EXECUTIVE SUMMARY

DUNT is an established and market leader in the doughnuts and coffee industry located in U.S that is looking to take advantage of the ever-increasing demand for baked goods and coffee. By utilizing their spoke and hub model, it is likely that DUNT will be able to expand its reach to customers worldwide without huge expenditures despite their less than stable financial position.

As such, the company is looking likely to continue growing and increasing their revenue, abet at a slower and steady rate due to their focus in strengthening their unrealized potential in the domestic first. Assuming they are able to ride on the CAGR of 10% growth for their doughnuts and maintain their position of market share in the coffee industry, using DCF, a target price of USD20.00, a 36% upside is generated as a 3 Y target price.

Company Overview

DNUT produces and distributes doughnuts. It offers various packaged and unpackaged doughnuts, pies, coffees and espresso drinks, chillers and iced beverages. The company owns and franchises Krispy Kreme Stores. It operates through the following segments: US and Canada, International and Market Development.

The U.S. and Canada segment includes all Krispy Kreme’s company -owned operations in U.S. and Canada, Insomnia-branded retail shops and consumer packaged goods operations. The international segment consists of all Krispy Kreme’s company-owned operations in the United Kingdom, Ireland, Australia, New Zealand and Mexico. The market development segment handles the franchise operations (reflecting royalties collected) across the globe, as well as Krispy Kreme company-owned shops in Japan. The firm sells its products through mass merchant, grocery and convenience stores.

The company operates a Hub and Spoke Distribution model. the company operated 8,583 DFD doors (Spokes) and 1,810 shops of which 1,218 are Fresh Shops, 382 are Hot Light Theatres Shops (Hub), and 210 are Cookie shops. As of January 2, 2022, the Company had 1,810 Krispy Kreme and Insomnia Cookies branded shops in over 30 countries around the world.

The company reported revenues of (USD) US$1,529.9 million for the fiscal year ended January 2022 (FY2022), an increase of 10.5% over FY2021. In FY2022, the company's operating margin was 1.9%, compared to an operating margin of 3% in FY2021. The net loss of the company was US$15.6 million in FY2022, compared to a net loss of USD$24.5 million in FY2021.

Revenue Drivers

The net revenue growth was driven by growth strategy and transformation of deploying their omni-channel approach globally.

The U.S and Canada’s fiscal 2022 revenue of US$1,033.1 million and consisted of In Shop / Drive-through, E Commerce and Delivery DFD (Delivered Fresh Daily) and Branded Sweet Treat line. The product offerings are branded into KK Fresh Hub and Spoke, Branded Sweet Treat Line and Insomnia Cookies.

The International Segment’s fiscal 2022 revenue of US$365.9 million and consisted of In Shop / Drive-through, Ecommerce and Delivery and DFD.

The Market Development’s fiscal 2022 revenue of US$130.9 million consisted of Japan, U.S. and Canada Franchise and International Franchises.

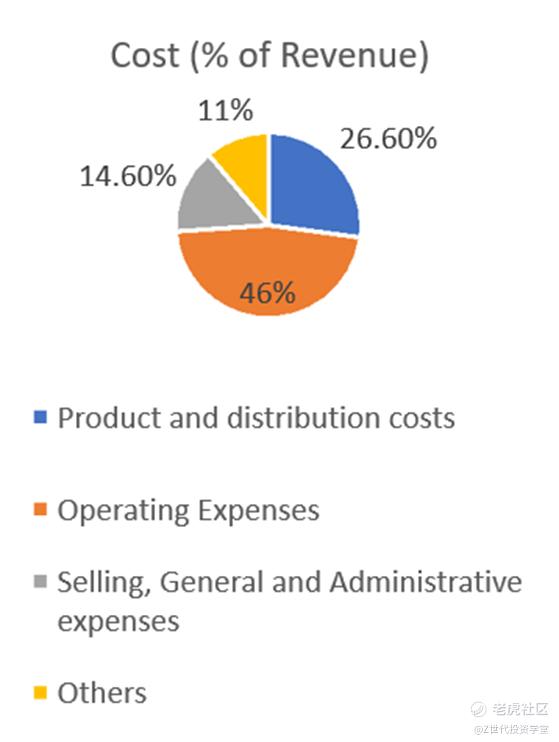

Cost Drivers

For cost drivers, the top 3 costs are their product and distribution costs, operating expenses as well as Selling, general and administrative expenses.

In terms of Product and distribution costs, it increased by US$ 52.1 million or 14.7% from the previous fiscal year driven by inflationary pressures on commodities and logistics costs as well as increased promotional activity in the U.S and Canada.

For operating expenses, it increased by US$74 million or 11.7% driven mainly by labour costs inflation and investments to support growth.

The last cost driver: Selling, general and administrative expense, increased by US$0.8 million or 0.4%. Despite that, SG&A decreased as a percentage of revenue due to decrease in advisory service fees as they completed their Re-IPO from 2021. The decrease was also due to lower share-based compensation expenses, as well as economies of scale from their top-line revenue growth.

Corporate Strategy

DNUT’s growth strategy concentrates on expanding to more grocery and convenience stores and adding more doughnut shops in both existing and new countries.

The company in FY2022 has opened several shops across the geographies. It opened its first branch in Dublin city, Ireland in August 2022. It aims to increase growth in sales and profitability by increasing trial and frequency, fresh points of access and driving additional efficiency benefits from its omni-channel execution.

Investment Analysis

Strengths

• Franchisee Operations:

○ Operated 839 franchise shops including 66 in US and Canada and 773 Krispy Kreme International

○ Partnered with several leading companies in food and beverage. Plans to expand licensing of its brand to additional beverages and other product categories.

• Operational Network:

○ Strong network helps to serve huge customer base, ensuring strong top line performance.

○ Geographically diverse operations help the company to mitigate various risks associated with overdependence on a particular market.

○ Owns a manufacturing facility in North Carolina which incorporates doughnut mixing plant and distribution centre. This is in addition of the 4 doughnut factories around US and 38 internationally, of which 25 are operated by franchisees.

• Strong Revenue Growth:

○ Following growth of 10.5% in FY2022, the generated revenue of US$1,384.4 million as against US$1,122 million in FY2020, with an annual growth of 23.4%

○ Revenue grew at a CAGR of 20.1% during 2019-2021

InvestmentThesis: Hub & Spoke Strategy to improve capital efficiency

Hub & Spoke Strategy will significantly improve margins

• Under H&S model, DNUT’s legacy stores in the US aren’t as much restaurants as they are miniature factories.

• Due to this , the potential returns of this strategy is higher as the CAPEX required to turn it into such Hubs are only coming from the equipment required. (US$2-4 million)

• This model is a better way to monetize legacy infrastructure that has largely been built out, reducing heavy debt and CAPEX expenditure

• There is still potential for growth within US (Hubs without spokes in the United States grew at a pace of 5% below hubs with spokes in previous quarter).

• There are still 118 stores in the United States that are hubs without spokes, showing there are still potential stores and markets to reach out to with this model, increasing revenue with better margins.

Investment Thesis: Product Market Growth

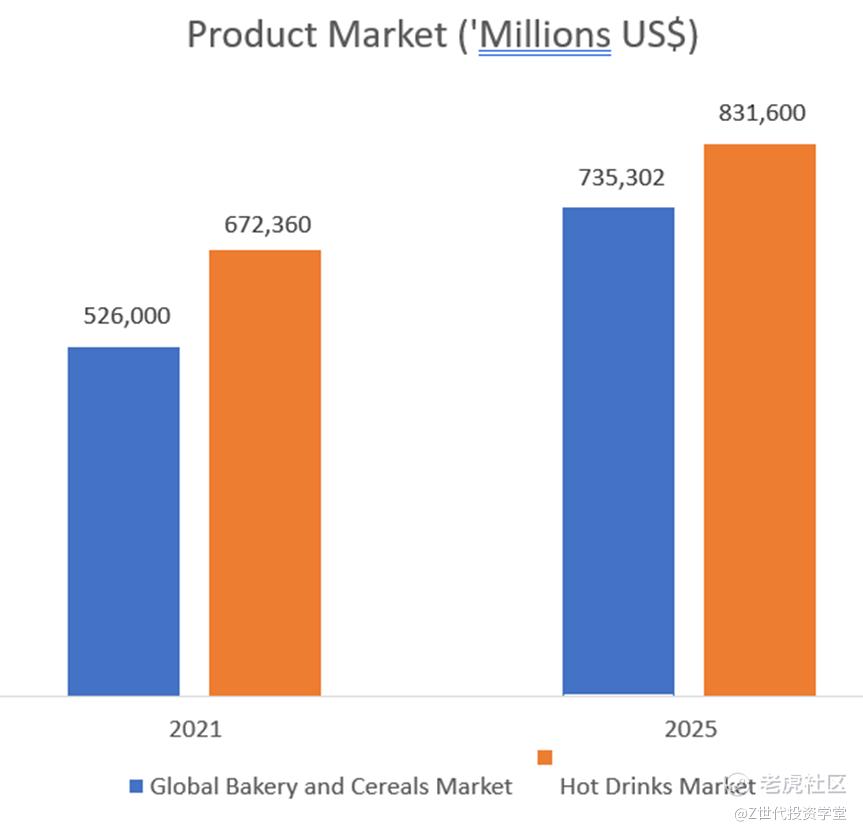

• Global Bakery and Cereals Market

○ DUNT is the leading manufacturer of bakery and sweets products and has an estimated 6.5% of total industry revenue.

○ With growth in the worldwide bakery market past 2 years, the global bakery and cereal market is forecasted at a value of US$735,302.2 million in 2025. Bread and rolls was the largest segment (33.8%), followed by cakes, pastries and sweet pies (19.3%) and cookies (11.8%)

○ Geography wise, Europe accounted for 34.5% of the global bakery and cereal market value, followed by Asia-Pacific (24.1%) and US (21.6%).

○ Hypermarkets and supermarkets formed the leading distribution channel, accounting for 39.4% of the market and convenience stores (17.2%)

○ Krispy Kreme is a prime position to leverage across the market due to their leading position in product offerings, their distribution channels where they deliver to DFD shops which provides additional access in grocery & convenience stores as well as Fresh Shops (capital-light Fresh Retail) at convenience retail locations.

• Hot Drinks Market

○ Revenue in the Hot Drinks market amounts to US$672.36 million in 2022, market is expected to grow annually by 4.39% to US$ 831,600 million by 2025

○ The largest segment in the market is Coffee with a market volume of US$495,500 million in 2023.

○ DUNT offers beverages such as coffee roasts, brewed coffee , hot chocolates and chillers.

○ By 2025, 73% of spending and 12 % volume consumption will be out of home consumption, while 6.3% will be generated through online sales by 2023, which DUNT has access to those markets through their diverse distribution channels.

Investment Thesis: New product offering reaching new markets

• New product offerings:

○ The company’s new products could help augment its revenue by catering to wide range of customers and new health trends due to increasing awareness of the customer base.

○ In August 2022, the company introduced a new Pumpkin Spice Latte Swirl Doughnut and a new Pumpkin Spice Iced Coffee.

○ In June 2022, the company launched Mixed Berry Cobbler, Blueberry Cheesecake, Strawberry Shortcake and Mixed Berry Glazed. These donuts would make summer sweeter for its customers. In the same month, the company introduced Original Glazed Soft Serve ice cream. It is available in shakes, cones and cups.

○ In May 2022, the company introduced Krispy Kreme’s Oh, Honey! collection doughnuts.

○ In April 2022, the company launched best-ever Original Glazed Cinnamon Roll. In September 2021, the company launched the new Apple Cider Glazed and Maple Glazed doughnuts to its popular seasonal Pumpkin Spice doughnuts

○ It’s Insomnia cookies and Consumer Product Goods (CPG) line businesses are expected to continue to grow and solidify their position in the markets

○ For example, Insomnia Cookies are a long-term growth asset as the TAM is huge with market address college students (there being +4000 college campuses in US alone), while having strong economics (27% margin, with <US$200K CAPEX, resulting in less than a year payback period). Since acquiring in 2016, it has grown to account for 18% of U.S and Canada fiscal 2022 Revenue.

精彩评论