Valuation

DUNT, with its current price of USD 14.77 as of 29th June 2023, the DCF valuation indicates a potential 36% to USD20.0 if DUNT can grow their product line with the Food and Beverages market growth of ~ 10% annually (varies depending on the year). Thus, DUNT 3Y DCF Target price will be USD 20.00.

As for assumptions, I assumed an average 10.54% growth annually in line with their products Market Growth (which is slightly pessimistic due to strong competition). I assumed that CAPEX would increase as a steady percentage of revenue as one of the main growth strategies is expansion (both domestically with the Hub and Spoke and Internationally with Franchisee).

Risks and Mitigation

• Liquidity Position

○ Low Liquidity places DUNT at a disadvantage while it seeks to fund any potential opportunities arising in the market.

○ At the end of FY2021, the current ratio of the company was 0.35, which was due to increase in current liabilities from US$497.8 million in FY2020 to US$526.2 million in FY2021, which increased 30.2%, from an increase in accrued compensation and structured payables.

○ Its current ratio is below that of its competitors such as Hostess Brands Inc and Starbucks Corp, which reported a current ratio of 1.64 and 0.77, respectively.

○ However, I believe that while the current ratio is not the best, they business model and structure is applied in such a way that is not too cash intensive and they are approaching the revamped business model and growth strategy in a careful and sustainable way.

○ Baring a huge economic downturn and sudden change in consumer preferences towards donuts, it should not be too much of a limiting factor.

• Exposure to health trends

○ With a growing emphasis on healthy eating, DUNT’s products, which are high in calories and sugar may not appeal to consumers who are interested in healthy eating. This may hamper the company’s long-term growth.

○ However, DUNT seems to have already taken note of such trends and in January 2023, launched 2 new doughnuts under 200 calories to cater to the health-conscious consumers. This will likely help cement their market share and appeal to the healthy eating market.

○ Furthermore, with the strong focus on coffee, DUNT has been making investments in its coffee offerings. They are leveraging on the opportunity to grow its coffee business and compete with other coffeehouse chains given the continued expansion of the global coffee market.

○ This ensures they are not so reliant on doughnuts which are generally considered ‘unhealthy” and provide them with diverse revenue streams.

• Intense Competition

○ DUNT operates in retail industry which is highly competitive. The competitive factors in the industry include the food quality, concept, convenience, location, customer service and taste.

○ It becomes important for them to distinguish themselves with its product and offerings in a stiff competitive environment

○ The company competes with Dunkin’ Donuts, Bimbo Bakeries USA, McKee Foods Corporation and Hostess, among others. If the company is unable to maintain the product quality and consumer loyalty, increasing competition will also force the company to reduce its prices which in turn may adversely affect its margins.

○ Despite this, Krispy Kreme has been renowned for its unique product offerings, including its seasonal doughnuts and limited-edition collaborations. Maintain relevance and bringing out new, exciting flavours that can help draw new clients. As per the product offerings, Krispy Kreme has been introducing at least 3 new products and partnerships over the past few years. This ensures that DUNT will stay relevant and has a unique edge over competitors.

○ In the past, Krispy Kreme has partnered and collaborated with businesses like Oreo and Nutella, which have been effective at building buzz and luring new customers. The company has the chance to keep forming these alliances and partnerships to offer its clients fresh flavours and goods.

ESG Analysis

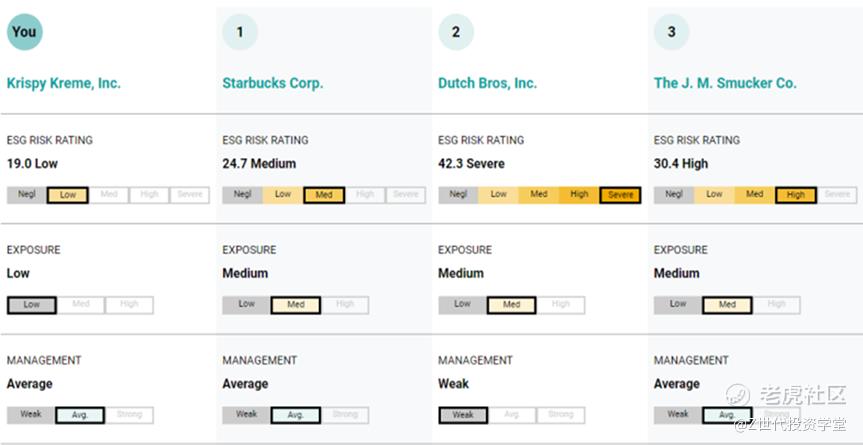

Referencing MSCI, Krispy Kreme compared to its peers has the lowest ESG risk rating and exposure compared to some of its peers. While it’s management role in ESG is only average, it is comparable with its peers in that regard and have made actionable steps to handle their Corporate Social Responsibility.

Social Factor (High): DUNT has a laudable stance as a socially conscious indulgence as the brand cares for the communities where they operate. The company has strong commitments to charitable donations and its social imitative. They have had no prior social issues facing them an engages locally with support and uplift community. An example was when they introduced ‘Beat the Pump” promotion where they aided consumers by pegging the price of a dozen Original Glazed doughnuts to a gallon of gasoline, and they offered free doughnuts to graduating seniors. They have raised more than US$36 million to support local community causes across America.

Regulatory (Poor): Despite being committed to diversity, equity and inclusion, having established a Diversity, Equity and Inclusion Council. DUNT is still regarded as having poor workforce diversity, which can hinder the company’s success in international market given that majority of growth to date had mainly been in the domestic market. This could lead to future financial instability. In the leadership team, female representation is only 2 out of 8 members, which represents a poor ratio. Out of 8 members, only 1 is of minority race. In 2022, the company had to pay $1.2 million to 516 staffers over not issuing wage bonuses. As such, they are focus to strive for gender parity globally and increasing people of representation together with developing comprehensive, global total rewards farmwork to drive pay equity. This should improve such ESG risk in the future.

Environmental (Medium): DUNT has not GHG emissions targets set despite conducing multi-year global emissions assessments to establish their baseline, making them hard to be accountable for their environmental footprint and impact, showing weak environment management. However, DUNT did make progress on responsible sourcing across the global supply chain and has set viable and accountable goals such as using 100% cage-free eggs by 2026 (so far having reached 45% with clear outlines). They are also committed to using sustainable palm oil and achieve 100% deforestation-free palm oil use by 2026 and reduce food waste reduction. These are material and actionable steps that will improve their standing within communities and receive support that has a positive environmental impact.

Conclusion

Since 1937, one of the oldest doughnut and coffee companies are still in high demand due to their ever-increasing range or products and their affordable pricing range, as well as its appealing branding strategies and logo. These are some of the factors that DUNT can provide in terms of customer value in the market.

Despite facing certain challenges operations and financial wise, I believe that this company’s legacy and strong reputation among communities will allow it to take advantage and ride on market growth and opportunities in the food and beverages market for quick service restaurants and expand its product offerings and reach overseas as such providing a 3Y forecast upside return of 36% at US$20.00.

Source: CapIQ, Annual Report, Earnings Report, Marketline, GlobalData , Euromonitor, Statista

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.

精彩评论