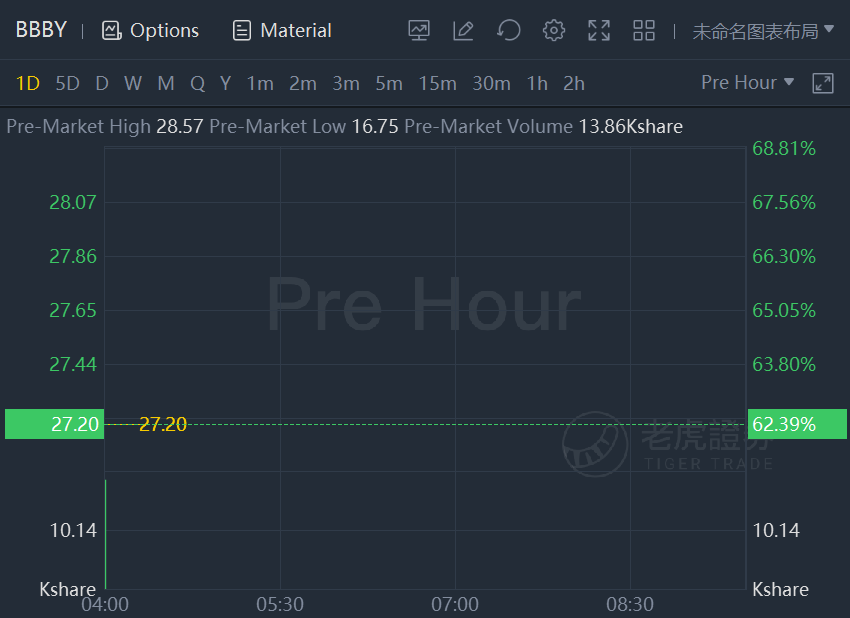

Bed Bath & Beyond stock soared as much as 62% to $27.2 per share in premarket trading on Wednesday, after the home-goods retailer announced news that likely fueled a so-called short squeeze, where hedge funds that had bet against the stock were forced to buy back their shares to cut losses.

Bed Bath & Beyond announced a partnership with grocery chain Kroger (KR) on Tuesday, noting that some of its home and baby products will be available in various Kroger stores and online starting next year. The company also announced the launch of its new digital marketplace that will sell goods from third-party brands.

Bed Bath & Beyond also completed $600 million in share repurchases since the end of fiscal 2020, and now expects to buy back another $400 million by the end of 2021—two years ahead of schedule. The company has a total market cap of $1.7 billion as of Tuesday’s close. The massive repurchase program underscores the firm’s confidence in its turnaround, says CEO Mark Tritton.

Bed Bath & Beyond shares have lost nearly 80% value since their latest peak in 2015. The retailer’s same-store sales have continued to shrink since 2015, with a particularly steep decline over the past two years due to the Covid-19 disruptions. Earnings per share even dipped into the negative territory in the May quarter of 2020.

The home-goods retailer has been staging a turnaround and introduced a number of private label brands in the past few months, but rising inflation, supply chain disruptions, and the Delta variant presented some new challenges. When the retailer reported its latest quarterly results in September, it posted revenue 26% lower from a year ago and earnings plunged a whopping 92%.

The stock is one of the most heavily shorted stocks as hedge funds bet the shares would continue to fall. According to FactSet data, about 27% of its floating shares were sold short as of Tuesday, the third-highest among the 1,500 largest U.S. public companies. The ratio was as high as 64% in January.

Since 2021, Bed Bath & Beyond shares have seen a few sharp spikes as retail traders on Reddit forums pushed up the price in stocks disliked by Wall Street, forcing hedge funds to cover their short positions. They’ve done the same to meme stocks like GameStop (GME) and AMC Entertainment Holdings (AMC). But the retailer’s stock has fallen out of favor since June, as the meme crowd moved onto other targets.

Bed Bath & Beyond also named two new executives: Anu Gupta as chief growth officer and Rafeh Masood as chief customer officer.

精彩评论