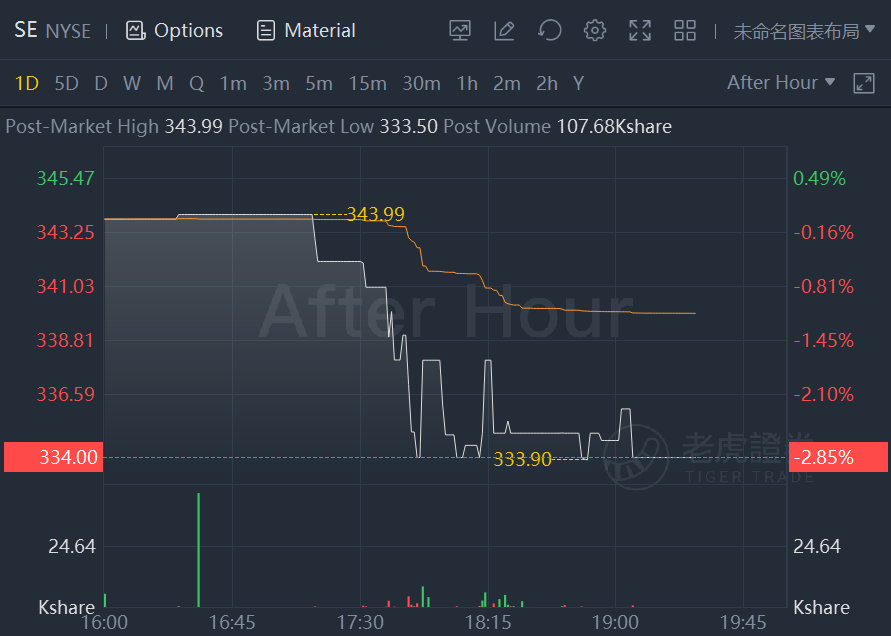

Singapore’s Sea Ltd. fell 2.8% in postmarket trading on Wednesday after launching the largest secondary offering of 2021 to date.

Sea Ltd. aims to raise $6.3 billion in the largeste quity offering of the year, a deal that will propel a global expansion and acquisitions for Southeast Asia’s largest company.

The online gaming and e-commerce firm backed by Tencent Holdings Ltd. is offering 11 million shares, a stake worth about $3.8 billion at Wednesday’s close. It also intends to issue $2.5 billion of equity-linked debt. Sea, which has risen more than 70% this year, fell in post-marketing trading in New York.

The region’s most valuable company has rapidly expanded its market share in e-commerce and gaming during the pandemic, riding hit titles like shooter game Free Fire and its Shopee online shopping app. Its founder Forrest Li became Singapore’s richest person in August after shares of his company surged.

“Sea is going for a market expansion, especially in new businesses such as e-commerce in Latin America and food delivery in Southeast Asia,” said Sachin Mittal, an analyst with DBS Group Holdings Ltd.“Competition is intensifying and gaining market share is of utmost importance.”

The 11 million shares alone that Sea is offering will be the biggest equity sale since Chinese e-commerce operator Pinduoduo Inc. raised $4.1 billion on Nov. 18, according to data compiled by Bloomberg. Including the convertible bonds, the overall deal will be the biggest equity raise since T-Mobile US Inc.’s in June 2020.

The deal, offered via Goldman Sachs,JPMorgan and BofA, arrives at a time of resurgence in cross-border issuance from Asia.Nio Inc.on Tuesday announced plans to raise up to $2.0 billion in what would be the biggest U.S. offering by a company based in China since Didi Global Inc.

Sea’s latest capital-raising follows a $2.6 billion stocksalein December and a $1.35 billiondealin 2019. It will deploy the latest chunk of capital toward “business expansion and other general corporate purposes, including potential strategic investments and acquisitions,” the company said in a statement.

Sea in August raised its annual forecasts for its two main business, underscoring its confidence in an expanding international business that’s gaining momentum beyond its home region.

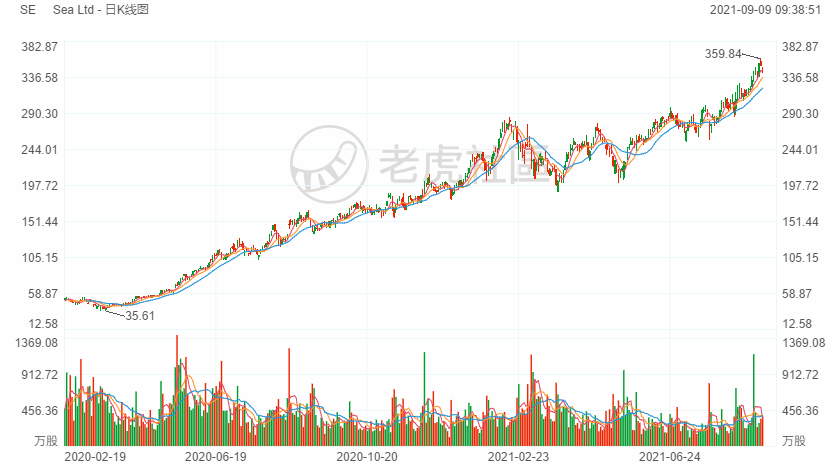

The stock has risen more than eightfold since the beginning of 2020 as Sea invests cash generated from popular mobile battle royale game Free Fire to establish itself as a leader in e-commerce in Southeast Asia. At the same time, it has expanded its online shopping business in Brazil as part of a strategy to become a global player, increasing competition with Latin American e-commerce giant MercadoLibre Inc.

In its home region, Sea remains locked in a fierce battle with GoTo and Grab Holdings Inc., all bolstering their e-commerce and fintech offerings in one of the fastest-growing internet markets on the planet. Southeast Asia’s online spending is set to triple to more than $300 billion by 2025, research from Google and its partners shows.

It’s now turning to fintech for further growth beyond gaming and e-commerce, while also expanding beyond the region. It won a digital-banking license in Singapore in December and acquired Indonesia’s PT Bank Kesejahteraan Ekonomi, better known as Bank BKE, people familiar with the matter said in January.

精彩评论