Already trading at less than half its IPO price, online retailer's shares drop more than 10% in after-hours trading.

The parent company of Wish has seen its stock deeply discounted since its initial public offering, and the price was slashed yet again in after-hours trading Wednesday.

ContextLogic Inc. (WISH), which offers the discount online-purchasing platform, reported a first-quarter loss of $128 million, or 21 cents a share, on sales of $772 million Wednesday, after reporting a loss of $66 million on sales of $440 million in the year-ago quarter. Analysts on average expected a loss of 17 cents a share on sales of $743.1 million, according to FactSet.

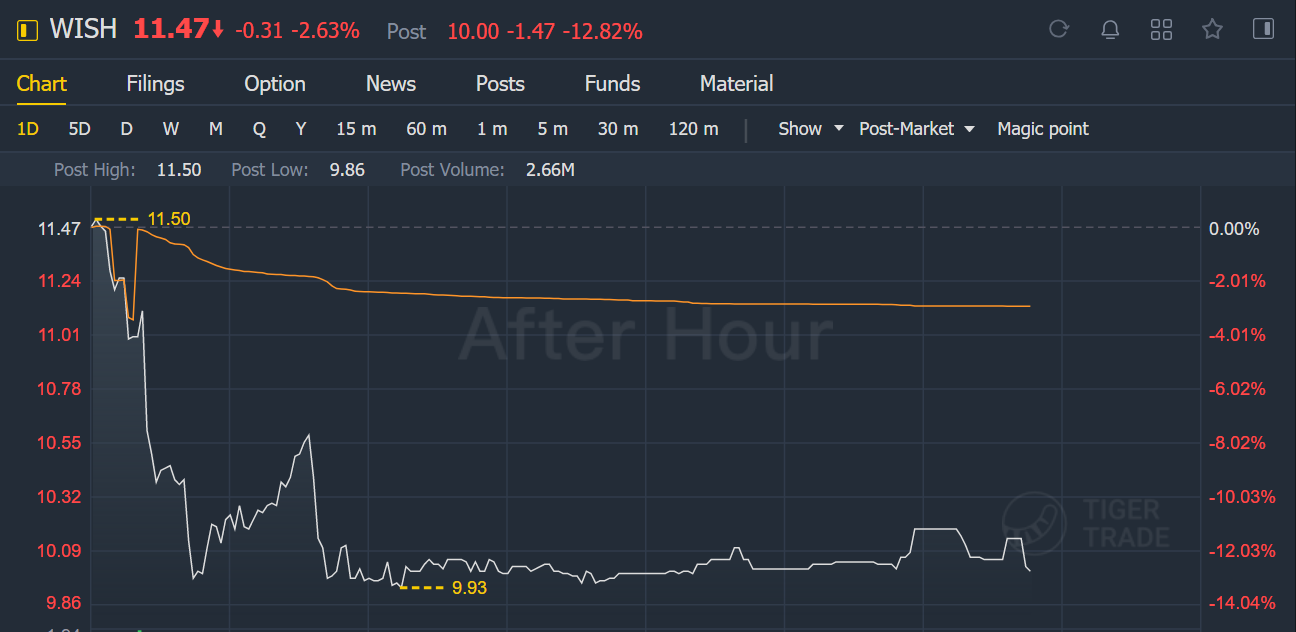

Wish went public at the end of last year at a price of $24 a share , but fell lower than that price on its first day of trading and has traded steadily lower than the IPO price since mid-February. Shares closed Wednesday with a 2.6% decline at $11.47, and dropped more than 10% in after-hours trading following the release of the results.

In a letter to shareholders, Wish -- which has advertised heavily in the past on platforms such as Facebook Inc. (FB) -- noted "increased sales and marketing costs driven by higher digital advertising costs." Executives also noted that Wish has moved into advertising on television and streaming platforms, as well as "experimenting with influencer marketing."

Executives also pointed to effects of the COVID-19 pandemic on its top customer targets, budget-minded consumers.

"We are confident we are making the right strategic decisions to grow our business for the long term," Chief Executive Piotr Szulczewski and Chief Financial Officer Rajat Bahri wrote in the letter to investors. "Last year, the value-conscious consumer demographic was disproportionately affected by the pandemic. As the economy starts to recover, we believe macro trends will have a positive impact on our business."

Wish's forecast failed to live up to analysts' expectations as well, however. Executives guided for second-quarter sales of $715 million to $730 million, while analysts on average were projecting $759 million, according to FactSet. The company also announced that former Square Inc. $(SQ)$ executive Jackie Reses will take over as executive chair, splitting the roles of CEO and chair that were previously both held by Szulczewski.

精彩评论