Summary

- COVID-19 aided in the consumer acceptance of PDD's business model and is likely to continue doing so as it makes agriproducts more affordable and economically viable.

- Regulatory risk does not have a permanent impact on PDD's business model and may benefit from China's aggressive enforcement of anti-monopoly laws.

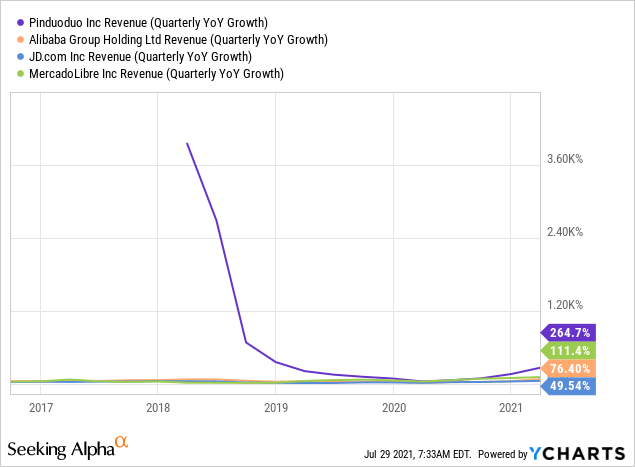

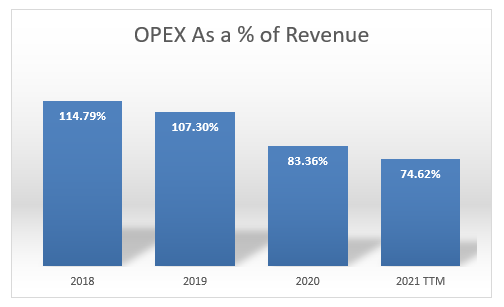

- PDD continues to strengthen its revenue streams, which have grown by 265 percent year over year and have an improving trend in terms of OPEX as a percentage of revenue.

Investment Thesis

Investors' fear of aggressive regulatory risk imposed on Chinese technology by the Chinese government has increased significantly after recent China's education crackdown. As a result, the price of Pinduoduo Inc. ($Pinduoduo Inc.(PDD)$ ) has fallen another 42% from its high last month. Such a risk is only temporary if proper rules are followed. PDD may also benefit from China's anti-monopoly measures in the future, as we will see a more balanced market share distribution among its competitors. With over 800 million active users and a network of 12 million farmers, its business model "Help the Farmers" has a lot of potential, as it has already surpassed Alibaba's ($Alibaba(BABA)$ ) and JD.com's ($JD.com(JD)$ ) user count. After years of investing in high-cost customer acquisition, PDD has reduced its long-term risk and is on track to earn profit in the next few years. PDD's strong revenue growth trend and position as a leader in agriculture e-commerce makes it worth catching in rock bottom.

E-Commerce in Agriculture: New Normal

Resulting from the safety and convenience of online shopping during the COVID-19 pandemic, consumers has shifted heavily to this mode of purchasing. PDD's business model has been strengthened and will continue to expand as Chinese farmers have not yet fully embraced E-commerce. By removing the middleman from the equation, the story becomes more affordable for consumers and more profitable for farmers. A win-win situation for both of the parties.

To further enhance its business model, PDD assists farmers in standardizing production in order to produce high-quality agricultural products and assists farmers in developing their own branding strategies through the use of their platform. Apart from continuing to improve its services, PDD is also investing in controversial plant-based meat. This could be an interesting catalyst for PDD, as the new product claims to aid in mitigating global warming and is generally more nutritious than traditional meat.

Strong Revenue Growth, But Little Margin Of Safety

With 800 million active users, PDD grew revenue by 265 percent year over year in Q1 2021, outpacing its competitors on this metric.

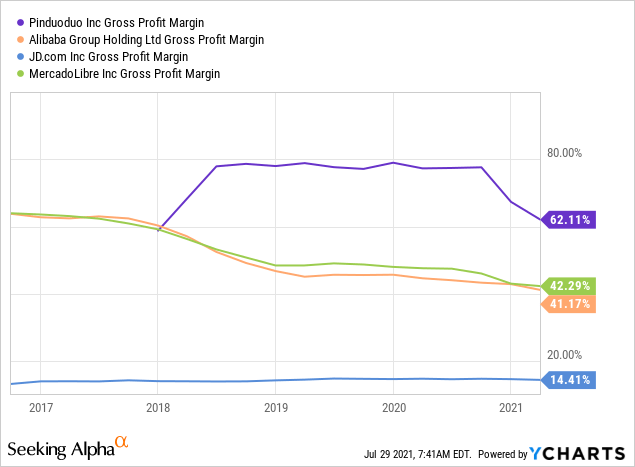

PDD generated a double-digit gross profit margin of 62.11 percent, a lot better compared to its peers. However, as a result of its high operating costs, PDD is having difficulty generating a profitable operating income. After examining its cost structure, PDD has decided to invest heavily in RandD in order to increase farmer operational efficiency and reduce their operating costs. Additionally, they are empowering their Duo Duo Grocery, which will focus on physical transactions. They asserted that it will continue to benefit the agricultural ecosystem while reducing carbon emissions associated with freight transportation.

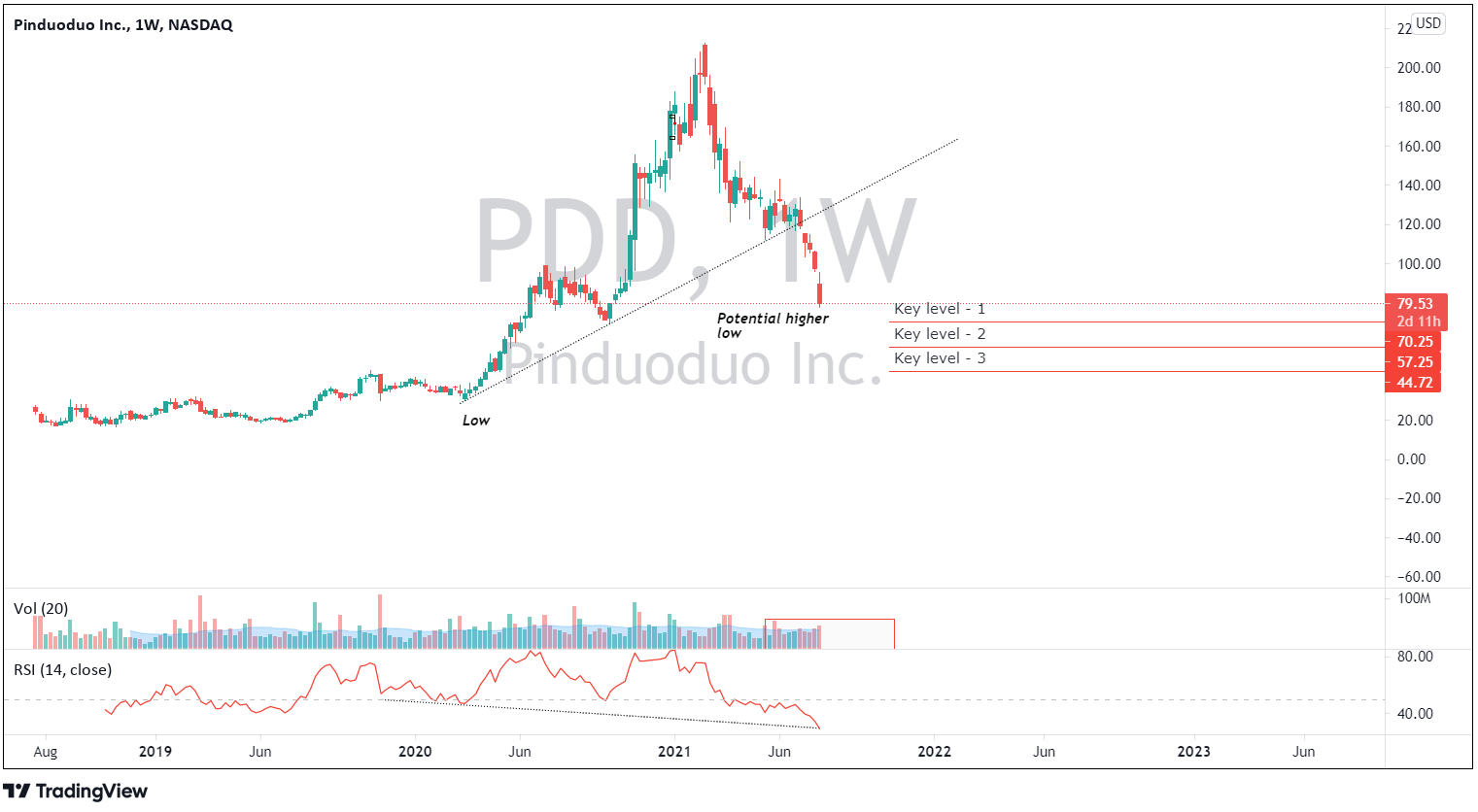

Going back to PDD's cost structure, the reason why I believe PDD has a chance to achieve a positive bottom line sooner is that their cost structure is constantly improving dating back from its 2018 figure. Using the analyst estimate for 2022 to support my investment thesis, PDD has a fair price of 91 per share at 204.29x earnings. As of now, there is little margin of safety, but below 45, investors can obtain it at a significant discount. However, until PDD achieves a successful turnaround in its operating income, the company faces a significant efficiency risk.

Price Action: Potential Bullish Divergence at Support Zone

Final Thoughts

Fear continues to spread among investors, making PDD's further drawdown remain possible. However, such regulatory risk results in temporary setbacks that can easily be circumvented by adhering to new rules. In my opinion, PDD's business model is exactly what the world needs, as it addresses larger societal issues such aspovertyand climate change. Long story short, I believe it will be a waste for PDD to not adhere to China's regulation. Another risk associated with investing in PDD is that the company's outstanding shares are constantly diluted to fund its costly technologicaladvancements. Investors, on the other hand, cannot ignore the what if scenario regarding PDD's bright long term opportunity. PDD is exhibiting early signs of a turnaround, making it a stock worth keeping an eye on.$Pinduoduo Inc.(PDD)$

精彩评论