Topic :Call Option Definition

What Is a Call Option?

Call options are financial contracts that give the option buyer the right, but not the obligation, to buy a stock, bond, commodity, or other asset or instrument at a specified price within a specific time period. The stock, bond, or commodity is called the underlying asset. A call buyer profits when the underlying asset increases in price.

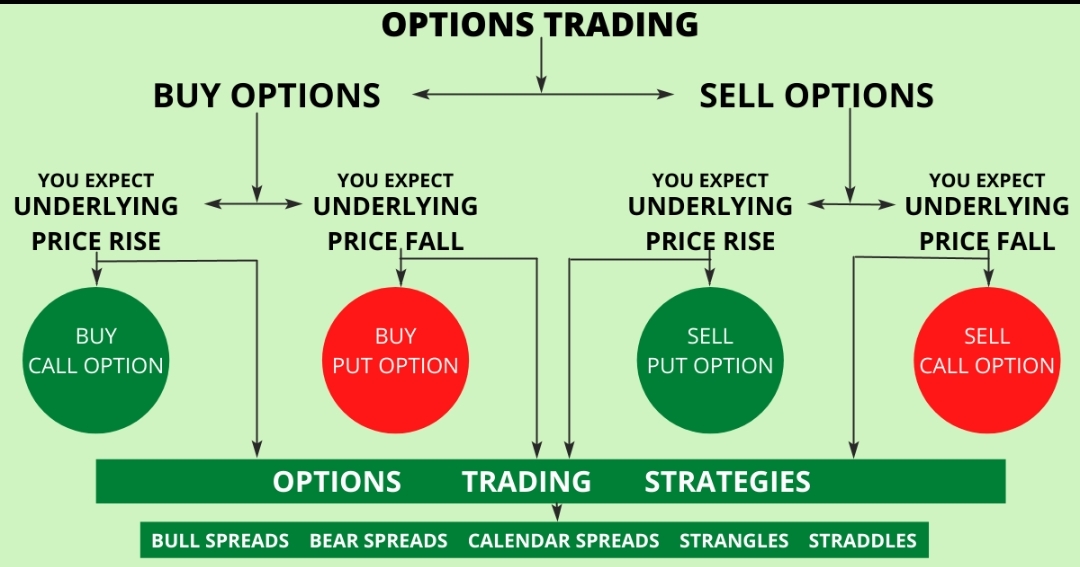

A call option may be contrasted with a put option, which gives the holder the right to sell the underlying asset at a specified price on or before expiration.

KEY TAKEAWAYS

• A call is an option contract giving the owner the right, but not the obligation, to buy a specified amount of an underlying security at a specified price within a specified time.

• The specified price is known as the strike price and the specified time during which a sale is made is its expiration or time to maturity.

• You pay a fee to purchase a call option, called the premium; this per-share charge is the maximum you can lose on a call option.

• Call options may be purchased for speculation or sold for income purposes or for tax management.

• Call options may also be combined for use in spread or combination strategies.

Understanding Call Options

Let's assume the underlying asset is stock. Call options give the holder the right to buy 100 shares of a company at a specific price, known as the strike price, up until a specified date, known as the expiration date.

For example, a single call option contract may give a holder the right to buy 100 shares of Apple stock at $100 up until the expiry date in three months. There are many expiration dates and strike prices for traders to choose from. As the value of Apple stock goes up, the price of the option contract goes up, and vice versa. The call option buyer may hold the contract until the expiration date, at which point they can take delivery of the 100 shares of stock or sell the options contract at any point before the expiration date at the market price of the contract at that time.

You pay a fee to purchase a call option, called the premium. It is the price paid for the rights that the call option provides. If at expiry the underlying asset is below the strike price, the call buyer loses the premium paid. This is the maximum loss.

If the underlying asset's current market price is above the strike price at expiry, the profit is the difference in prices, minus the premium. This sum is then multiplied by how many shares the option buyer controls.

For example, if Apple is trading at $110 at expiry, the option contract strike price is $100, and the options cost the buyer $2 per share, the profit is $110 - ($100 +$2) = $8. If the buyer bought one options contract, their profit equates to $800 ($8 x 100 shares); $1,600 if they bought two contracts ($8 x 200).

Now, if at expiry Apple is trading below $100, obviously the buyer won't exercise the option to buy the shares at $100 per, and it expires worthless. The buyer loses $2 per share, or $200, for each contract they bought—but that's all. That's the beauty of options: You're only out the premium if you decide not to play.

精彩评论

Thank you for sharing.