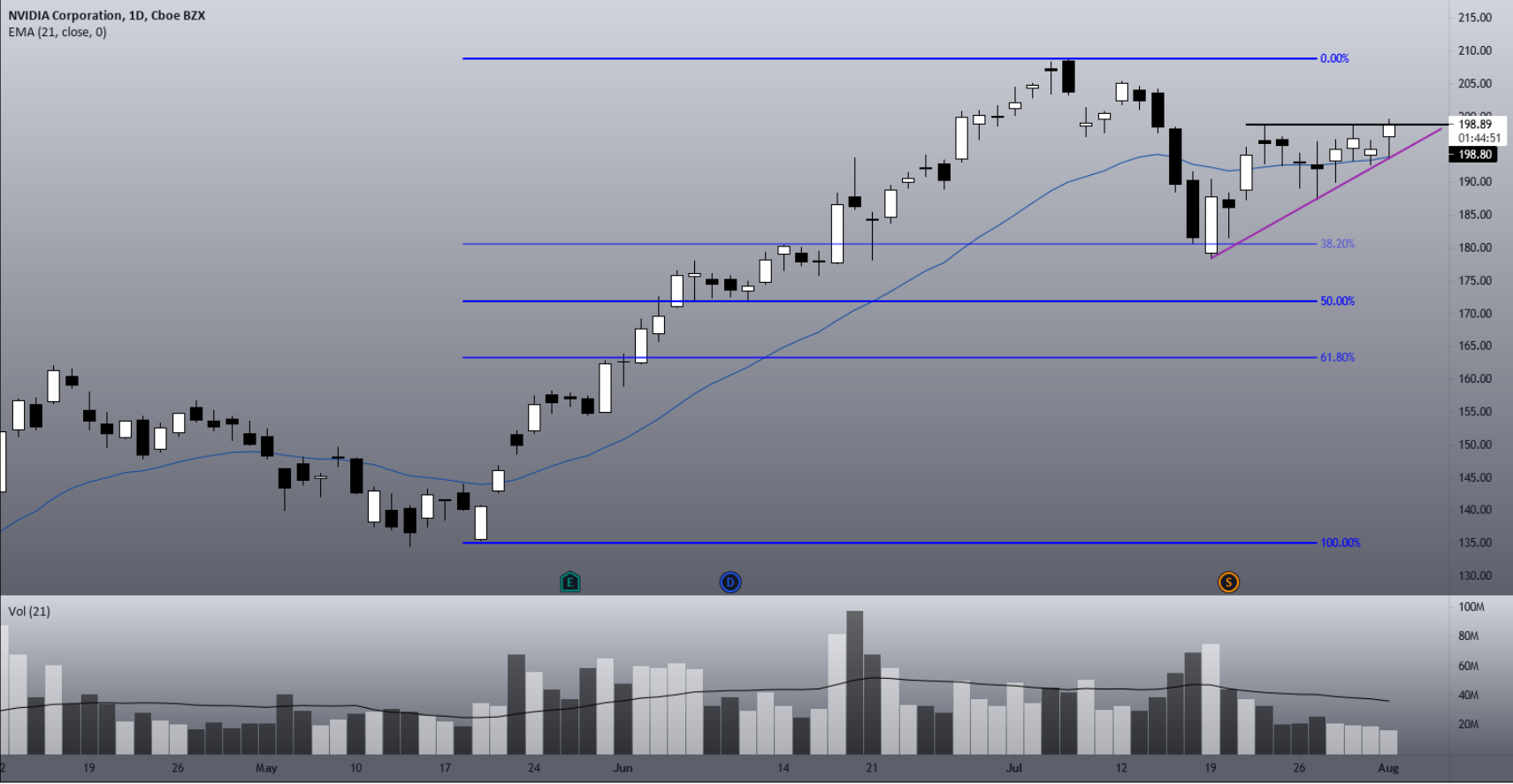

First, $NVIDIA Corp(NVDA)$ defeated the resistance at purple trendline, which we talked about in our last study, and it retested the $ 198, only to drop to the purple trendline again, but this time, to retest it as a support level . This is another example of the Principle of Polarity in Technical Analysis .

What’s more, the area around the 21 ema is another good support to work with, and the main challenge on NVDA is the resistance at $ 198.80. If NVDA defeats this resistance, we might fly to higher levels again.

Of course, if NVDA loses the 21 ema , I see it dropping to the Fibinacci Retracements again, but as long as we are above it, we’ll be fine. If we trigger this pivot point , even better.

We have an Ascending Triangle pattern too, and the purple trendline in the daily chart is connecting the previous bottoms quite well. If NVDA breaks this pattern upwards, it’ll be a good sign.

The bias is clearly bullish , and since we lack bearish structure, all we can do is to assume it’ll keep trending. The only thing we must do is wait for a breakout of the $ 198.80.

精彩评论