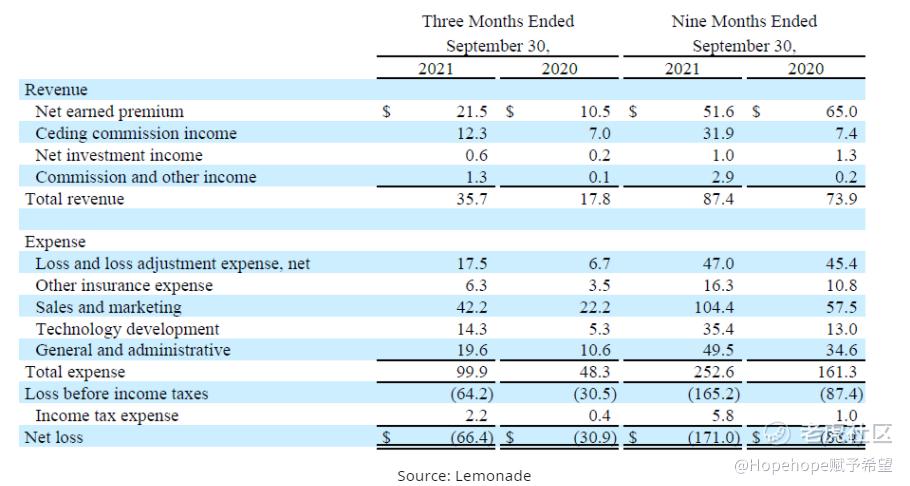

I took a quick thought of Lemonade's 3Q2021 results and was not exactly that pleased with the results. True enough, they have spent alot more on marketing, which explains for another 20 million USD jump in this category. To make matters worth a closer look pertains to the increased in general admin and tech development expense.

Source: Lemonade

True enough that spending to get growth is alright if the growth eventually catches up so it is important for me to note this further in subsequent quarters as well as for me to continue monitoring its share price.

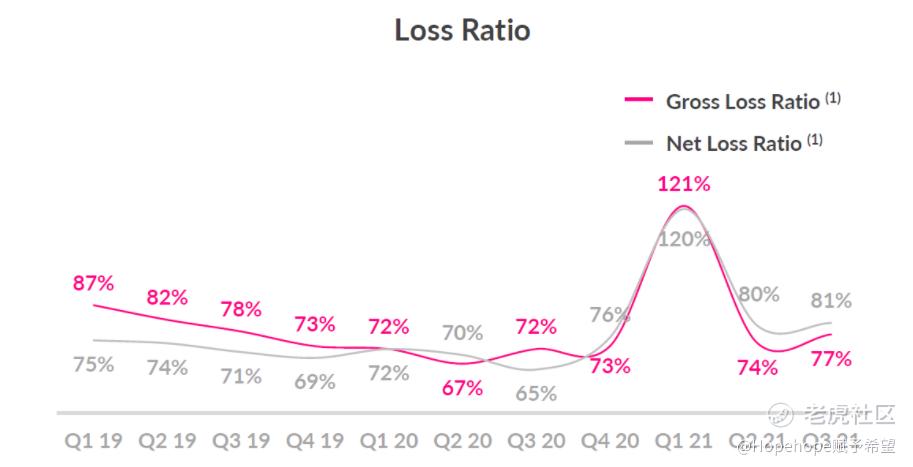

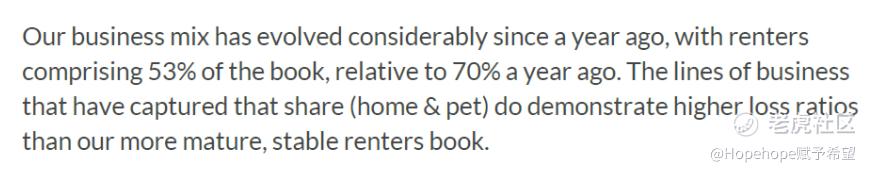

Another disappointing point is the increase in net loss ratio as well as gross loss ratio. This doesnt show an improvement in a falling level of loss ratio. See below for their explanation:

-

The question to think through is what is wrong with the AI and algorithm that led to the loss ratio in home/ pet ratio for it to grow in 3Q!

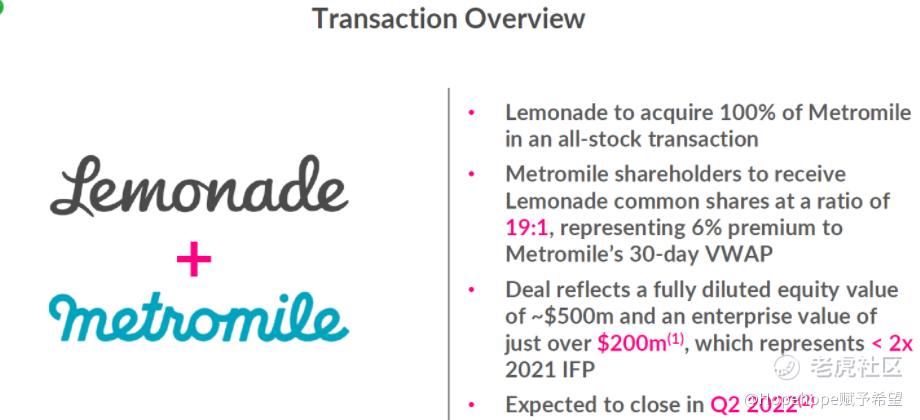

Another news caught my attention is Lemonade wanting to buy metromile. I can understand where Lemonade is coming from since they have launched car insurance recently so they do wish to expedite this part of the business to reduce unnecessary loss ratio as they scale up.

Nevertheless, my key concern pertains to the cash burn at Lemonade's various business lines and being left with around 300 million USD, I wonder if they would do another equity fundraising in the days to come.

I will watch the price action these few days following the results but I am generally not optimistic in the short run and will remain on the sideline. Do stay tuned to my youtube channel if you like to see if I have any change of view in the coming days.

My youtube channel if you are keen to find more research and analysis:-

https://www.youtube.com/channel/UCAPWOEQKCpCWmzKkdo7v-iw

As always, this should not be construed as any investment or trading advice.

精彩评论