(Oct 20) Stocks traded slightly higher Wednesday as investors eyed a batch of stronger-than-expected earnings results with increasing optimism over the trajectory of corporate profits, even in the face of ongoing supply chain constraints.

The S&P 500 gained about 0.2% just after the opening bell. The blue-chip index closed out a fifth straight session in positive territory on Tuesday, marking its longest winning streak since August.

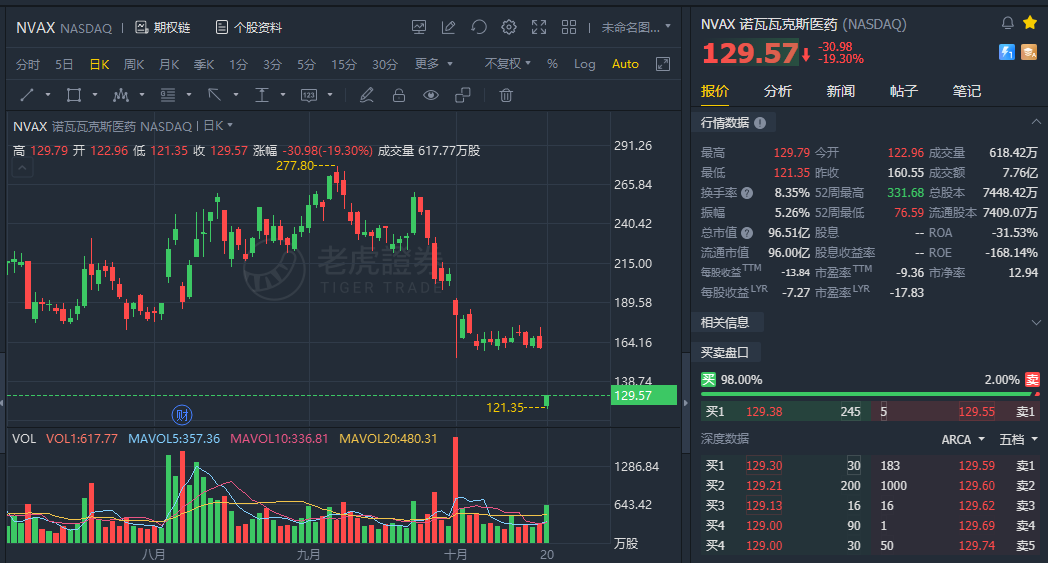

Shares of Novavax Inc fell 19.3% after a report from Politico said the company faces significant hurdles in proving it can manufacture its experimental COVID-19 vaccine that meets regulators’ quality standards, resulting in production delays.

Bitcoin (BTC) prices rose above $64,000 and closed in on an all-time high. The cryptocurrency held onto gains from earlier this week, after the first-ever Bitcoin futures exchange-traded fund, or the ProShares Bitcoin Strategy ETF (BITO), rose by nearly 5% in its public debut on the New York Stock Exchange on Tuesday.

Shares of Netflix fell in early trading despite posting third-quarter earnings and subscriber growth that exceeded Wall Street's expectations. United Air Lines (UAL) shares rose after the carrierdelivered a smaller-than-expected quarterly loss and revenue that topped expectations, albeit while remaining some 32% below 2019 levels.

These better-than-feared earnings results — in addition to those from earlier reporters including the big banks last week, and Procter & Gamble and Johnson & Johnson earlier this week — have helped assuage traders' concerns that corporate profits would slow dramatically after a second-quarter surge. Investors have been nervously monitoring inflation data showing prices jumping by the most in decades, on top of a myriad reports over persistent labor and materials shortages and delivery issues. All of these factors were expected to weigh heavily on corporate profits.

"We think investors have been too pessimistic on earnings expectations," Jon Adams, BMO Capital Markets senior investment strategist,told Yahoo Finance Live."It does look like Q2 was likely the peak, but Q3 is going to be strong, probably above 30% year-over-year [growth]."

"We think the strength will continue into the fourth quarter, we're not overly concerned about profit margins," Adams added. "We are closely monitoring supply chain issues and increasing wage pressures but still think that profit margins are at healthy levels, and that there's more upside to come."

Other pundits also suggested price pressures may begin to ease over the coming quarters.

"I do think that as these supply chain issues subside throughout the course of 2022, we're also going to start to see inflation moderate from these elevated levels," Meera Pandit, global market strategist at JPMorgan Asset Management, told Yahoo Finance Live. "It won't be completely transitory. Things like housing, things like food – we've seen wages come a little bit higher. So we're going to see higher inflation than we did during the last expansion. But it's going to come down and moderate from these levels."

精彩评论