U.S. stock futures were sharply higher on Tuesday morning as the market tried to bounce after a punishing bear market for the tech-heavy Nasdaq and a 19% pullback for the S&P 500.

Market Snapshot

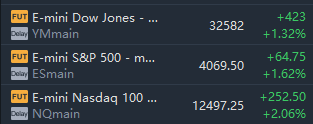

At 7:50 a.m. ET, Dow e-minis were up 423 points, or 1.32%, S&P 500 e-minis were up 64.75 points, or 1.62%, and Nasdaq 100 e-minis were up 252.5 points, or 2.06%.

Pre-Market Movers

Wal-Mart– Walmart slumped 7% in premarket trading after missing bottom-line expectations for the first quarter. The retail giant earned $1.30 per share, 18 cents a share below estimates as inflationary pressures offset the positive impact of better-than-expected sales.

Home Depot – Home Depot added 2.7% in the premarket after the home improvement retailer reported better-than-expected profit, revenue and comparable sales for the first quarter, while also raising its full-year forecast. Home Depot earned $4.09 per share for the quarter, compared to a consensus estimate of $3.68 a share.

Citigroup – Citi rallied 5.4% in the premarket following news that Berkshire Hathaway(BRK.B) took a nearly $3 billion stake in the bank during the first quarter. Berkshire’s latest 13-F filing also showed that the company sold nearly all of an $8.3 billion stake in Verizon(VZ), whose shares fell 1%.

United Continental – United Airlines shares rallied 4.6% in premarket action after the airline raised its current-quarter revenue forecast, saying it expects its busiest summer since before the pandemic began.

Twitter – Twitter fell 1% in the premarket as Tesla CEO Elon Musk continues to cast doubt on whether his deal to buy Twitter for $54.20 per share will be completed. Musk is suggesting that he could seek a lower price, saying there could be at least four times the number of spam or fake accounts than the company has said.

Take-Two – Take-Two jumped 4.9% in the premarket despite a quarterly miss in its key bookings metric as well as weaker-than-expected guidance. Analysts have pointed to a history of conservative guidance from the video game maker, and are also expecting a more upbeat outlook once its pending acquisition of Zynga(ZNGA) closes.

JD.com – JD.com surged 9% after beating top-line and bottom-line estimates for its latest quarter, as the China-based e-commerce giant saw increased demand amid new Covid-related lockdowns. JD.com is also among tech stocks benefiting from hopes for relaxed regulatory curbs on tech companies, along with Pinduoduo(PDD), up 8.6%, Alibaba(BABA), up 7.64% and Baidu(BIDU), gaining 4.1%.

Tencent Music – Tencent Music shares jumped 6.5% in premarket trading, despite a 15% slide in quarterly revenue. Tencent Music shares are also benefiting from those hopes for looser regulatory curbs.

Lordstown Motors Corp. – Lordstown CFO Adam Kroll said doubts about the electric vehicle maker’s ability to stay in business will remain in place until it secures more funding. Lordstown originally issued a “going concern” warning in June 2021. The stock fell 1.8% in premarket trading.

Market News

Twitter said on Tuesday it was committed to completing Elon Musk's $44-billion deal at the agreed price and terms.The deal is subject to the approval of Twitter stockholders and is expected to close in 2022, the company said.

Microsoft 's chief executive is promising to boost employee compensation amid continued low unemployment across the U.S. and high inflation. The company plans to nearly double global merit-based salary budget.

JD.com reported quarterly earnings of $0.40 per share which beat the analyst consensus estimate of $0.24 by 66.67 percent. This is a 5.26 percent increase over earnings of $0.38 per share from the same period last year. The company reported quarterly sales of $37.80 billion which beat the analyst consensus estimate of $34.82 billion by 8.56 percent. This is a 21.89 percent increase over sales of $31.01 billion the same period last year.

Sea Ltd said total revenue in the first quarter of 2022 rose 64.4% to $2.9 billion, above analysts' estimate of $2.76 billion, and it widened its full-year 2022 e-commerce revenue outlook range to between $8.5 billion and $9.1 billion, compared with $8.9 billion to $9.1 billion forecast earlier.

Home Depot's earnings per share were $4.09, up from $3.86 a year earlier. Analysts had expected earnings of $3.69 a share. The company raised 2022 guidance for sales growth to 3% and an operating margin of about 15.4%.

Wal-Mart reported total U.S. comparable sales rose 4% in Q1 to top the consensus estimate for a 2.2% increase. Comparable sales were 3% higher at Walmart stores with transaction growth flat and average ticket up 3%. Comparable sales rose 10.2% at Sam's Club locations in the U.S. off transaction growth of 10.0%.

Robert Scaringe, the CEO of Rivian Automotive, Inc., purchased 41,000 shares of the company’s Class A common stock at an average price of $25.7772. The total amount of purchased shares is approximately $1.05 million.

Intel shareholders rejected compensation packages for top executives, including a payout of as much as $178.6 million to Chief Executive Officer Pat Gelsinger, a regulatory filing showed on Monday.

精彩评论