Today, lets discuss about how the GAAP accounting method is very badly affecting Berkshire's Hathaway 'image'

●The change in Generally Accepted Accounting Rule (GAAP) in 2017 was made by the FASB. All companies have to report unrealized gains in their financial reports.

●If you dont already know, Berkshire owns about 300 Billion USD worth of stocks in various companies. These equities flactuate on a daily basis crazily. Some days it goes up and some day it goes down. This will affect the Income statement (Net Profit/EPS) very badly.

●To evaluate Berkshire, its best to ignore the Profit completely and its an inaccurate depiction. You must instead look at Berkshires Operating Income.

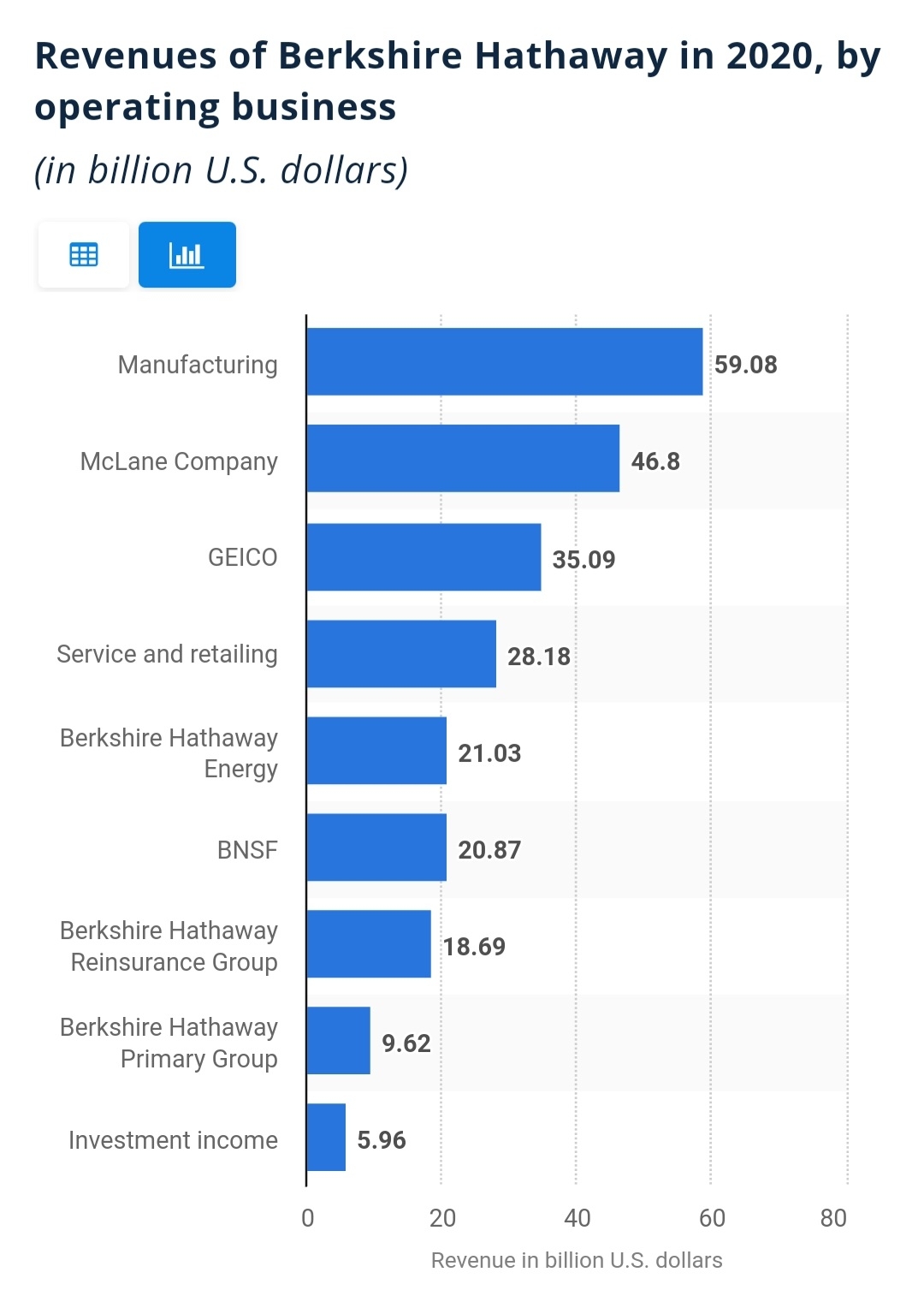

● Berkshire has 9 segment of income-Manufacturing, Mc Lane company, GEICO, Service and retailing, Berkshire Hathaway Energy, BNSF, Berkshire reinsurance, Berkshire hathaway primary group and investment income.

●For example, in 2018, Berkshire operating income from all of these segments are $32.11 Billion. However due to the stock portfolio declined by $28.11 Billion, the net profit for 2018 was only $4 Billion. That gives berkshire a crazy PE ratio of 171 as the EPS was only 1.63 compared to 2017 where it was 18.22.

● The GAAP accounting rule is badly affecting the image of berkshire. Therefore when evaluating, you have to dig deeper. Only focus on Berkshire's Operating Income and free cash flow.

●Operating income for Berkshire has grown 450% in the past 3 years and its free cash flow has grown at a CAGR of 9.9% for the past 10 years.

● This shows that the company is extremely healthy and is growing a steady pace. This is in line with Peter Lynch quote 'Growth at Reasonable Price.' The 9.9% of growth per year, with compounding with bring the companys stock price to exponentially high.

Comments by me:

-While the overall market is overvalued, Berkshire is still a good buy. Its growth rate and earnings are fairly priced to its stocks.

-By buying Berkshire, you are buying a peice of America. It Is almost similar to the S&P500.

-Dig deeper into berkshire. Its operating income and free cash flow growth will amaze you.

精彩评论