U.S. stock index futures edged higher on Wednesday as technology and growth stocks snapped back, while investors waited for private payrolls data to gauge how fast the Federal Reserve will raise interest rates to tame decades-high inflation.

Market Snapshot

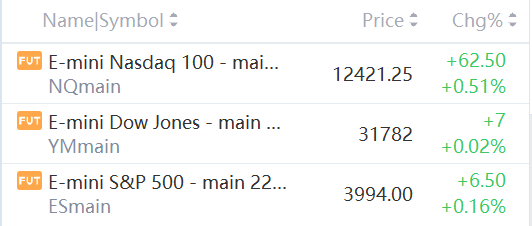

At 8:00 a.m. ET, Dow e-minis were up 7 points, or 0.02%, S&P 500 e-minis were up 6.5 points, or 0.16%, and Nasdaq 100 e-minis were up 62.5 points, or 0.51%.

Pre-Market Movers

Designer Brands – The footwear and accessories retailer reported better-than-expected profit and revenue for its latest quarter and raised its full-year outlook. Designer Brands added 1.8% in the premarket.

Express – The apparel retailer's shares slid 4.7% in premarket trading after its quarterly revenue missed estimates and it cut its full-year guidance. Express noted challenging economic conditions that worsened as the quarter progressed.

Chewy – Chewy slumped 12.6% in the premarket after cutting its full-year outlook. The pet products retailer reported a surprise profit for its latest quarter, but sales are lagging as prices rise and consumers focus pet spending on food and medications.

HP Inc. – HP Inc. shares tumbled 7.1% in premarket trading after quarterly earnings matched estimates and revenue missed forecasts. HP is the latest computer maker to report a slowdown in spending on electronics.

CrowdStrike – CrowdStrike reported better-than-expected quarterly profit and revenue, and the cybersecurity company also issued an upbeat forecast. CrowdStrike is seeing strong demand for cybersecurity software even in the face of a weakening economy.

Snap – Snap tumbled 7.2% in the premarket after losing two key executives to Netflix (NFLX). Chief business officer Jeremi Gorman will become the streaming service's president of worldwide advertising, while Snap's vice president of sales for the Americas, Peter Naylor, will become Netflix's VP of ad sales. The news follows a report in The Verge Tuesday that the social media company would lay off 20% of its workforce amid a slide in digital advertising.

Bed Bath & Beyond – Bed Bath & Beyond slumped 24% in premarket action after the housewares retailer filed to sell additional common shares in the future. Bed Bath & Beyond also provided an update on moves to shore up its finances, including commitments for more than $500 million in new financing.

PVH – PVH cut its full-year outlook and also announced it would cut "people costs" by about 10% by the end of 2023. The maker of the Tommy Hilfiger and Calvin Klein apparel brands said it is facing a challenging economic environment and hopes to save more than $100 million annually through the job cuts. PVH lost 3.7% in the premarket.

Hewlett Packard Enterprise – Hewlett Packard Enterprise posted results in line with Wall Street forecasts, even as IT business spending declines. CEO Antonio Neri told Barron's that the provider of networking equipment and services is seeing "enduring demand." HPE shares rose 1.8% in premarket trading.

Market News

Grab, Singtel Join Singapore’s Digital Bank Battle Next Week

Grab Holdings Ltd. and Singapore Telecommunications Ltd. plan to roll out a banking app next week, joining tech giants in taking advantage of the country’s fintech liberalization.

Called GXS, the bank will start by offering a savings account from Sept. 5 and envisions expanding into credit products over time. It will begin by targeting younger users and the gig economy workers that underpin Grab’s car-hailing and meal delivery services, according to a statement.

NetEase Acquires France’s Quantic Dream in Gaming Expansion

China’s biggest games distributor after Tencent Holdings Ltd., NetEase is stepping up the international expansion of its gaming business to counter economic and regulatory headwinds at home. With Quantic Dream, it secures its first studio in Europe and the developer of an upcoming game in the Star Wars franchise.

Visa Says U.S. Payments Volume Climbed 11% Y/Y in August

Visa said its U.S. payments volume in August increased 11% from a year ago, even after the company suspended its operations in Russia in March 2022, and was flat with July 2022.

Credit payments volume increased 17% and debit volume rose 7% Y/Y, both up one point from July.

China's Tencent Music Entertainment Partners With Billboard

Tencent Music Entertainment Group inks a partnership with Billboard to highlight China's music industry and share Billboard's global content to TME's wide-ranging channels.

The partnership leverages company's leading technologies and Chinese music industry insights with Billboard's global brand authority, drawing on both domestic and international markets to promote the impact of Chinese music around the world.

精彩评论