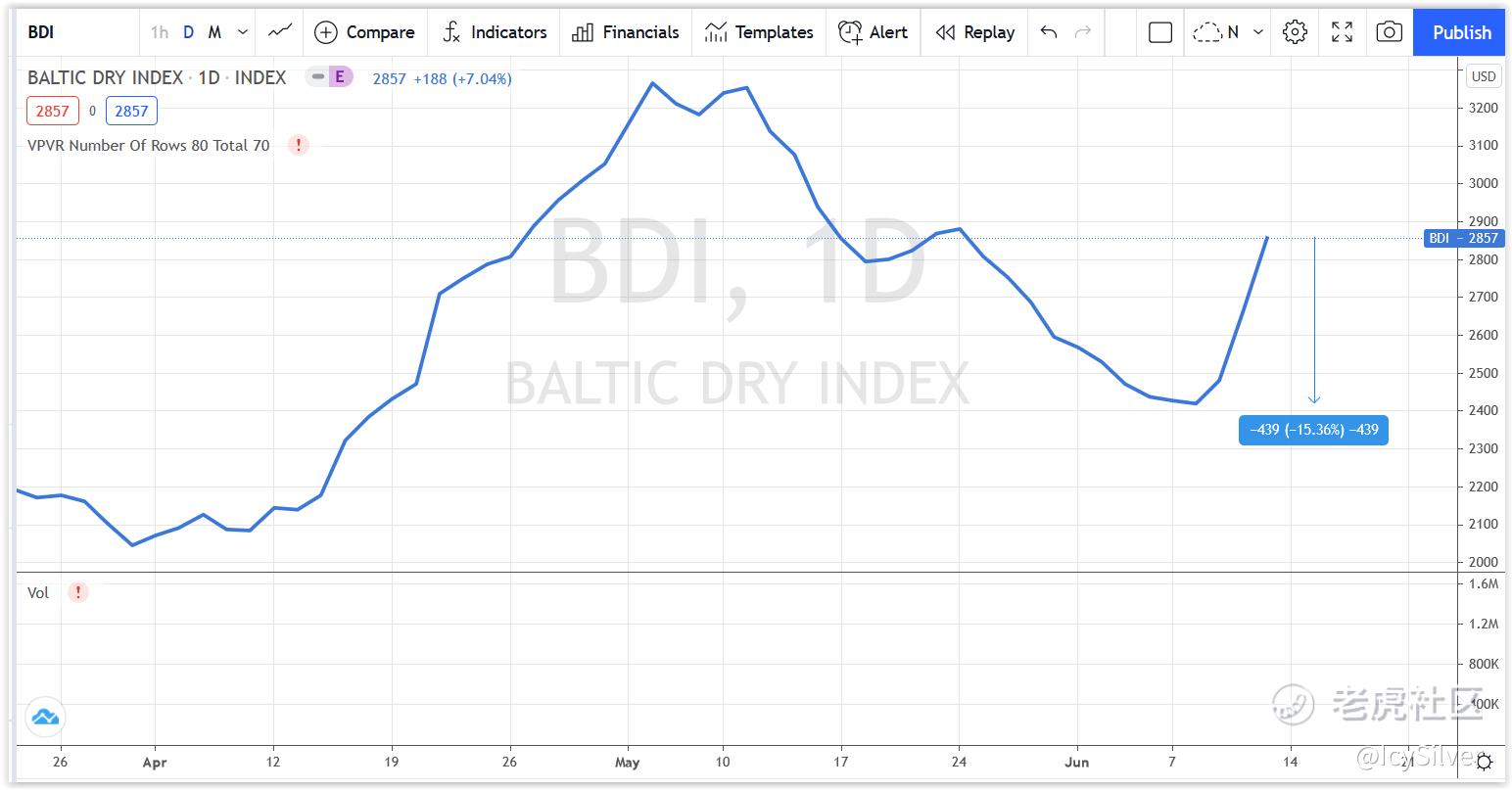

Recently the Baltic Dry Index increased 15% since 8 June. It is a marker of major commodity movements by sea. Therefore, some dry bulk stocks are also trending upwards.

Let's take a look at few dry bulk stocks.

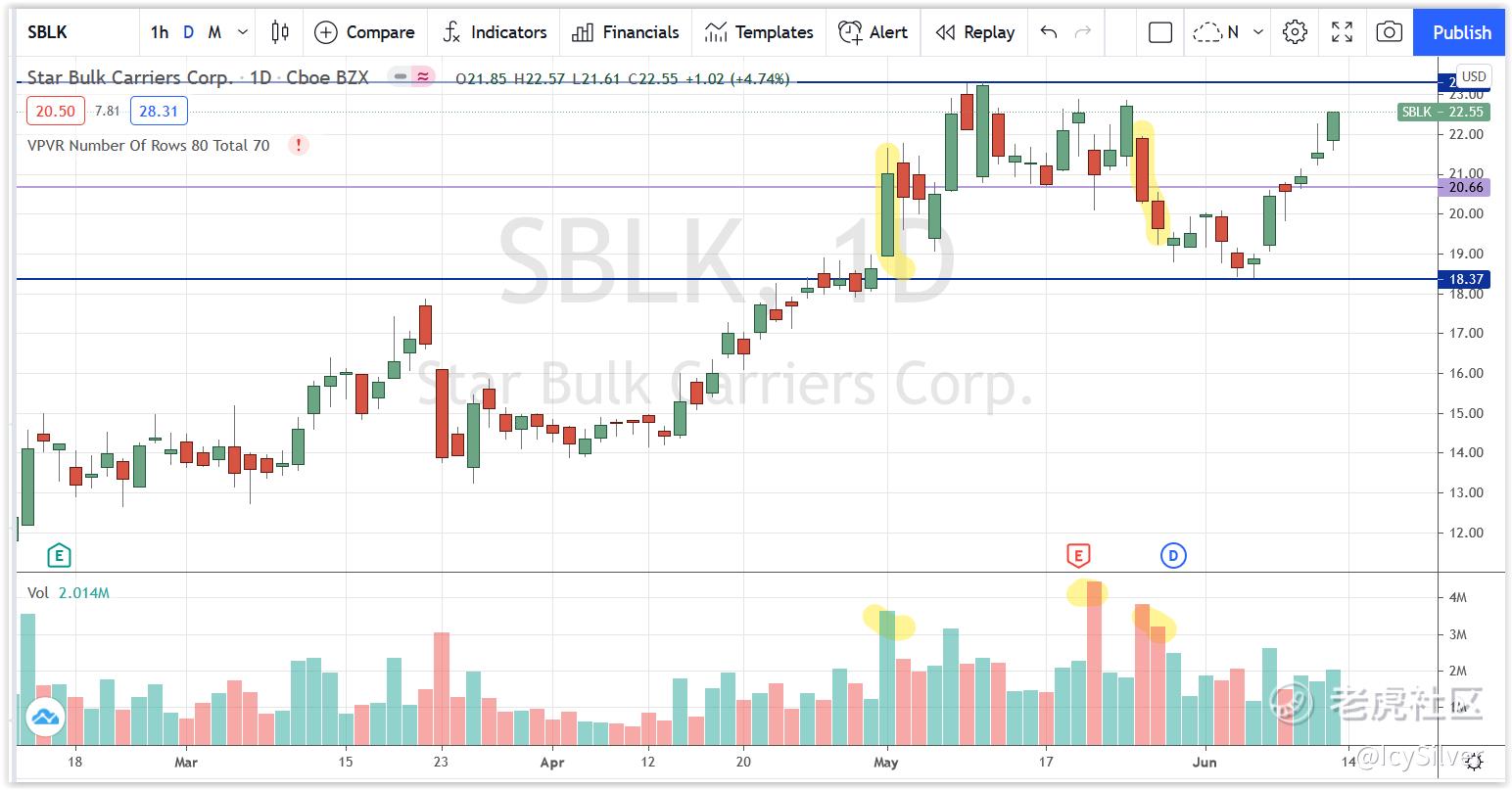

SBLK$Star Bulk Carriers Corp(SBLK)$

This is a marine shipping company based in Greece that specialises in commodity bulk shipping.

It has been in steady uptrend since Feb 2021. Interestingly on 3 May, there was a spike in volume to push the price into the range between $20.50 to $23.30.

Although there was a pull back to $18.40, but prices has since moved up from 7 June onward.

If price can sustain above $23.30, which is also the 52 weeks high, next target is around range of $40.

The nearest support is at $20.60.

DSX$黛安娜船舶(DSX)$

Since Jan 2021, the price has been up trending. Rejection seen at $5.20 on 2 June with spike in volume, but the volume on the following day is roughly 25% of 2 June, suggesting exhaustion of supply. The next few days saw a rally up to break 52 weeks high. There may be a reaction to pull back around $5.20, but otherwise could be a good entry if you like break out trades.

If price can stay above 5.40, next target might be around $6.45 or beyond $9.

The nearest support is at $4.80.

GNK$根科船务贸易(GNK)$

This company operates a fleet of dry bulks transporting commodities. This stock break up from range between $14.80 to $17 on 9 June with slightly higher than usual volume.

As the price has broken out from range, there is higher probability of a retest around $17 but if price stays above $18, the next target is $24 or beyond.

The nearest support is at $18 if more conservative.

最近波罗的海运价指数自 6 月 8 日以来上涨了 15%。它是大宗商品海上运输的标志。因此,一些干散货船股也呈上涨趋势。 我们来看看几只干散货船股票。

SBLK 这是一家位于希腊的海运公司,专门从事大宗商品运输。 自 2021 年 2 月以来,它一直处于稳定的上升趋势。有趣的是,5 月 3 日的成交量激增,将价格推高至 20.50 美元至 23.30 美元之间。 尽管回落至 18.40 美元,但价格自 6 月 7 日起上涨。 如果价格能够维持在 23.30 美元上方,这也是 52 周的高点,那么下一个目标将在 40 美元左右。 最近的支撑位在 20.60 美元。

DSX 自 2021 年 1 月以来,价格一直呈上涨趋势。 6 月 2 日的阻力价为 5.20 美元,成交量激增,但第二天的成交量约为 6 月 2 日的 25%,隐喻供应量枯竭。接下来的几天看到了反弹并突破了 52 周高点。可能会出现回调至 5.20 美元附近的支撑点,但如果您喜欢突破**易,可能是一个不错的入场点。 如果价格能保持在 5.40 美元以上,下一个目标可能在 6.45 美元左右或 9 美元以上。 最近的支撑位在 4.80 美元。

GNK 该公司经营着一支运输商品的干散货船队。该股在 6 月 9 日从 14.80 美元至 17 美元区间震荡,成交量略高于平时。 由于价格已超出幅度,重新测试 17 美元左右的可能性较高,但如果价格保持在 18 美元以上,则下一个目标是 24 美元或更高。留意未来几天的趋势。 如果保守的话,最近的支撑位是 18 美元。

精彩评论