Options Ideas:

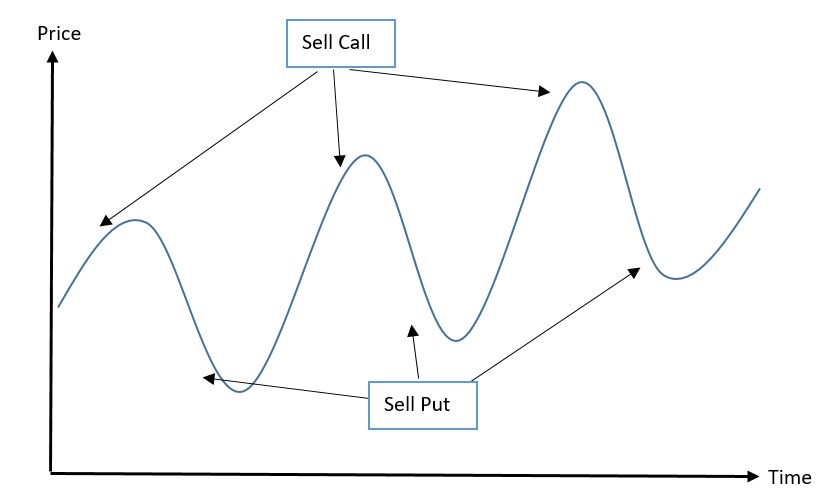

1. Stock prices tend to be volatile. In the usual case, when it goes up to a peak, it will retract. When it goes down to a certain trough, it will rebound.

2. Call Option tends to more expensive when the stock price increases, while Put Option tends to be more expensive when the stock price decreases.

3. Selling a Put Option when the stock price drops close to the trough allows you to earn a higher option fee, and when the stock price rebounds, the sold Put Option is likely to turn useless.

4. Selling a Call Option when the stock price rises close to the peak allows you to earn a higher option fee, and when the stock price retracts, the sold Call Option is likely to turn useless.

5. If things turn out to be expected like 4 & 5, you can earn the option fee.

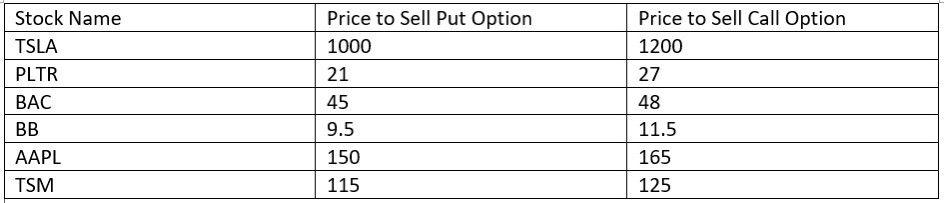

6. Piece of Advice: Sell Put Options on stocks that you are willing to buy and own, while sell Call Options on stocks that you own, ie covered call, to protect yourself from unlimited losses.

7. Stock price is unpredictable, that is the beauty of the game, have fun, invest safely.

精彩评论