Xilinx Inc., which is being acquired by Advanced Micro Devices Inc., reported better-than-expected second-quarter, including a 22% revenue increase--7% increase from the previous quarter,--despite industry-wide supply chain challenges. Here's what you need to know:

PROFIT: Net income rose to $234.5 million from $193.8 million a year earlier. On a per-share basis, profit was 94 cents, or $1.06 as adjusted. Analysts surveyed by FactSet expected 91 cents a share, or 86 cents as adjusted.

REVENUE: Net revenue rose to a record $935.8 million from $766.5 million. Analysts expected about $891 million.

AMD and Xilinx said the deal is on track to close by the end of the year.

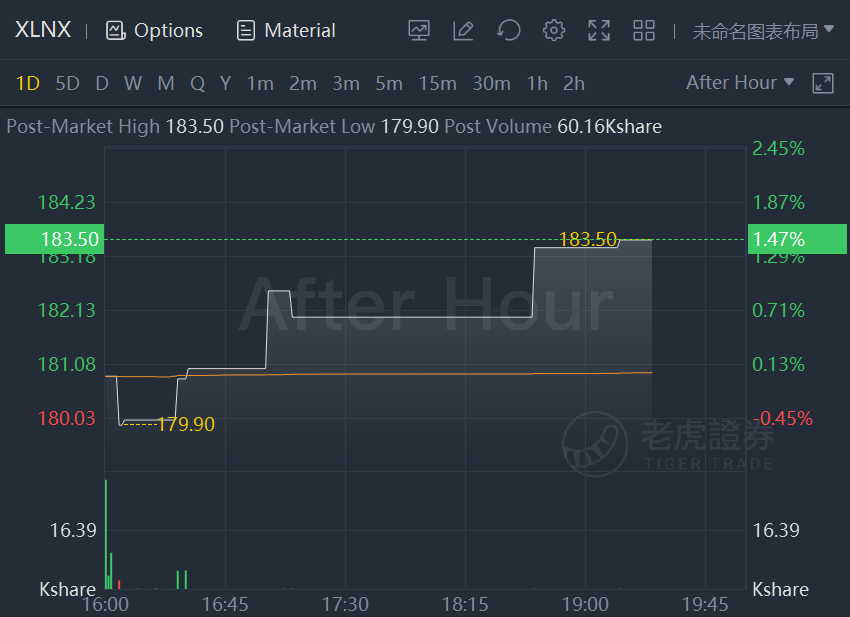

Xilinx shares rose 1.5% in extended trading.

Xilinx Reports Record Revenue in Fiscal Second Quarter 2022

- Record revenue of$936 million, representing 7% sequential growth and 22% annual growth amidst continuing industry-wide supply chain challenges

- Aerospace & Defense, Industrial and Test, Measurement & Emulation (AIT) revenue increased 20% sequentially, with strong performance in all sub-markets led by another record performance in the Industrial end market and improvement in Aerospace & Defense business

- Automotive, Broadcast and Consumer (ABC) revenue in the quarter increased 19% sequentially, with record quarters in all sub-markets, led by the Automotive end market

- Wired and Wireless Group(WWG) revenue increased 9% sequentially and 42% year-over-year as robust global 5G deployments continue and strength from the Wired business

- Data Center Group(DCG) revenue declined modestly, down 3% quarter-over-quarter, as Networking strength was offset by a decline in Compute

- Platform transformation continues with total Adaptive SoC revenue, which includes Zynq and Versal platforms, up 9% sequentially and 56% year-over-year, and representing 29% of total revenue

精彩评论