$Alibaba $Tencent $JD $Huya $LendleaseReit $Ping An

What a busy month we have since the last update!

We had so much entertainment in the past week ranging from the Chinese market meltdown due to the regulatory crackdown to the Olympic matches which my family and I watched with enthusiastically on the television every single day inspiring to be better.

The Olympics in particular was significant because it was the first time I get to watch it with my children who’s grown up and sort of understand what these sports and commitments these athletes have put in – and so I have used this opportunity to educate my kids the importance of hard work and dedication.

In the stock market, the continuation of the regulatory crackdown from the previous month means I get to enter at an even juicier level, activating my fund savings on rare occasions for companies like Tencent which I’ve increased a 9x fold position from the previous month.

A little context on the activation of the fund savings – it is something which I’ve rarely activated unless I know I’m getting in at a really juicy level from an investment perspective. The last time I activated some portion of the funds was during the depth of the COVID last year, and then another one more recently.

For those interested in the analysis for Tencent, you can refer back to my previous post here which I highlighted that investors are getting the treats of the decades where you can buy great conglomerates like Tencent at a juicy valuation like this today because of the ongoing regulatory going on. In every other instance, it is unlikely that we can get a discount on the company.

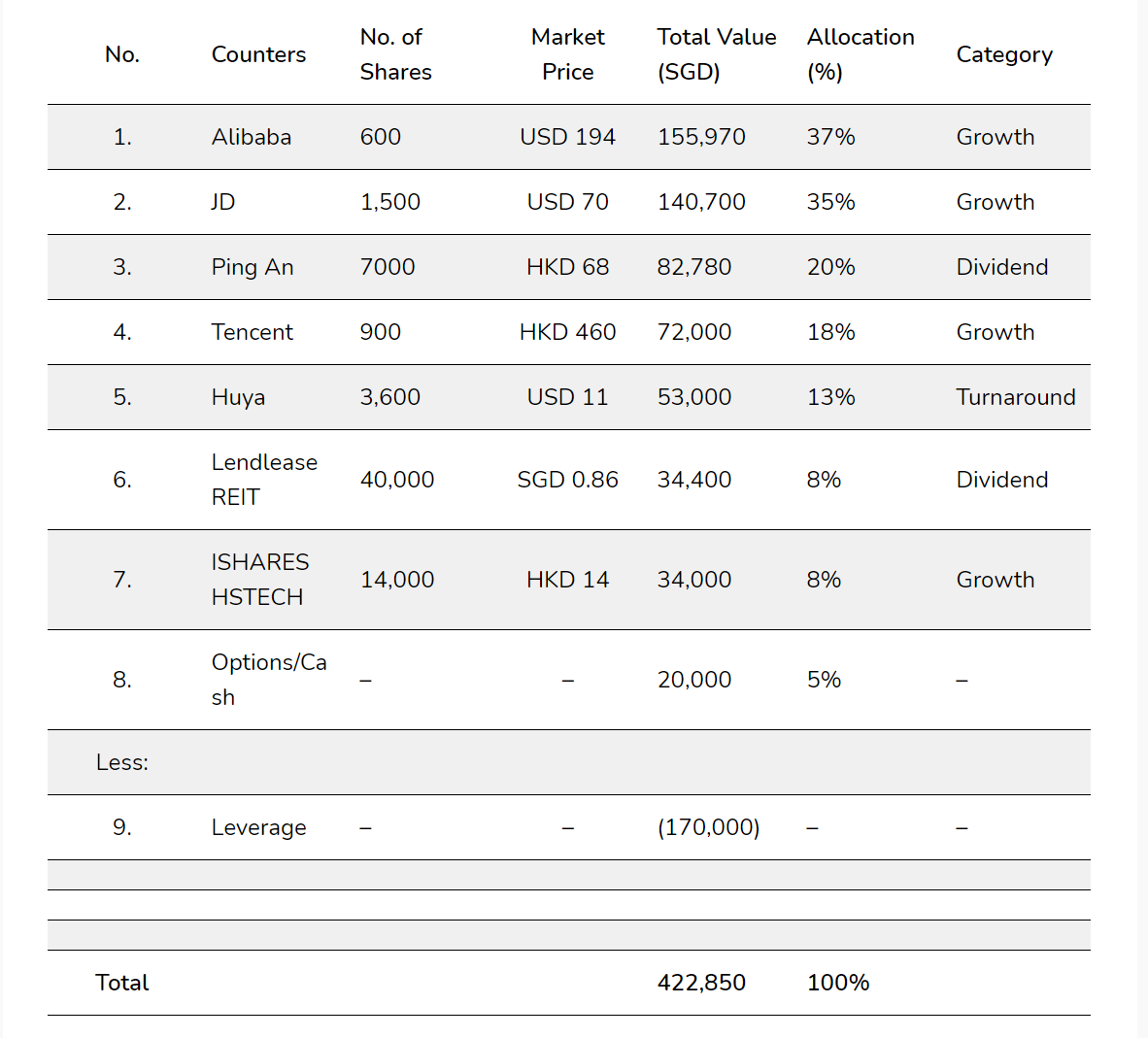

I also used this opportunity to add to my positions on Alibaba, JD and ISHARES HSTECH in particular. If you’re interested to know my average costs, you can find my previous article where I published my average costs on these companies. With these purchases, my average costs are now slightly lower than when the article was published and it makes me excited knowing these are good averages which I think I can comfortably sleep on.

On other news, I have also divested my position for AMD at $119.5 after seeing its share price continuously hit up after they announced their earnings. With the heavy run-up, I decided to divest as I thought the valuation has very much gone from an undervalued positions to fairly valued at the moment and I wanted a better entry price if I was to re-enter in the near future.

Portfolio Updates:

The portfolio wouldn’t have increased this month if not for the additional capital injection from the special funds.

In all other months, I usually have my dividends, options income or organic salary income pumped in effectively every month on a small amount basis so it doesn’t feel that significant. The capital injection from the special funds are rarely used on events specific where I think there are compelling bargains in the market out there.

With the recent addition of the Chinese stocks, there are some readers who may be concerned about the huge upswing in the concentration towards the Chinese portfolio. My reply to that is it is precisely because of the bargain that the portfolio is more concentrated towards a particular sector or geographical concentration.

When there are ample opportunities in the future where I can find bargains in the Singapore or the US market, I will also increase my allocation eventually to that proportion of conviction. At the moment, I just can’t find most of those just yet.

This portfolio concentration is not a mid to longer term concentration so it will eventually subside and change once the wind blows the other way.

With that, I hope everyone have a great week ahead and stay safe physically and on the market!

Aug 2021 – Portfolio & Transaction Updates + $85k Savings Activated – 3foreverfinancialfreedom (3Fs) Financial Independence

www.3foreverfinancialfreedom.com

精彩评论