【For Hong Kong Investors Only】While China's consumption recovery faces headwinds, there are promising signs that policy support may help revive consumer spending from current low levels.

The government is clearly prioritizing growth, as seen in the recent politburo meeting emphasizing stability. A slew of new measures aim to boost autos, appliances, services, and rural consumption directly.

If implemented effectively over the long term, these targeted steps could help lift incomes and living standards. Stabilizing property and employment, as targeted, would also boost consumer confidence and spending power.

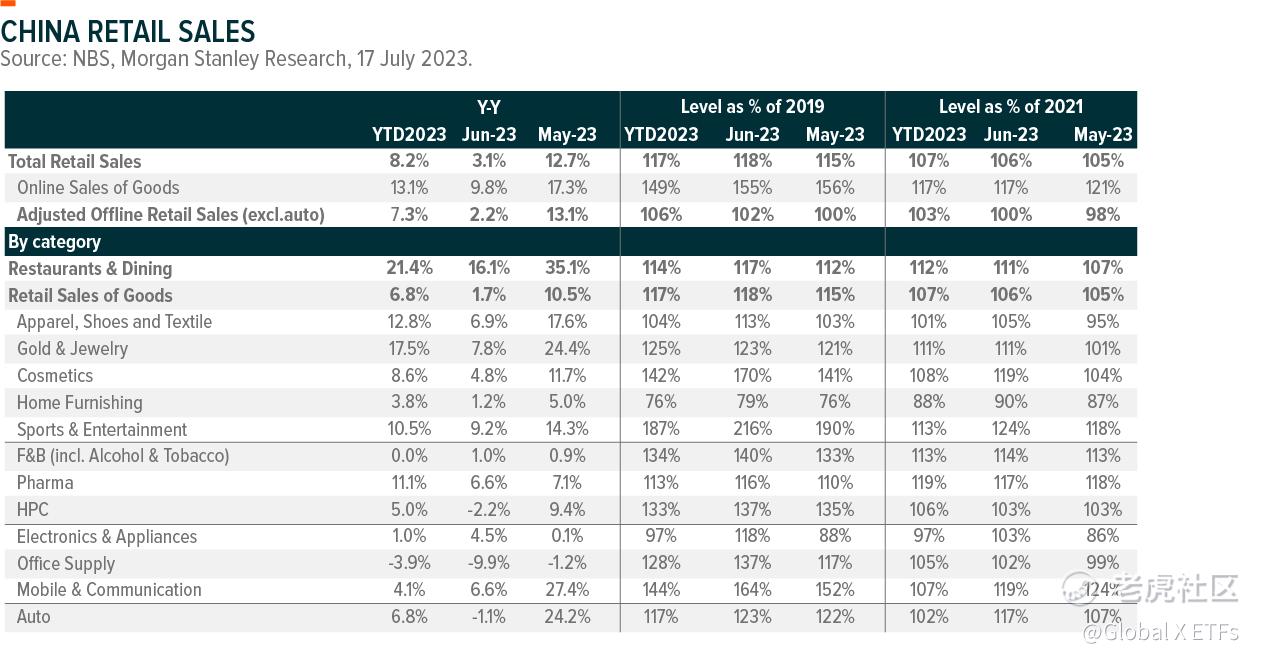

Early indicators show resilience in certain sectors like luxury goods. Higher-end domestic brands continue outpacing mass players. This demonstrates solid underlying demand once macro conditions improve.

Exports may be slowing, but the domestic economy remains largely insulated, benefiting from past opening-up. With large fiscal buffers and policy levers, authorities have the ability to sustain support.

Forward-looking investors are paying attention to signs of stabilization. Successful policy implementation could lay the foundation for a more durable consumption recovery in the next 1-2 years as employment and income growth take hold.

ETFs tracking consumption sectors offer diversified exposure to this long-term theme at reasonable valuations. As the recovery story plays out, opportunities may emerge for early participants. With China still in growth mode, the consumption revival also has implications for global supply chains.

Patience is required given economic complexities, but a glass-half-full perspective sees improving fundamentals and policy commitment supporting an inflection point over the medium term.

Explore more about the Global X China Consumer Brand ETF (2806), including its risk factor: https://www.globalxetfs.com.hk/campaign/china-consumer-brand-etf/?utm_source=tiger&utm_medium=video&utm_campaign=ac

-

This material is intended for Hong Kong investors only. It is not a solicitation, offer or recommendation to buy or sell any security or other financial instrument. Investment involves risk. Past performance information presented is not indicative of future performance. Investing in the funds may expose to risks (if applicable) including general investment risk, equity market risk, sector/market concentration risk, passive investment management risk, tracking error risk, trading risk, risk in investing financial derivative instruments, securities lending risk, distributions paid out of capital or effectively out of capital risk. Investors should refer to the fund’s offering document for further details, including the risk factors. Certain of the statements in this Document are our expectations and forward-looking statements. Such expectations, views and opinions may change without notice and are based on a number of assumptions which may or may not eventuate or prove to be accurate. Investors should ensure they fully understand the risks associated with the applicable investment and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice if in doubt. Issuer: Mirae Asset Global Investments (Hong Kong) Limited. This material has not been reviewed by the SFC.

精彩评论