$STI ETF(ES3.SI)$ If you are new to investing and have limited capital, STI ETF would be a great place to start.

STI ETF tracks the index of the top 30 companies listed in Singapore Stock Exchange. It started in 31 August 1998. It has an expense ratio of 0.30%

The good news is that the 3 local Singapore Banks are included in the STI ETF with DBS at 18.7% Index Weight, OCBC at 11.7% and UOB at 10.5%.

Best of all STI ETF pays a steady dividend twice yearly.

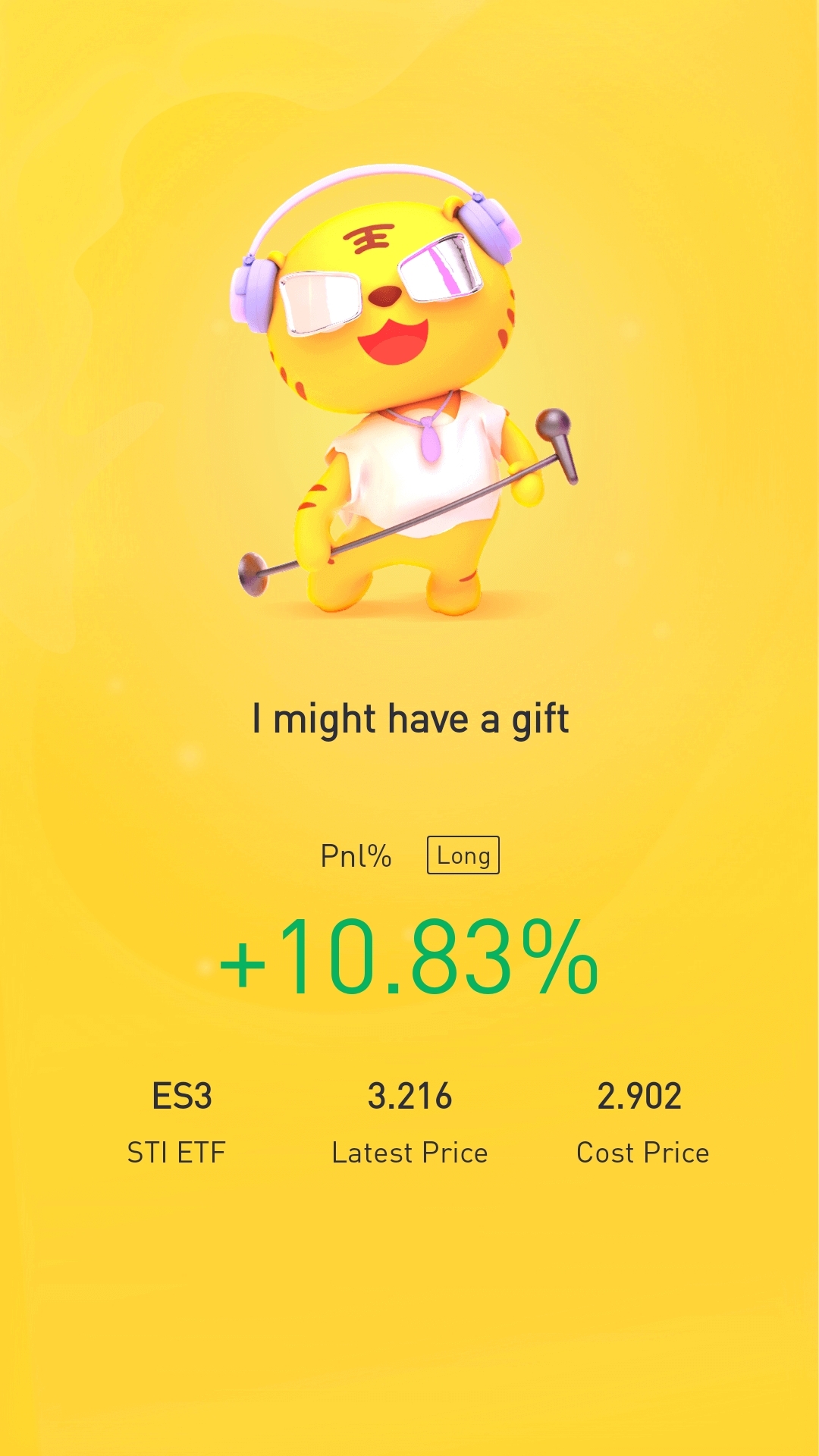

Recently STI ETF has been on an uptrend and hopefully it will hit record high soon.

I am proud to be a Singaporean and investing in STI ETF means I am investing in the future of Singapore. As Singapore's economy grows with the reopening of our borders, $STI ETF(ES3.SI)$ will also grow in tandem with it! Go Singapore, Go STI ETF!

精彩评论