$COMFORTDELGRO CORPORATION LTD(C52.SI)$

ComfortDelGro use to be darling of Singapore stock investor. But of recent years, share price has been on a downward trend. First was the distruption from Grab. Then come the Pandemic.

Share price is now close to 15 years low. I am thinking of buying in using CPF, since the dividend historically beat the 2.5%.

Share a bit more on the recent news and development.

ComfortDelGro is a land transport service company. Its business includes bus, taxi, rail, car rental and leasing, automotive engineering services, testing services, etc. Besides being a market leader for buses and taxis in Singapore, its business spans other geographies such as the UK, Australia, China, Vietnam, and Malaysia.

Recent drop suspect due to

IPO plan halt in Australia. But may not necessary be a bad decision. A change in market environment such as intense competition for funds on the ASX could have led to the decision. But its just a matter of time the IPO plan will surface again.

Another point to note, with Grab set to list via a SPAC in the US, these new private-hire competitors may be subject to increased scrutiny which could reduce aggressive promotions and competition.

A while back ComfortDelgro also snagged a billion-dollar rail contract in New Zealand.

It had also announced the acquisition of a school bus business in Australia last month.

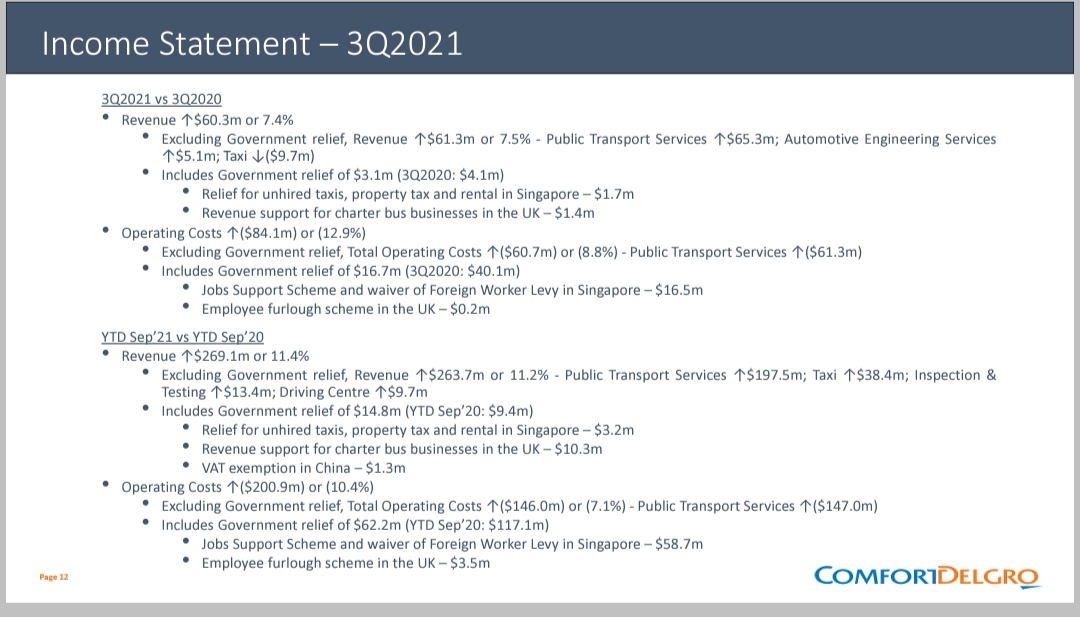

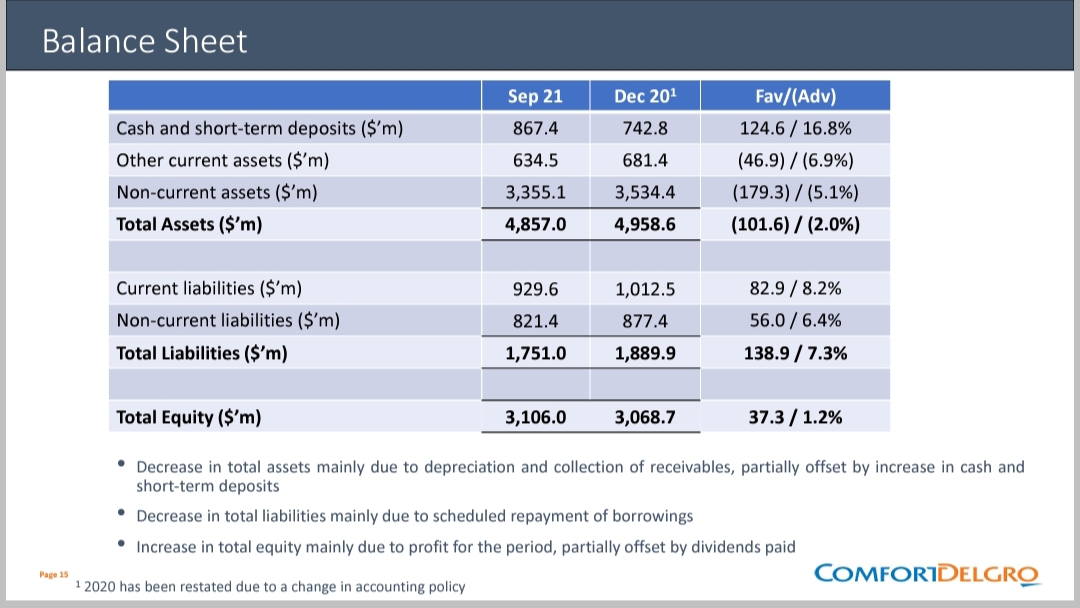

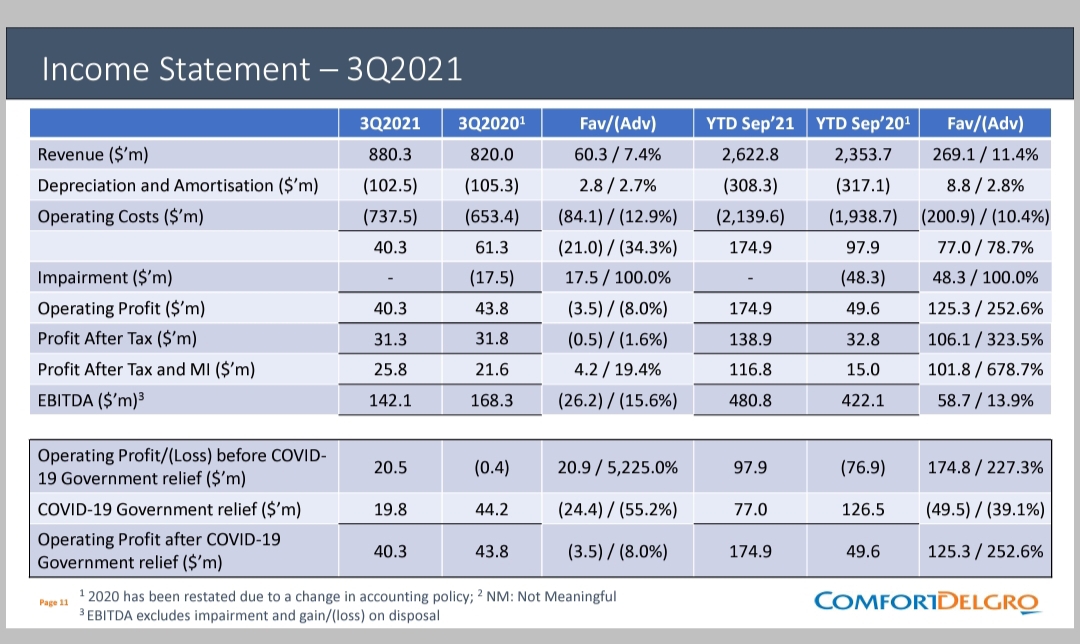

As for financials, it reported an improvement in its financials for its fiscal 2021 third quarter.

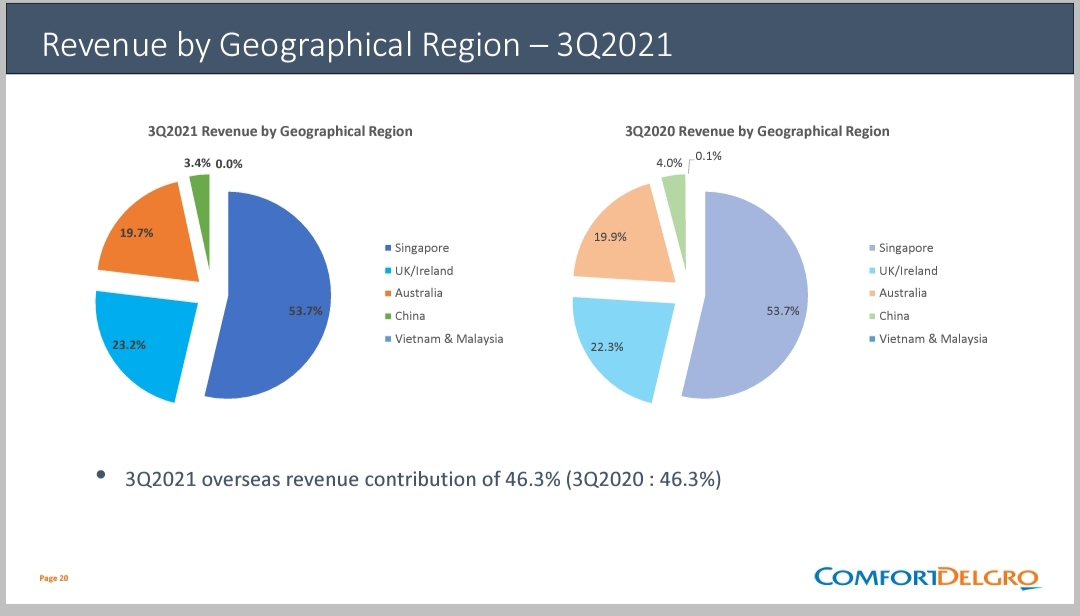

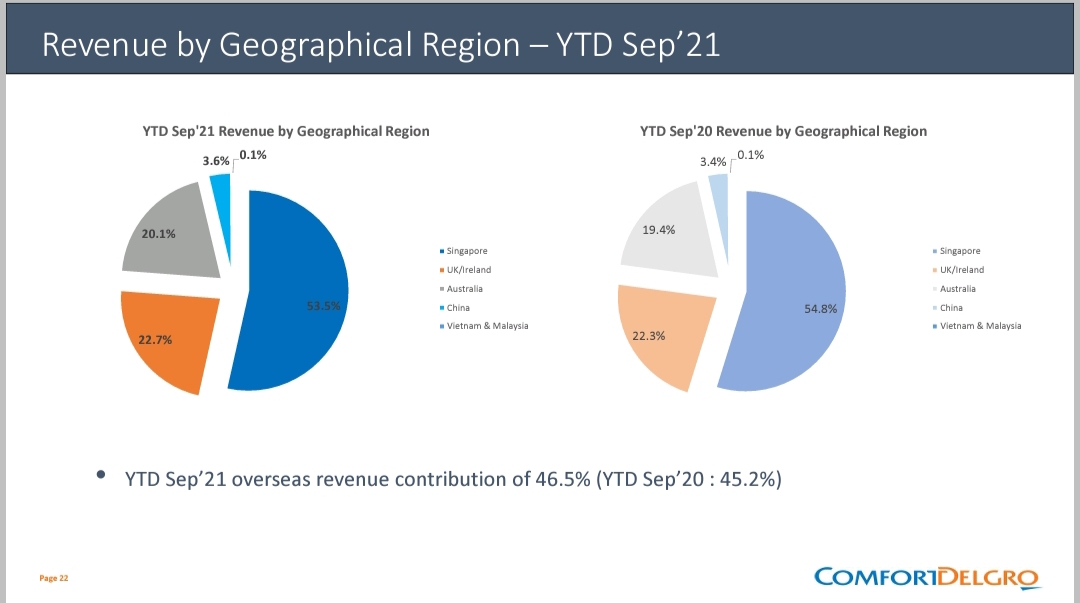

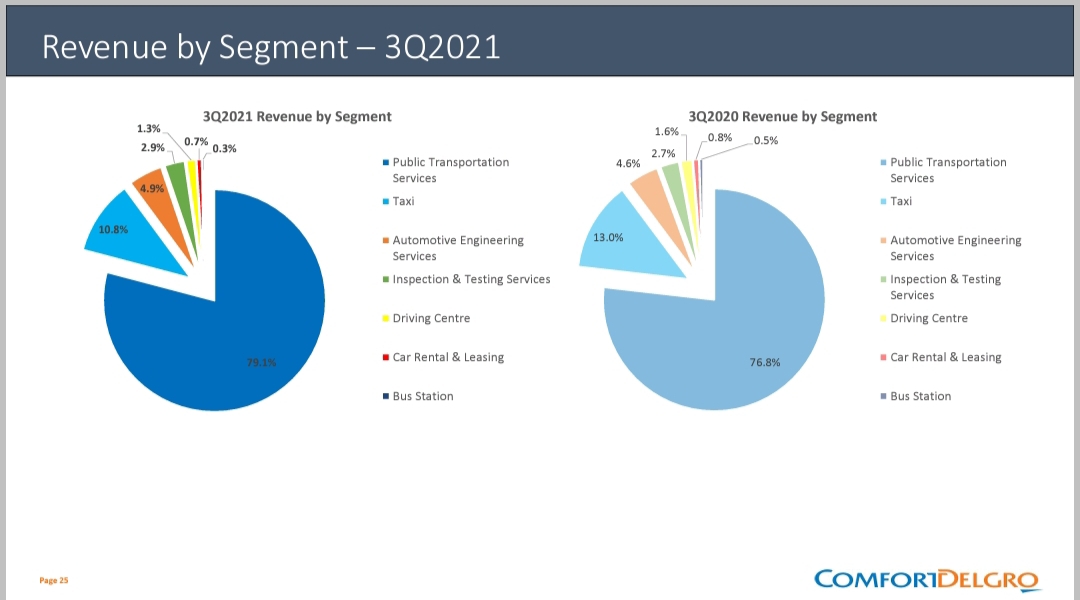

Revenue increased by 7.4% year on year to S$880.3 million as ridership increased on public transport and engineering services also saw a boost.

However, its taxi division saw a decline in revenue as work from home remained the default.

Operating profit, however, declined by 8% year on year due to a 55.2% year on year fall in COVID-19 government reliefs to S$19.8 million.

Excluding these reliefs, operating profit would have clocked in at S$20.5 million, reversing the S$0.4 million operating loss a year ago.

Despite the drop off in reliefs, net profit still climbed by 19% year on year as 3Q2020 recorded an impairment of S$17.5 million.

For the first nine months of 2021 the company reported a net profit of S$116.8 million, significantly higher than the S$15 million in the same period last year

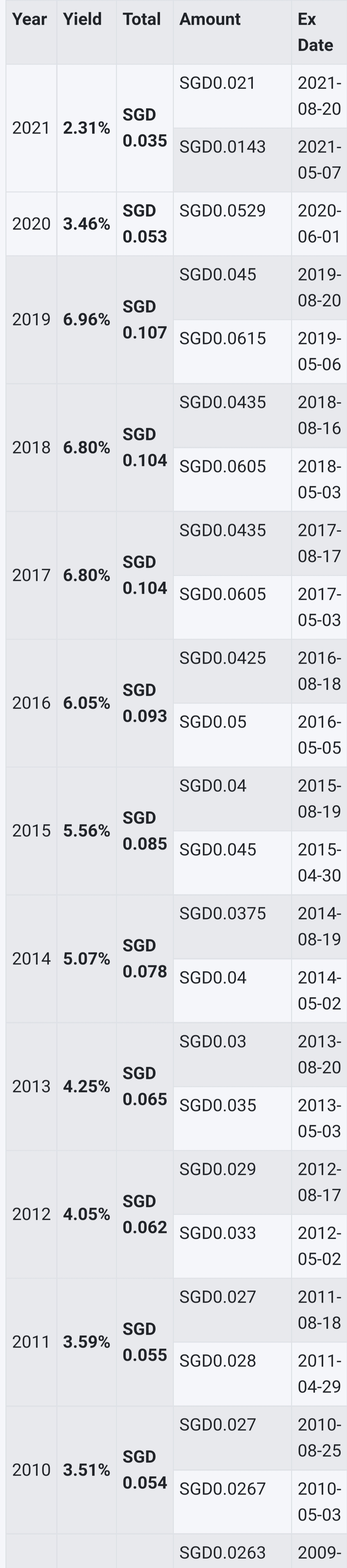

I have attached some charts and figures including dividend history over the last 10year for your reference.

Taking an average figure, assuming dividend can go to 7-8cents then at current entry price will see a yield of around 5%. double of cpf OA interest. And since we are still at a pandemic recovery phase, share price appreciation is more likely than downside.

Thanks for reading and do share your thoughts. Happy investing.@Tiger Stars

精彩评论