Singtel : Finally turning around

BUY Entry – 2.38 Target –2.60 Stop Loss – 2.28

Singtel provides an extensive range of telecommunications and digital services to consumers and businesses across Asia, Australia, Africa and the US. It serves over 753 million mobile customers in 21 countries, including Singapore, Australia (via wholly-owned subsidiary Singtel Optus) and the emerging markets of India, Indonesia, the Philippines, Thailand and Africa.

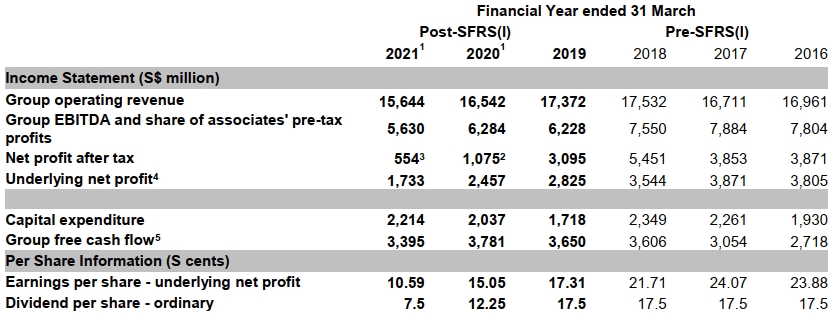

Five years of underperformance. Shares of Singtel have lost almost 50% from their 10-year peak of S$4.57 that they traded at in April 2015. The underperformance was due to the sequential underlying earnings decline over the past four years, mainly because of the drag from Bharti Airtel, its Indian associate.

Improving outlook. Consensus anticipates an improving outlook for Bharti as the Indian wireless industry becomes a quasi-duopoly, which should drive revenue and earnings growth going forward. Bharti recently announced revisions to its prepaid and postpaid plans that could improve ARPU by 4-7%, according to estimates by JP Morgan. Meanwhile, its 100%-owned Australian subsidiary, Optus, is seeing a better competitive environment as operators remove discounts and are offering less bonus data.

Longer-term driver. Beyond the next 12-24 months, a key driver will be Singtel's digital banking plans together with its partner, Grab Holdings. The Singtel-Grab consortium will allow it to take deposits and offer banking services to retail and corporate customers. For now, we think Singtel’s share price has likely not factored in contribution from the digital bank business, and will likely be a positive boost to its shares when visibility emerges.

Consensus estimates. Consensus has an overall positive outlook on Singtel, with 17 BUYS / 2 HOLDS / 0 SELL, and a 12m TP of S$2.94 (+23% upside potential). EPS is forecasted to finally grow 32% and 18% for FY2022 (YE March) and FY2023. The stock offers a decent dividend yield of 4.2% for FY2022 and 5.0% for FY2023.

精彩评论