Facebook于2019.7.24盘后发布了2019Q2的财报,从财报数字上看,符合一贯的预期,没有太大的惊喜,也没有太大的惊吓。关于具体的财务数据,丸子就不赘述了,大家看看财报就好了。$Facebook(FB)$

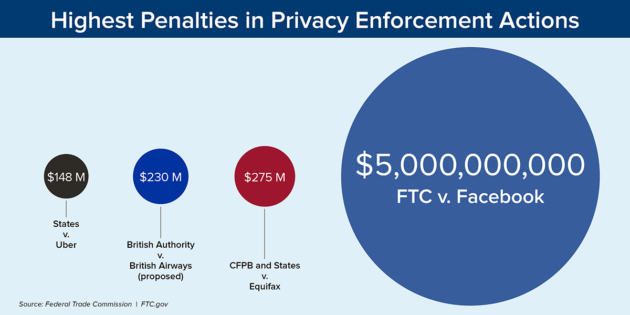

这段时间最重要的事就是FTC在隐私问题上的处罚协议,Facebook被罚50亿美元,并在公司运营和监管上做重大改变。50亿的罚款,2019Q1已计提了30亿,2019Q2再计提20亿。

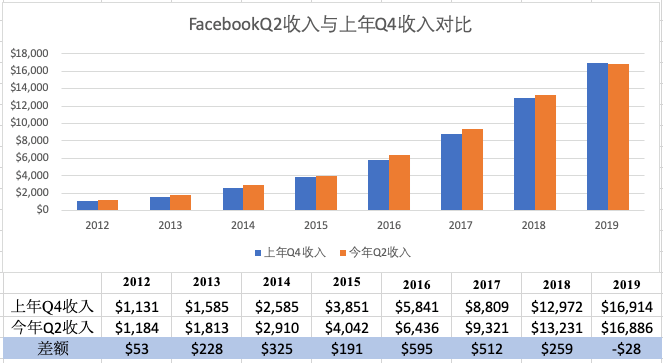

财务上的一个小细节是,随着FB收入增速的逐渐放缓,2019Q2首次出现了Q2的收入比去年Q4收入低的情况。

Facebook Q2收入与上年Q4收入对比

在财报电话会议上,扎克伯格仍然是对Facebook的系列产品有远大的规划和乐观的展望,让投资者对未来充满信心。

但CFO David Whner一出场,按照一贯的套路,就给投资者泼了冷水,把投资者拉回到了残酷的现实,我们今天主要看看残酷的现实有哪些。

1. 11亿美元的一次性税收计提,不过这不是针对Facebook的特定费用,影响不大。

"Our Q2 tax rate was 46% and was higher than expected due to the tax treatment of the FTC accrual and a court ruling in the IRS vs. Altera case. In that case, the Ninth Circuit reversed a prior Tax Court decision addressing the tax treatment of certain share-based compensation expenses. We changed our treatment this quarter to reflect the Ninth Circuit opinion which resulted in a one-time income tax charge of $1.1 billion."

"我们第二季度的税率为46%,高于预期,这是由于FTC应计罚款的税收处理以及法院对IRS vs. Altera案的裁决。在此案中,第九巡回法院推翻了税务法院先前关于某些股权激励费用的税务处理的裁决。我们在本季度改变了我们的处理方式,以反映第九巡回法院的意见,这导致了11亿美元的一次性所得税费用。"

2. 收入继续减速,Q4和2020年会减的更厉害

“However, we continue to expect that our constant currency revenue growth rates will decelerate sequentially going forward. We also expect more pronounced deceleration in the fourth quarter and into 2020, partially driven by ad targeting related headwinds and uncertainties.”

“然而,我们仍然预计,我们的不变货币收入增长率将在未来继续减速。我们还预计,第四季度和2020年将出现更明显的减速,部分原因是广告定向相关的不利因素和不确定性。”

“And then the second question was on the ad targeting-related headwinds. So we think of those new in really 3 components. The first is regulatory as you think about things like GDPR and other impacts and how those will be rolling out globally. The second is platform changes as it relates to operating systems and more of a focus on privacy from the operating systems and the impact that can have on measurement and also on targeting. And then the third is our own product changes as we put privacy more front and center. So really it's the compounding of those 3 issues that are creating headwinds that we think are going to impact us as we get later in the year and into 2020.”

“...关于广告定向相关的不利因素。我们认为包括有3个部分。第一个是监管,GDPR和其他类似监管在全球陆续推出。第二个是平台变化,操作系统更加关于隐私,这对测量广告效果和广告定向都会产生影响。第三个是我们自己的产品变化,我们把隐私放在更重要和更中心的位置。因此,这三个问题的叠加,在今年下半年到2020年对我们产生不利影响。”

3. FTC隐私相关协议对未来监管和产品开发有重大影响

“I want to reiterate that our agreement with the FTC involves implementing a comprehensive expansion of our privacy program, including substantial management and board of directors' oversight, stringent operational requirements and reporting obligations, and a process to regularly certify our compliance with the privacy program. These efforts will require significant investments in compliance processes, personnel, and technical infrastructure. In addition, these efforts will make some of our existing product development processes more difficult, time-consuming, and costly.”

“我想重申,我们与FTC达成的协议涉及全面扩大我们的隐私计划,包括实质性的管理和董事会监督,严格的运营要求和报告义务,以及定期证明我们遵守隐私计划的程序。这些工作将需要在合规流程、人员和技术基础设施方面进行大量投资。此外,这些工作将使我们现有的一些产品开发过程更困难,更耗时,成本更高。”

4. 后续的反垄断调查

“The online technology industry and our company have received increased regulatory scrutiny in the past quarter. In June 2019, we were informed by the FTC that it had opened an antitrust investigation of our company. In addition, in July 2019, the Department of Justice announced that it will begin an antitrust review of market-leading online platforms.”

“过去一个季度,互联网技术行业和我们公司受到了越来越多的监管审查。2019年6月,FTC通知我们,他们已经开始对我们公司展开反垄断调查。此外,美国司法部于2019年7月宣布,将对市场领先的在线平台展开反垄断审查。”

5. 支付系统推进速度比较慢

Libra系统处在和监管博弈的过程中,不获得监管同意,无法正式推出。

法币支付系统,如在印度的WhatsApp支付,因为监管原因也是没有大范围推出。

丸子对Facebook的看法

对于Facebook的机会和问题,其实已经分析过很多了,就不再多说了。丸子对Facebook长期的增长潜力仍然非常乐观,但也清醒的认识到,在短期、中期内Facebook仍然面临着很多问题和挑战,在增速上不会很乐观。

Facebook目前的价格,丸子认为较为合理,所以会保持目前的持仓,不会卖出,也不会再买入,做好长期持有的准备。

新的投资目标

丸子在上篇投资的板凳深度中提到,想要有更多的标的来做分散化。目前在美股市场上,对微软比较感兴趣。丸子目前的美股持仓是Facebook和苹果,这两个都是面向消费者市场的,而微软是面向企业市场的,正好对目前的持仓做补充。

微软2019Q2的财报数据不错,三大主要业务板块发展比较均衡,云业务有非常大的竞争力和增长空间,当然,现在价格也不便宜。所以,后续会对微软保持更多的关注,加深理解,如果有好的买入机会再考虑入手。

微软CEO萨提亚·纳德拉写过一本书,英文名叫“Hit Refresh”,中文翻译为《刷新:重新发现商业和未来》,就像点击浏览器的“刷新”按钮一样,纳德拉2014年上任CEO之后,对微软进行了refresh,让老态龙钟的微软又重新焕发了活力。

这本书丸子买了纸质书看,也在微信读书上听了几遍。纳德拉在书中也描述了自己在家庭上的不幸,两个孩子患有疾病,需要持续的照顾,这使得自己能够拥有“同理心”,这使得纳德拉的个人形象更具体,更有人情味。如果对投资微软有兴趣,这本书值得一读。

免责声明:文章涉及标的不作为投资推荐,市场有风险,投资需谨慎。

文:小丸子 / 微信号: 丸丸股票(wanwangp)

精彩评论