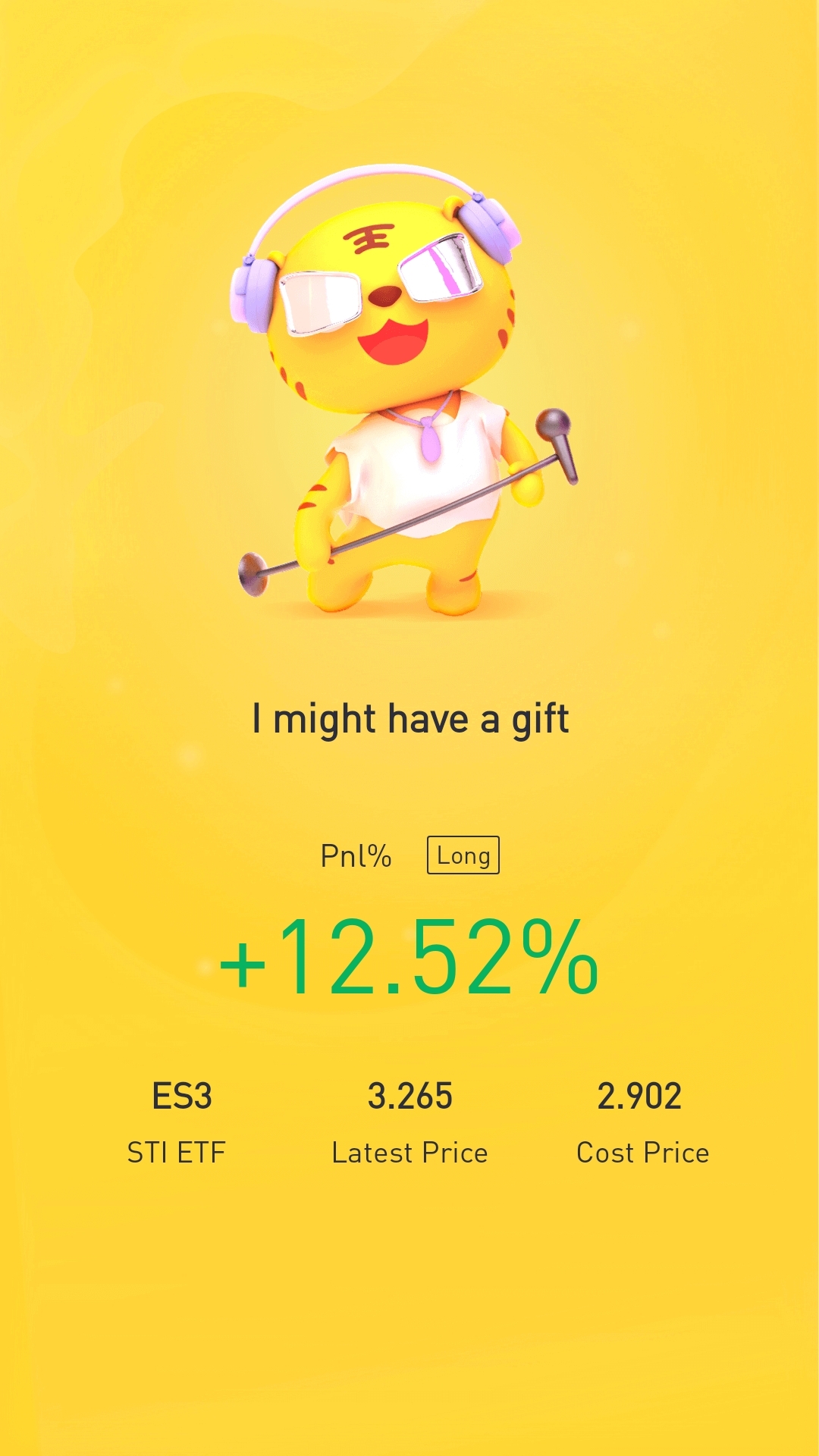

$STI ETF(ES3.SI)$If you are new to investing and have limited funds, then STI ETF would be a great choice. The STI ETF is a blue chip index that tracks the Top 30 of Singapore's largest companies listed in the Singapore Stock Exchange.

It is the oldest and largest STI ETF in Singapore, started in 2002 with Assets Under Management of SGD1. 6 Billion as at 13 October 2021.

As a bonus, you get the Top 3 local banks which takes up 40.9% of the index. The 3 local banks have just released their 3rd quarter earnings reports and they were excellent. UOB net profits jumped 57%, DBS 31% and OCBC 19%! Needless to say, STI ETF has also performed well lately too.

The best thing about investing in STI ETF is the dividends which is paid half yearly.

There are many naysayers who said that STI ETF is a laggard in performance compared to other ETFs. However to me STI ETF has a special place in my portfolio because I believe in the future of Singapore and want to be part of it. It is also tax free, no capital gains tax and no foreign currency risk exposure. Best of all, it gives better returns than putting money in a regular savings account.

精彩评论