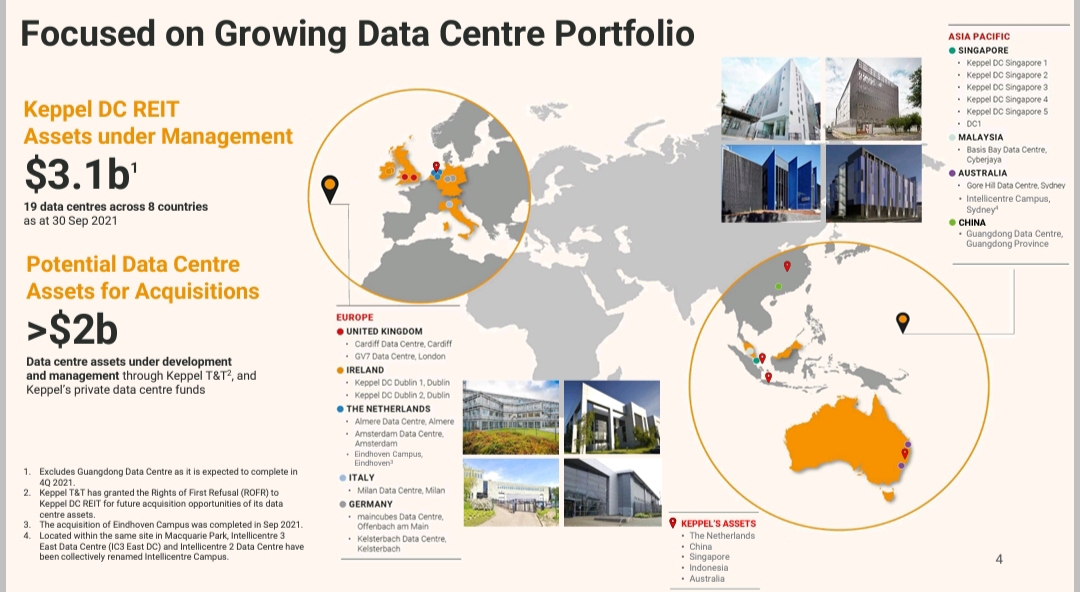

Another REITs to share. This time round, its Data Centre REITs. In fact this is he first and only Data Centre REITs listed on SGX. But more are coming. Keppel DC REIT is a Singapore-based real estate investment trust (REIT). It was established with the principal investment strategy of investing, directly or indirectly, in a portfolio of income producing real estate assets which are used primarily for data centre purposes, with an initial focus on Asia Pacific and Europe.

Its worst taking a second look at it now, as the price has come down to $2.35 from the peak of around $3. How time has changed. At the peak of the pandemic, investor were jumping into this reit and back then yield was like 2+%. Now at $2.35, there is no clear sign of investor interest. That is quite understandable. As we get closer to post pandemic, there are better opportunity to invest in growth stock. For me, i am taking a stand by the side. Watching closely. Will surely consider getting in if yield is at 4.5% or more.

In term of DPU upside, lately the acquisition of Guangdong Data Centre and ROFR granted for the other five data centres within the campus has reignited optimism on the growth trajectory.

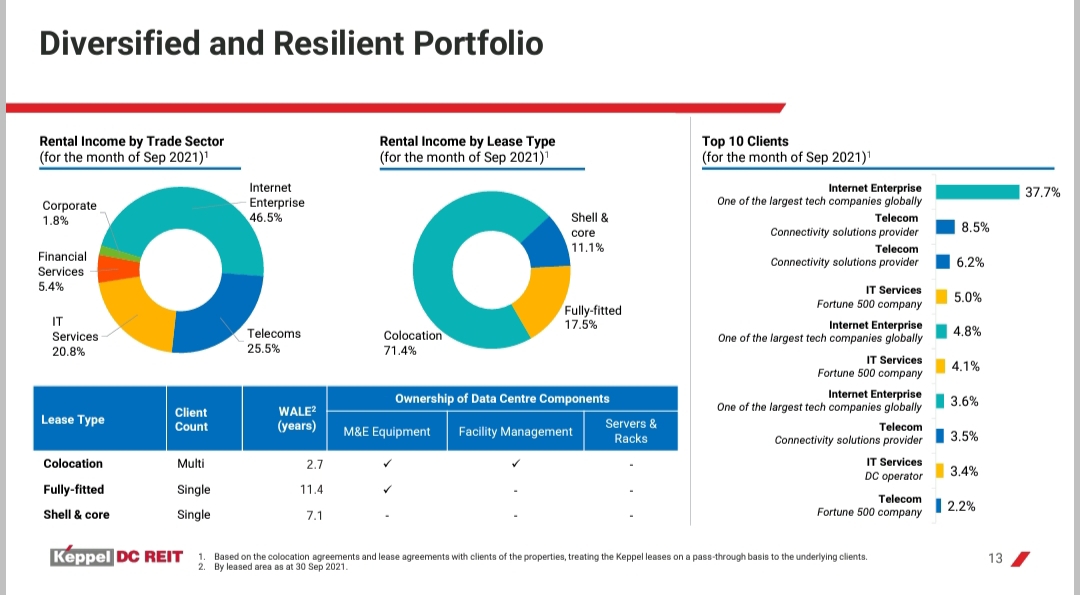

The REIT’s data centre investments have paid off because the digital economy relatively remained unscathed throughout the 2020 pandemic crisis, which is still happening today. The world’s biggest internet companies, such as Facebook, Google, and other services, need more data centre infrastructure. This can explain the sudden rise of Keppel DC REIT’s revenue and distribution growth.

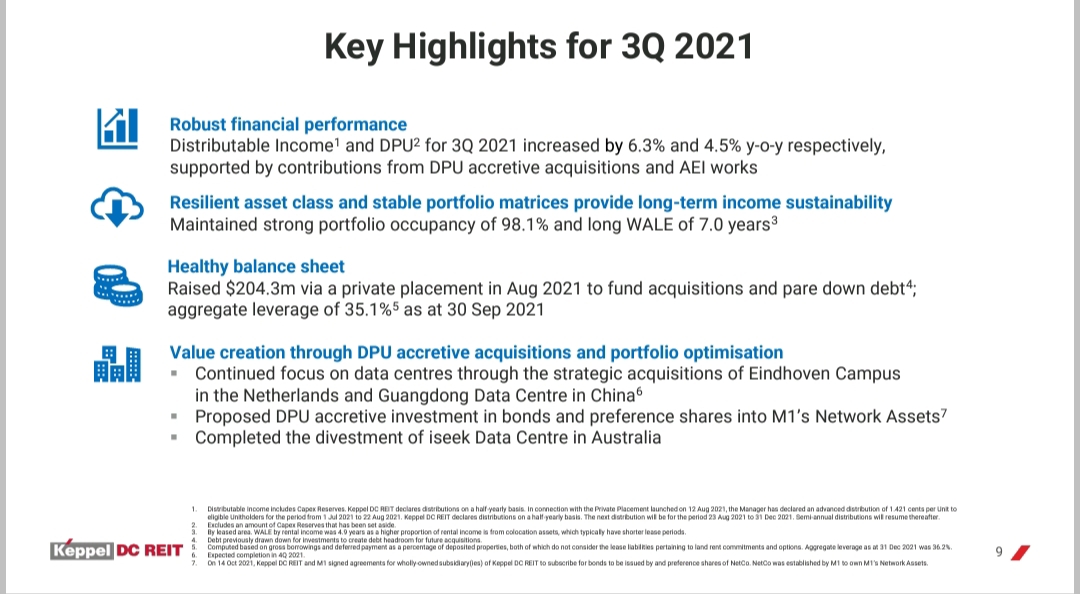

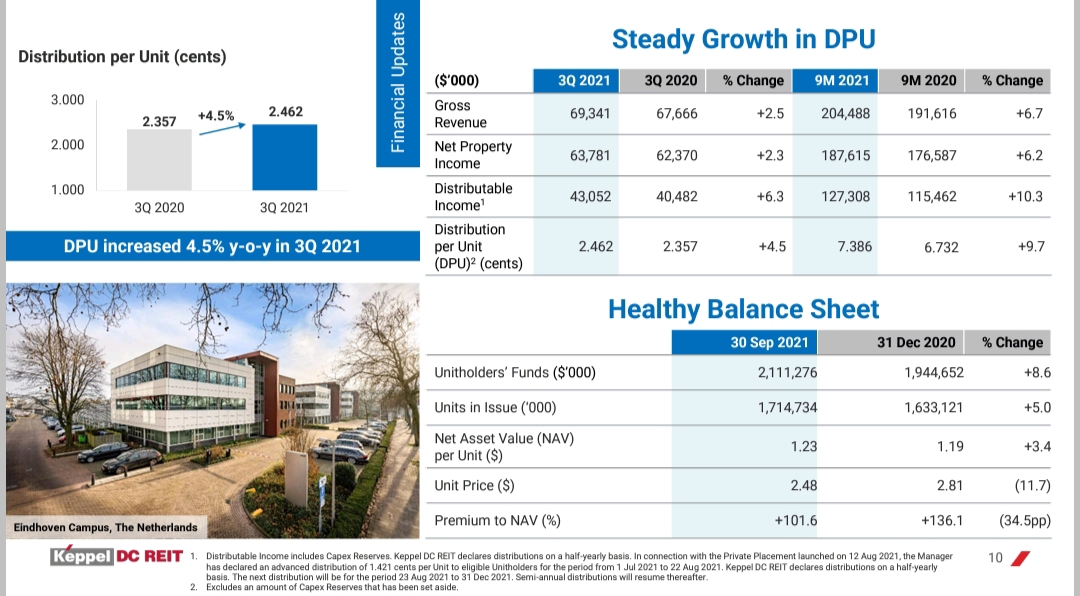

The approximately 0.3% growth of its distribution yield from 2020 supports the view that the company is continuing its growth towards new acquisitions, deals, and acquisitions in the Asia Pacific and Europe.

The REIT’s gross revenue has increased by a remarkable 36.3% increase yearly. On the other hand, its DPU increased by 20.5%, which means that those who earned S $7.61 per DPU in 2019 have received S $9.17 in 2020. We believe that this increase is due to the profitable activities of Keppel DC Singapore 4 and DC1 in 2019. Furthermore, new data centre acquisitions in Europe last 2020 allowed it to increase DPU rates.

DPU is expected to grow by a CAGR of more than 7% from now till FY23, driven by recent acquisitions, organic growth from AEIs and developments, and further potential acquisitions by the end of FY22. Given its improved debt headroom, we have assumed S$100m worth of acquisitions by end-FY21 in addition to the investment in M1 network assets that will be fully debt-funded. In addition, we have assumed a further S$300m by the end of FY22 in our estimates.

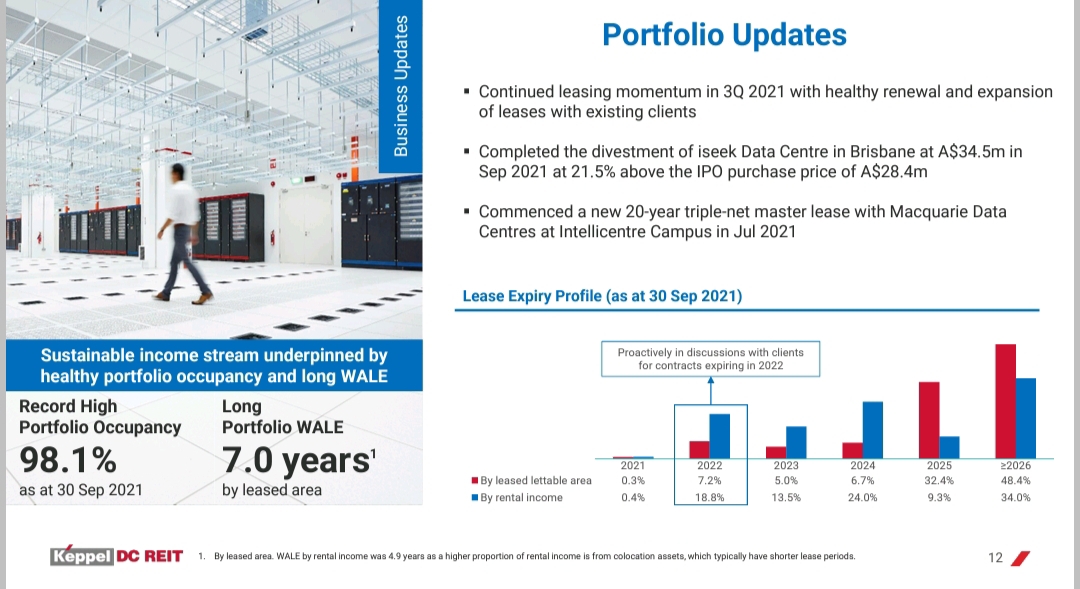

KDCREIT's current portfolio occupancy of 98% is the highest since its IPO in 2014. The continued strong demand for data centre capacity amid the prolonged COVID-19 outbreak and rise of the digital economy would support higher occupancies and revenues across its portfolio in the foreseeable future.

Thank you for reading. @Tiger Stars

精彩评论