As China providing opportunities for investors to ride the waves of growth, Lion Global Investors and OCBC Securities Private Limited are together providing a new ETF - The Lion-OCBC Securities China Leaders ETF, listing soon on Singapore Stock Exchange.

ETF's Facts

- Underlying Index: Hang Seng Stock Connect China 80 Index

- Index Provider: Hang Seng Indexes Company Limited

- Currency of Account (Base Currency): RMB

- Trading Currency: SGD / RMB

- SGX Code: YYY (SGD), YYR (RMB)

- Trading Board Lot Size: 10 units

- Management Fee: 0.45% per annum

- Expense Ratio: Capped at 0.62% per annum for 2 years from the inception of the Fund

- Dividend Distribution: Annual Distribution at the Discretion of the Fund Manager

- Replication Strategy: Direct Replication or Representative Sampling

- Classification Status: Excluded Investment Product

- Issue Price: SGD 2.00

- Designated Market Maker: Phillip Securities Pte Ltd

- Participating Dealers: OCBC Securities Private Limited /CGS-CIMB Securities (Singapore) Pte. Ltd. /iFAST Financial Pte. Ltd. /Phillip Securities Pte Ltd /Tiger Brokers (Singapore) Pte. Ltd. $(TIGR)$/UOB Kay Hian Holdings Limited

Investment Objective

The investment objective of the Fund is to replicate as closely as possible, before expenses, the performance of the Hang Seng Stock Connect China 80 Index using a direct investment policy of investing in all, or substantially all, of the underlying Index Securities.

About the Index

The Hang Seng Stock Connect China 80 Index is compiled and calculated by Hang Seng Indexes Company Limited and is designed to measure the overall performance of 80 largest Chinese companies in terms of market capitalisation listed in Hong Kong and/or mainland China that are eligible for Northbound or Southbound trading under the Stock Connect schemes.

Eligibility Criteria

- Geographical Requirements: A-shares; or Mainland Securities listed in Hong Kong

- Turnover Requirements: 6-month Average Daily Turnover >= CNY / HKD 20 million for A-shares / HK-listed stocks respectively

- Constituent Selection

Constituent Selection

- Selection Criteria: The top 80 companies with the highest Company Market Value. Rank will be selected as constituent companies

- Number of Constituents Fixed at 80 companies

- Buffer Zone: Existing constituent companies ranked lower than 96th will be removed from the index, while non-constituent, companies ranked 64th or above will be included; Companies will be added or excluded according to their Company MV Rank to maintain the number of constituents at 80

- Review Frequency: Half-yearly (Data cutoff in June & December)

- Rebalancing Frequency: Quarterly (The ETF will rebalance at the first Friday of March, June, September and December of

each year) - Fast Entry: No

- Replacement: for Ad-hoc Removal: Yes, the outgoing constituent will be replaced by the highest ranked candidate from last regular review

- Weighting: Freefloat-adjusted market capitalisation weighted

- Capping: 8% on individual company; 40% on industry

- Launch Date: 3 May 2021

- Base Date: 31 December 2014

- Base Value 3,000

- Currency: Offshore Renminbi

- Dissemination Frequency: Real-time at every two seconds

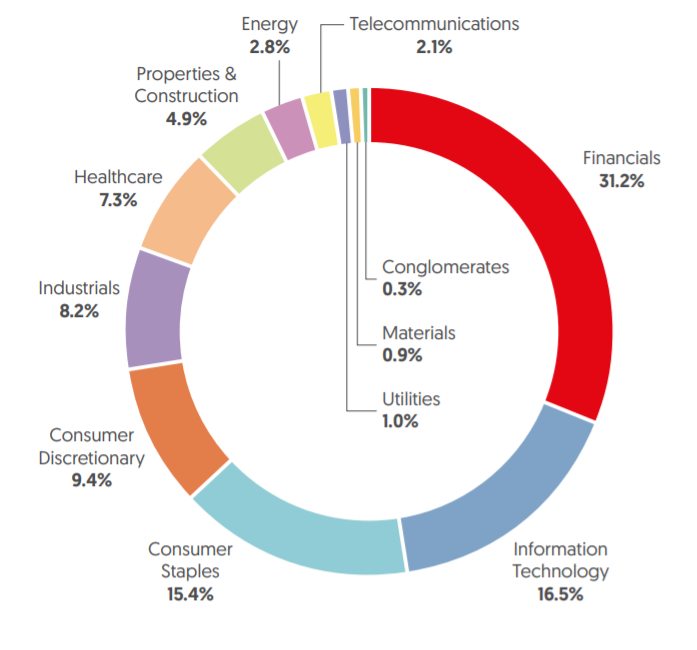

Sector Breakdown

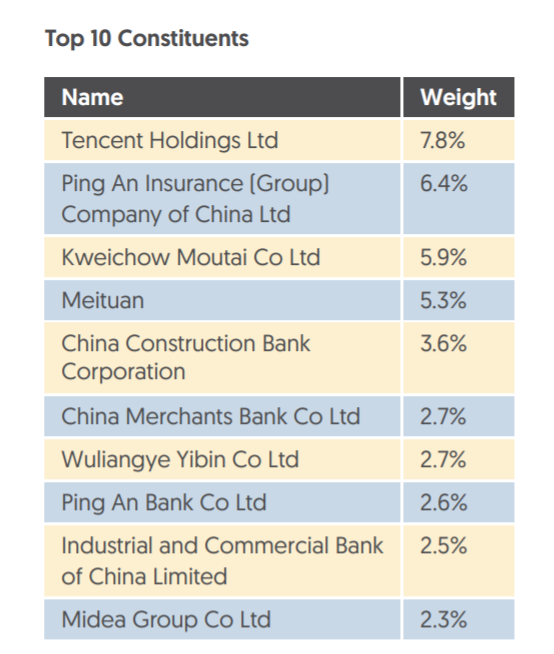

Top Constitutes

Performance of last year

Tiger Brokers’ investors will be able to subscribe for units in the Lion-OCBC Securities China Leaders ETF via the trading platform between July 12 to 27, 2021, 12 noon before the listing date.

For ETF's details, please Check this.

For the Index details, please Check this.

精彩评论