Background

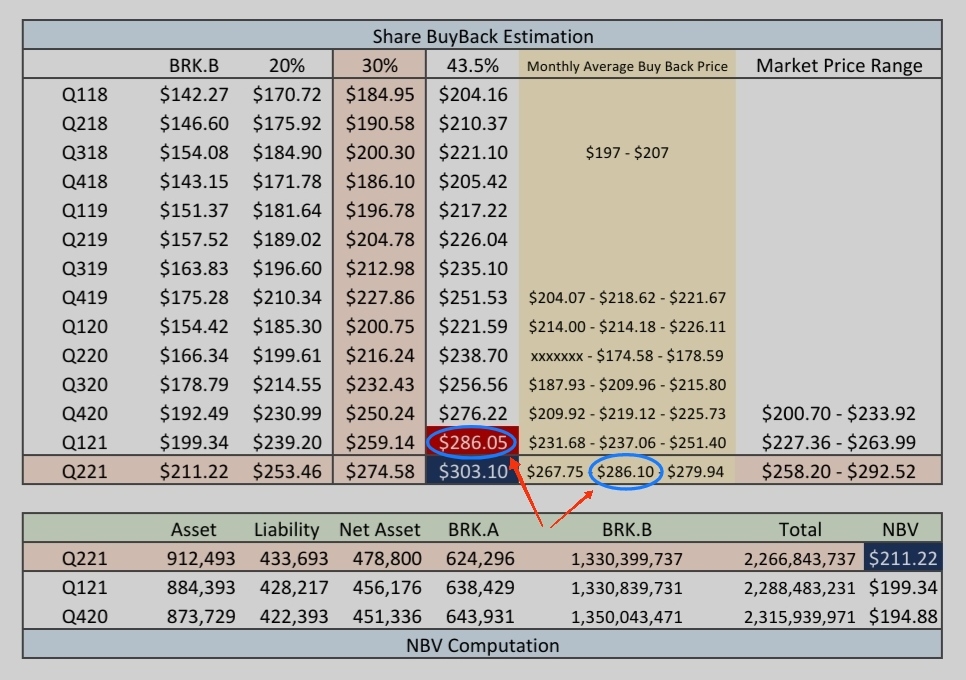

° In a previous post, I estimated the IV (Intrinsic Value) of BRK.B to be 1.3 * NBV after comparing past Shares BuyBack data.

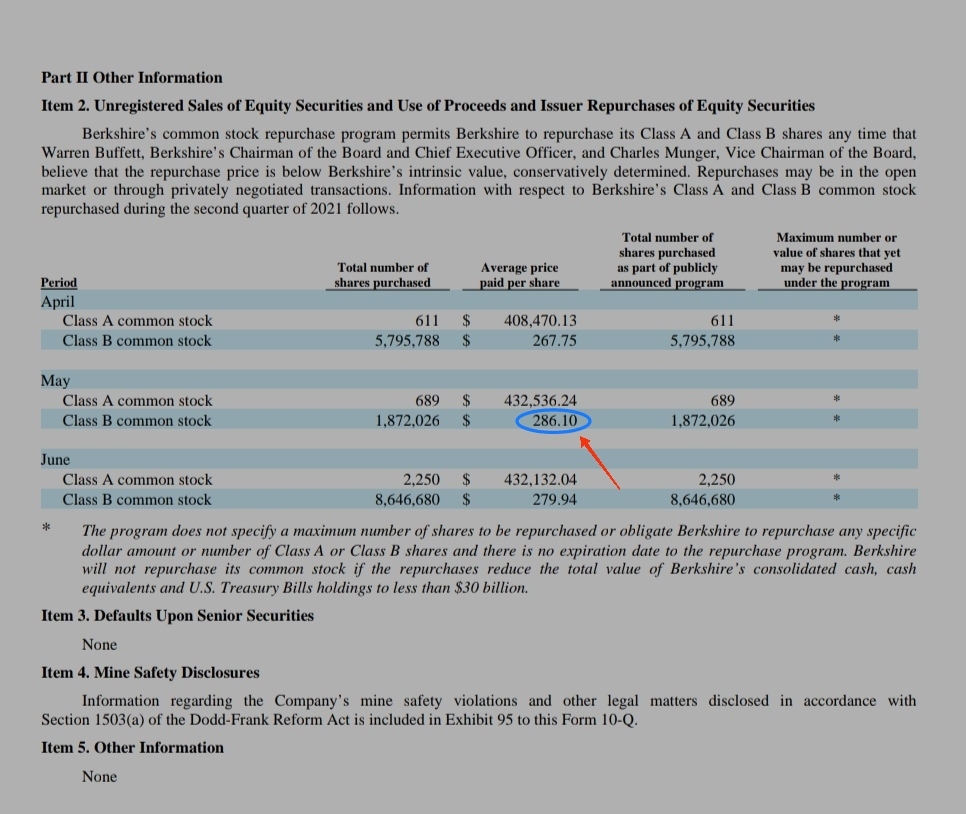

° However, from their latest Q221 Financial Report, the highest Average Price Paid for their Shares BuyBack in Q121 was $286.10 (for May).

What Does that Mean?

° For Q121, using my computed NAV = $199.34 & my previously estimated 1.3 * NBV, I'd projected Max Shares Buyback Price = $259.14.

° With this latest data of $286.10, this means the formula could be around 1.435 * NBV instead !!

What's Next ?

° From the latest Q221 Financial Report, I have computed NBV = $211.22.

° At 1.3 * NBV, my estimated Shares Buyback Max Limit = $274.58.

° At 1.435 * NBV, my estimated Shares Buyback Max Limit = $303.10!!

CAUTION!!

° DYODD (Do Your Own Due Diligence) - Don't blindly trust what you read, please do check the figures & reasonings. Then form your own conclusions & action plan, if any.

° There's NO GUARANTEE that BRK will do any Shares Buyback. It depends on their Free Cash Positions & Opportunity Cost ie If they find a better alternative eg acquisition target which offers better returns, they'll likely opt for that.

° I'm using Quarter End NBV as that's what is available to us. However, BRK could be using Month End NBV (Only available to themselves) to compute Share BuyBack Prices for every new month & with rising NBV (due to improving economy & Investment Share Prices), the factor (1.435) could be actually lower.

精彩评论