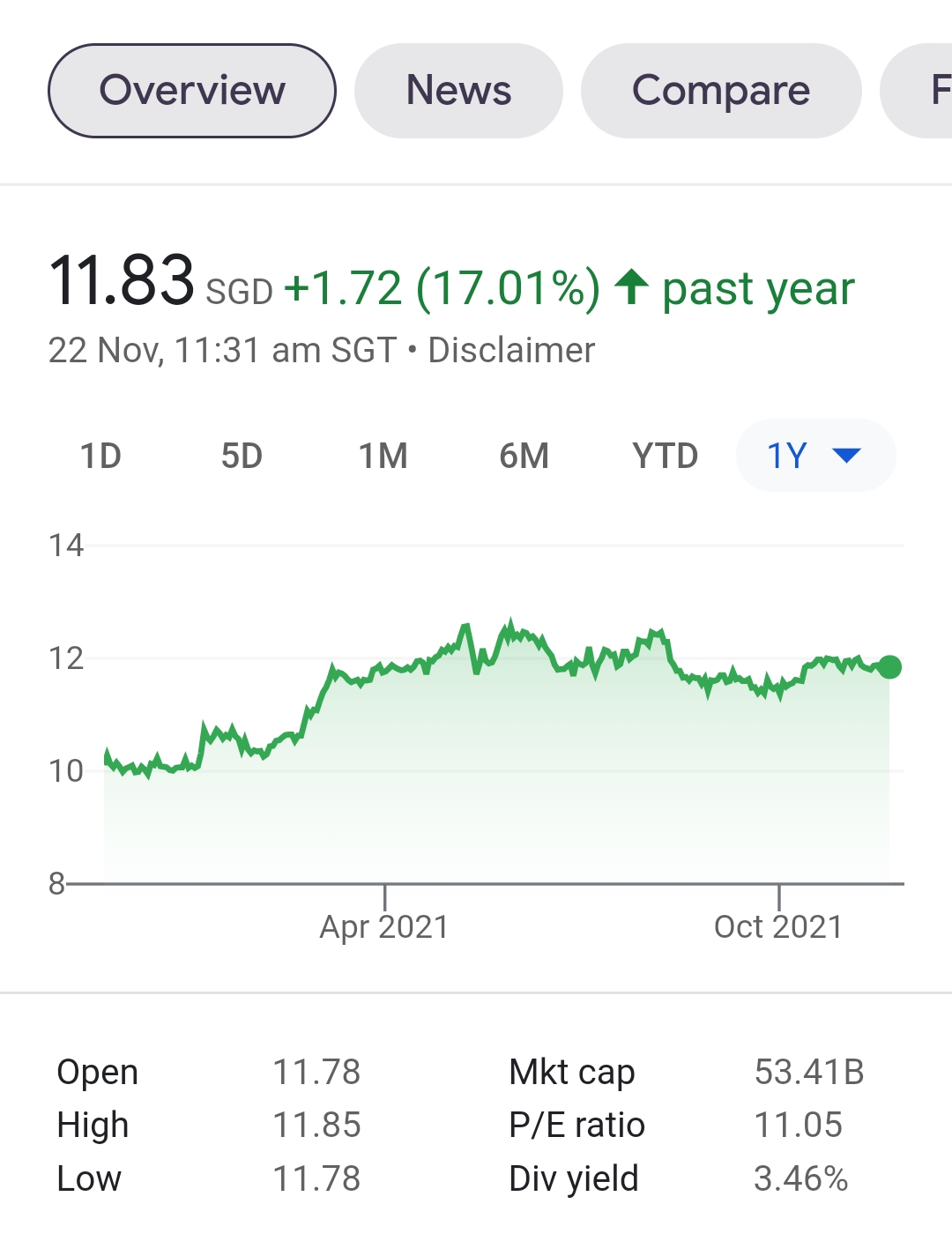

$OVERSEA-CHINESE BANKING CORP(O39.SI)$

As all of you know the entire STI index is almost bank and reits centric. Reits are generally more stable. So that left us with the 3 major banks to move the needle of the STI index. The Banks weightage on STI is about 40%. Thats why you can see a clear trending between the Bank stock vs STI index. And of the 3 banks, they too trend the similar. We know DBS being the biggest of all, lead the way. Price to Book value also on the higher side compare to the other 2 banks. I have previously shared on DBS, today, wanted to share to smallest of the 3, OCBC. Is there more opportunity in investing in the little brother instead of the biggest?

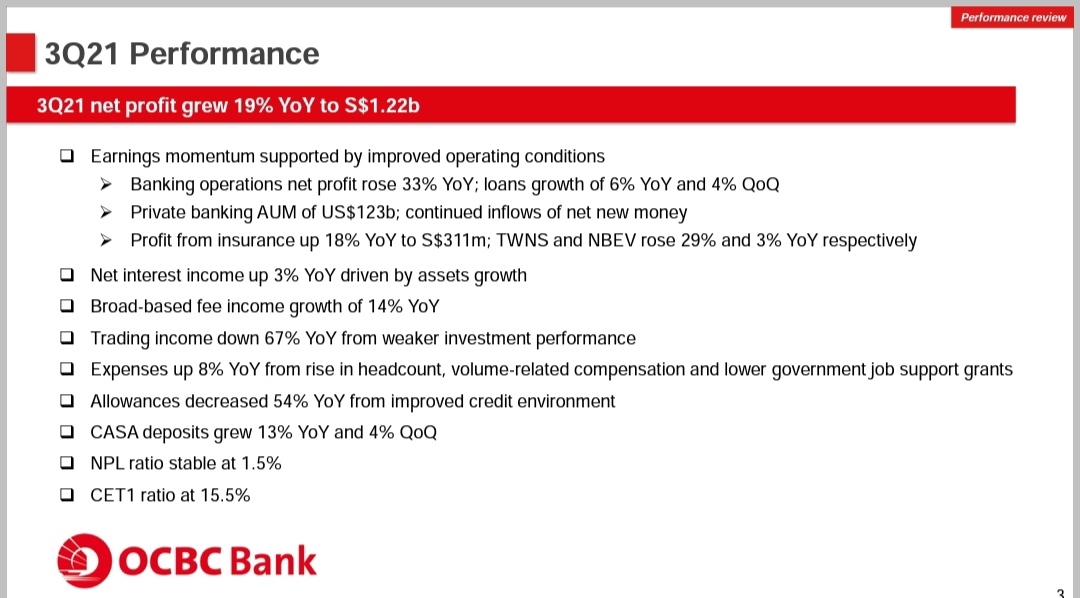

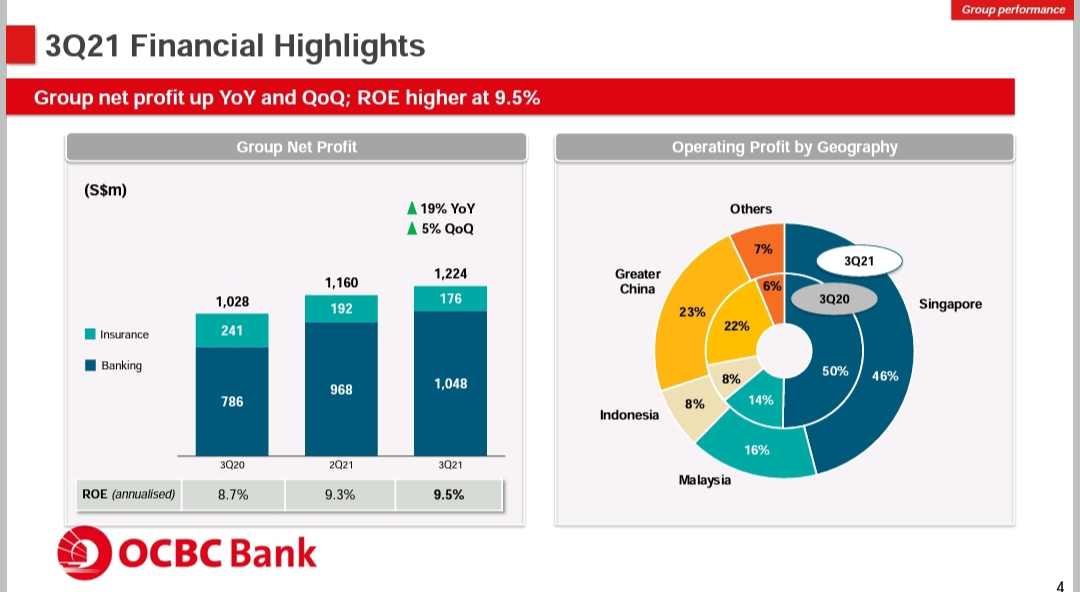

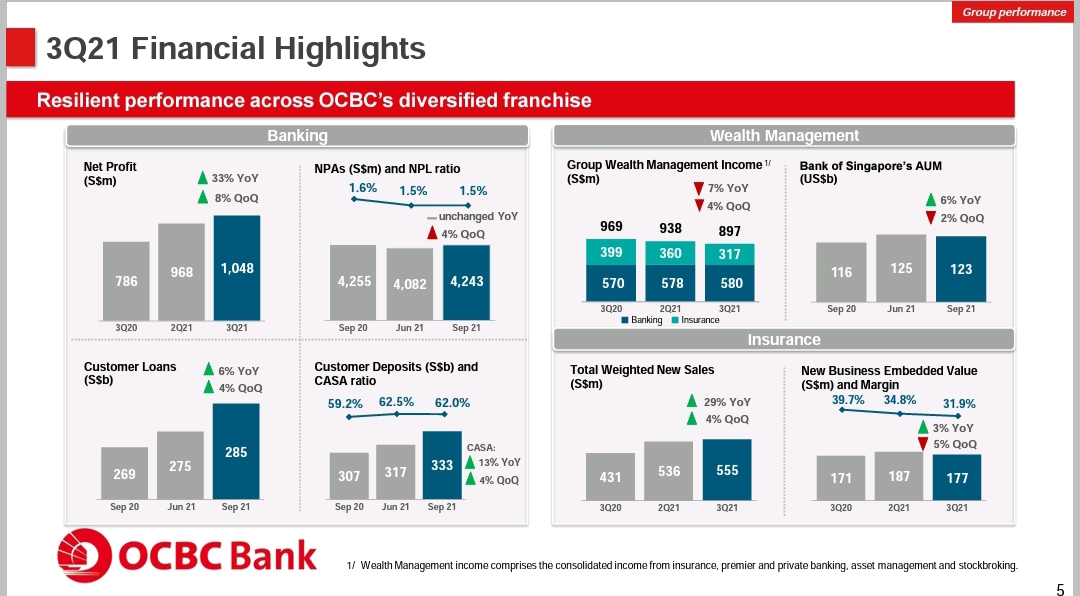

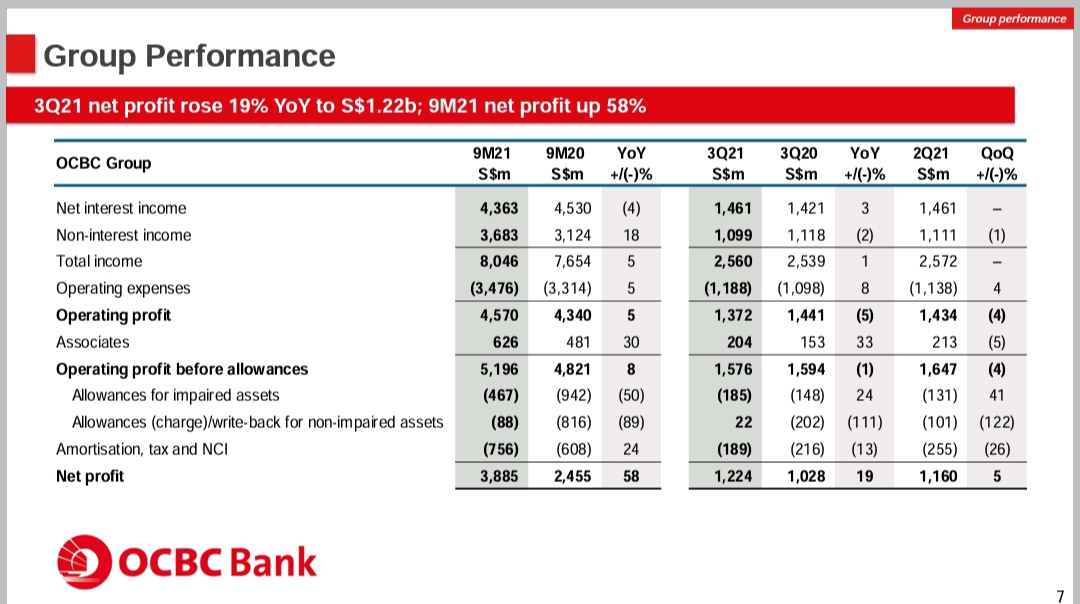

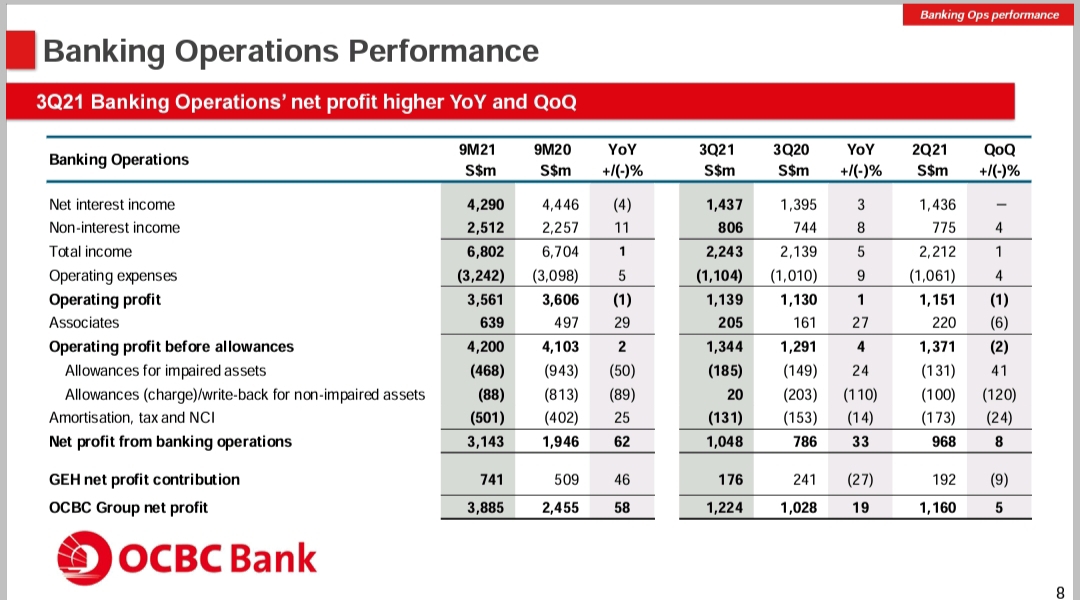

OCBC reported that group net profit for the third quarter of 2021 rose 19% to S$1.22 billion from S$1.03 billion in the same quarter a year ago.

This beat analyst estimates of S$1.19 billion.

The bank said this was driven by resilient business growth and lower allowances as the credit outlook continued to improve.

Net interest income grew 3%, underpinned by a 4% increase in average loan volumes, partly offset by a 2 basis points decline in net interest margin.

Out of 22 analysts rating the stock, 17 suggested ‘buy’, five said ‘hold’, while none gave ‘sell’ calls on the OCBC counter.

Their average target price stood at $13.92. That is like 16-17% upside from current price of around $11.80

Local bank analysts also rated OCBC shares a ‘buy’ on 22 October with a target price of S$15.65, stating that their earnings forecast for 2021 remains largely unchanged.

With the digital bank coming on board, it may give some pressure to the traditional banks. Unlike DBS, personally I do not see that the leadership team of OCBC continue to innovate and look for opportunity to add value for investors. They are very focus on the traditional banking, and not as agressive and innovative compared to DBS.

I am confidence with the Global and Singapore economy. And Banks typically do well during good economy cycle. However my preference is still on the Big brother DBS, even though we its trading at a premium over OCBC. But short term I shall not be adding more position on Banks in Singapore. As shared before I was really blessed that I am vested with an average price of $21 for DBD. Will sit on it and continue to enjoy the dividend from th Bank.

And my key strategy is to have Reits and blue chips like Big brother DBS to have a stable passive income through retirement, at the same time small growth from stocks like DBS.@Tiger Stars

精彩评论