Enterprise software firm Oracle Corp fell short of Wall Street expectations for first-quarter revenue, hurt by competition in the cloud computing space.

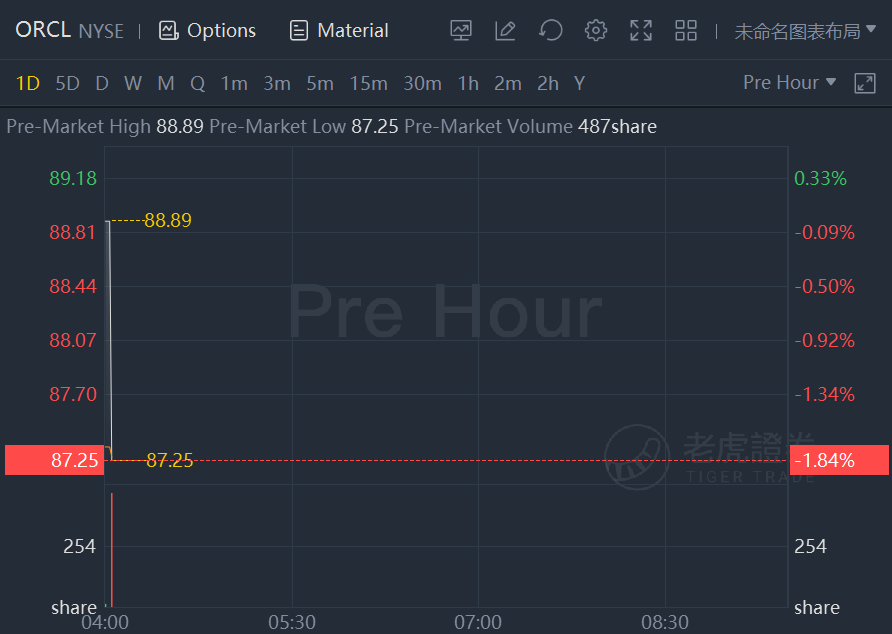

Shares of the Austin, Texas-based company slid 1.8% in premarket trading.

Analysts say Oracle, whose shares have risen about 40% this year, is well positioned to benefit from cloud computing but a crowded space of rivals, including Microsoft Corp's Azure, Amazon.com Inc's Amazon Web Services, Salesforce.com and IBM Corp, will keep the heat on the company.

"Expectations would be for revenue forecasts to continue moving higher," said Jack Andrews, analyst at Needham & Co.

To bolster its footing in the cloud computing space, Oracle, which counts Zoom Video Communications as one of its customers, has been ramping up investment to set up more data centers that can be rented out to clients as they expand and shift operations to the cloud.

Oracle said its two new cloud businesses, software-as-a-service and infrastructure-as-a-service, made up 25% of the company's total revenue with an annual run rate of $10 billion.

Andrews expects these businesses to drive overall growth over time as they continue to become bigger contributors to Oracle's revenue stream.

Total revenue rose 4% to $9.73 billion in the quarter ended Aug. 31. Analysts were expecting revenue of $9.77 billion, according to IBES data from Refinitiv.

But revenue at Oracle's cloud license and on-premise license support was down 8% at $813 million during the first quarter.

Excluding items, Oracle earned $1.03 per share, topping analysts' expectations of 97 cents per share.

精彩评论