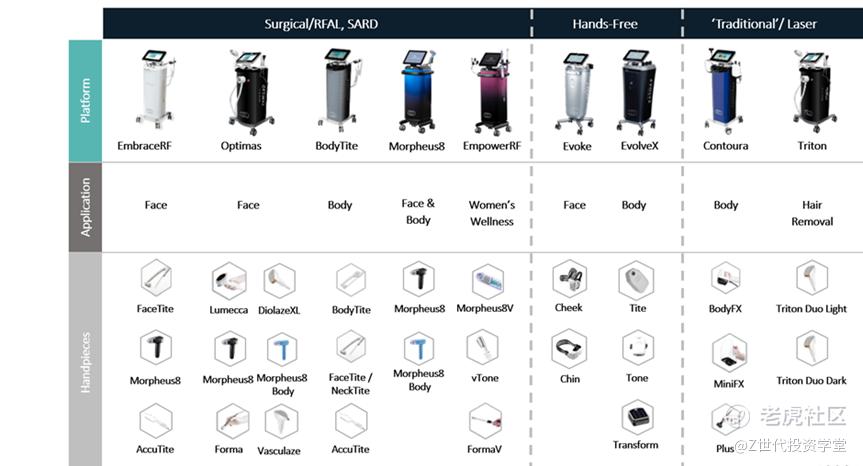

InMode is supposedly a recognized leader in the specialist field of minimally invasive medical treatment solutions, with a questionable strong brand reputation and a growing global footprint. InMode has leveraged its minimally invasive radio frequencies technologies-based surgical aesthetic solution to offer a comprehensive line of products across several categories for plastic surgery, gynecology, dermatology, otolaryngology, and ophthalmology. Below you can find InMode product selection. The company competes with Cutera Inc, Apyx Medical Corporation etc. However, its competitors mainly use laser-based treatments while Inmode uses radio frequencies technology.

Competitive Advantage?

R&D capabilities:

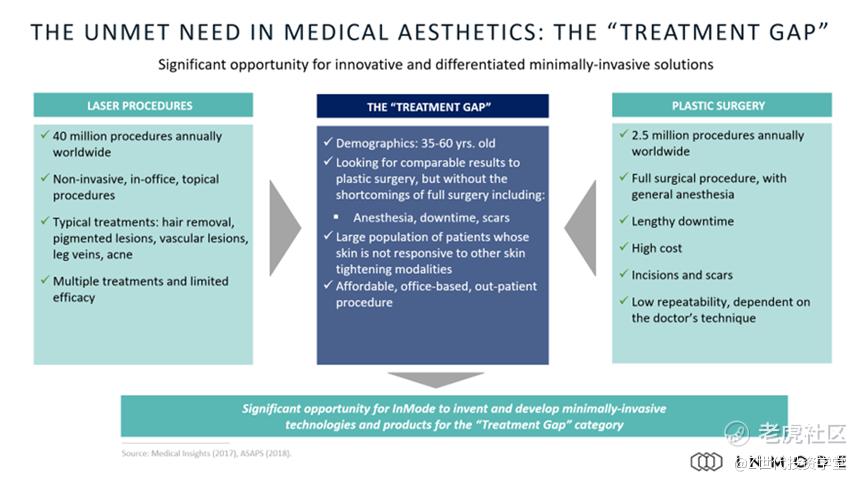

InMode's notable competitive advantage lies in its consistent ability to introduce innovative and patented products to the market, featuring platforms that are lighter in weight compared to the bulkier offerings of its competitors. I think what’s amazing is the treatment effects that provide comparable results to plastic surgery without as much downtime, but does it really work? I don’t know.

Strong Brand:

Moreover, InMode has successfully positioned itself as a dominant player in the market, enjoying widespread recognition in the industry and a highly regarded product lineup, recognized by both medical practitioners and patients alike. The company places a strong emphasis on post-sales services and assistance, offering comprehensive training and education for healthcare professionals, thereby fostering greater customer loyalty. Due to the specific training and equipment prerequisites associated with InMode's products, it becomes challenging and expensive for aestheticians to transition to alternative offerings, granting InMode a distinct advantage over its competitors.

Investment Thesis:

InMode offers a wide range of technologies that produce results comparable to plastic surgery while avoiding the limitations imposed by traditional treatments. With no need for general anesthesia, lengthy recovery times, or incisions, InMode's solutions increase accessibility and patient affordability for a wider spectrum of patients.

InMode operates within a capital-intensive industry, but it maintains a competitive advantage through its innovative business model. Each newly launched platform achieves 85% gross margin through the utilization of patented RF (radiofrequency) technology and pricing products at a premium level. Possible margins for a fad company?

Furthermore, competitors face the challenge of undergoing a lengthy FDA approval process, spanning approximately five years, further solidifying InMode's dominant position within the market. Moreover, the sales of consumables should exceed the sales of aesthetic equipment overtime. The fact that the revenue contribution for equipment is at c.89% level, which means that there is more leeway to grow as their devices get adopted more, the sales of consumables would increase, improving cashflow quality too.

Financials:

Gross margins look a bit too exciting, showing tremendous pricing power while EBITDA margins are improving. This is an exciting company, even for a healthcare equipment company. The competitor’s margins cannot fight with InMode for really good reasons.. The risk-reward ratio is too attractive to go unnoticed. Growth is reducing yes which explains the fall in valuation. That’s why the company is re-rated but looking at a value perspective, this is quite cheap.

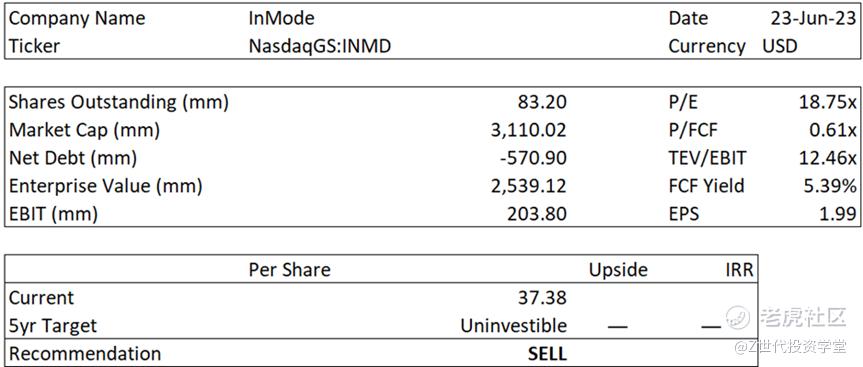

Valuation:

If I’m buying, I would pay a 20x P/E multiple for it. By assuming revenue growth sticks to 20%, and net margins staying at higher levels at 30% (which is lower than their previous years) plus assumption of dilution of 5% every year due to historical observation, I get a fair market value of $64 at 2027E. I would prefer to enter it at $35 to obtain an annualized 13% return. But of course, I’m not going to buy…

ESG:

I don’t like that the company is constantly diluting its shares, despite it being cash generative. The prospect of low demand or a drop in product appeal, risks related to protecting intellectual property rights, and the difficulty of staying at the forefront of product innovation are just a few of the potential long-term dangers that could arise.

This company’s ESG report is just unimpressive and a secondary school kid can also do it as well…

What really troubled me is the CEO. Moshe Mizrahy used to be the co-founder of Syneron where the firm is accused of embezzling trade secrets and violating copyrights. Can I say he was part of it? No. But any association deserves a brow raise.

The work from Marcus Aurelius Value really sealed the coffin for this stock for me. According to them, CEO Mizrahy’s long-time business partner and INMD’s former VP of Regulatory Affairs was charged by the SEC with fraud in 2017 for his alleged role in a multi-million insider trading scheme. Do you really want to trust a possible fraud to handle your face? I guess not. Makes you wonder who he is hanging out with as well.

Now going into product ineffectiveness, while not reported vastly, it shows that there are many victims who fell at the hands of Invasix which is/was a product of Inmode. Permanent scarring happened to victims, and it’s not revealed in their prospectus. My suspicion is that they want to hide any information that affects its IPO valuation. Moreover, this also explains founder constant liquidation. At this point, I also think their numbers are fudged to a certain degree. I will stay away from this stock! Sell.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.

精彩评论