Lets look at this new growth company today:

$SoFi Technologies Inc.(SOFI)$

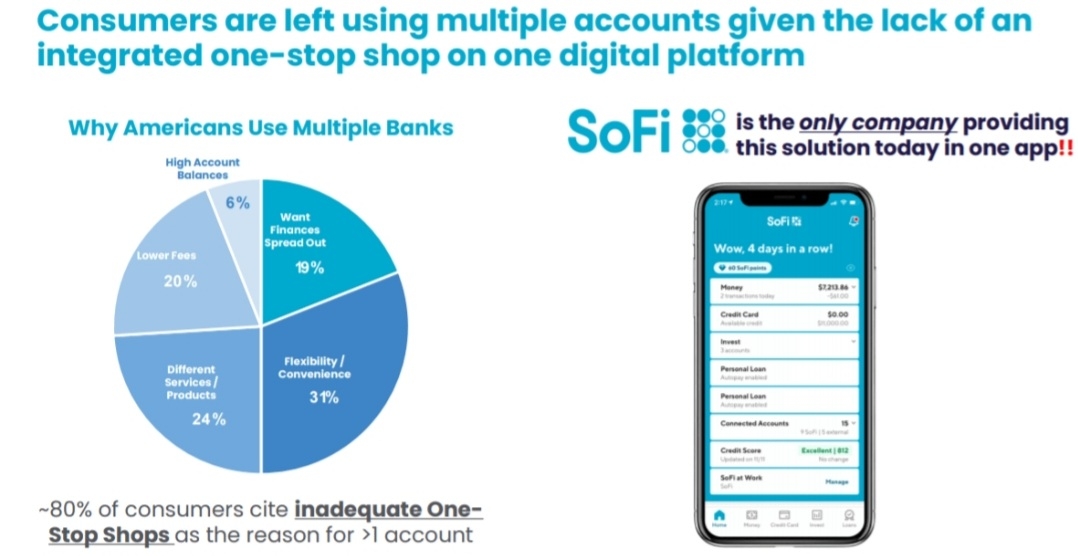

Sofi Tech is a new company which went public through a SPAC merger on June 1. Sofi is a disruptive player in the fintech industry. Sofi operates an online platfoem that offer all types of Loans (Mortgage, Student, Personal, Home Loans) as well as insurancr products it also has a investment platform for investors and offers many ETF.

Here are the key takeaways for this company:

-Currently the company is unprofitable due to high Operating Expense. However, I believe the company will be able to cover the operating expense in 2 years to come once their revenue and earnings are steadily increasing.

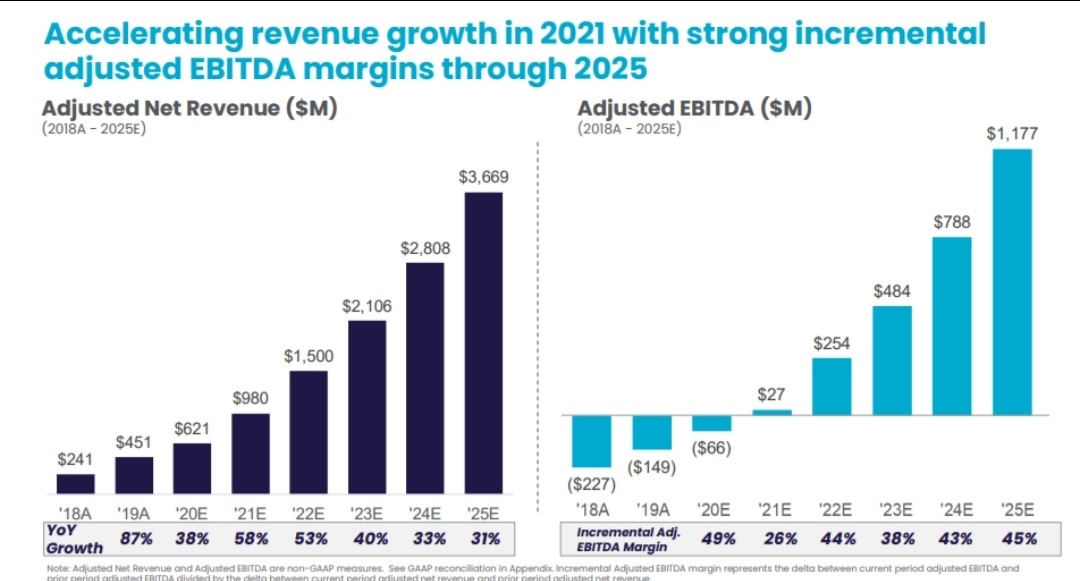

-Revenue is forecasted to grow more than 20% annualy in the next 5 years, and earnings are expected to turn positive by 2023

-Currently there is no dividends, which is very common among growth companies such as $Alphabet(GOOG)$and $Amazon.com(AMZN)$

-Current CEO's compensation for 2020 was 53 million USD. Which is too high compared to its peers company.

-Recently, softbank group has acquired a 14.82% stake in the company. The company has 35.5% of institutional investors which shows how much the company potential can be.

My personally opinion:

-This is a very speculative stock and it has not shown a proven track record. Bec the company is new.

-I feel the company has a potential to be a 10 bagger, which means the share price could soar up all the way to 200 USD from 20USD and a market cap of 180B.

-Will u invest in this speculative stock? Does it have a future in the disruptive and competitive fintech world? Only time will tell.

Let me know what u think in the comment box below!

精彩评论