Summary

- COIN reported strong Q2 results.

- Q2 affirmed our reasons to forget Bitcoin and buy COIN instead.

- We detail 3 reasons why in this article.

Back on May 20th, wetold investors to forget Bitcoin(BTC-USD) and buy Coinbase (COIN) instead. Recently, COIN reportedstrong Q2 resultswhich affirmed our thesis for choosing COIN over BTC. We detail 3 reasons why in this article.

#1. Agnostic To Cryptocurrency Winners

As management stated on theearnings call:

We 're agnostic about which assets are going to win, we really just want to support every asset that's legal for our customers. And we have a very rigorous process we've created on the compliance, and the legal and cybersecurity evaluation of these assets to make sure they comply with those standards, but once we get comfortable with that, we want to list various assets that meet those listing criteria... We want to be the Amazon of assets, list every asset out there in crypto that's legal. There are thousands of them today. There are eventually going to be millions of them.

With thousands of crypto assets today and the trajectory heading towards millions in the future, it is very difficult to pick which ones will emerge as long-term winners. While Bitcoin andEthereum(ETH-USD) havesignificant advantages today, it is hard to know for sure whether or not they will remain the top players in the crypto space in the future. Even if they do, it is hard to know how much higher their pricing will go as much of their future success is already priced in. With constant innovation and change in the space, both of these assets will face growing competition and the constant threat of disruption displacing them as the leading cryptocurrencies and eventually causing their value to fall.

Furthermore, Bitcoin in particular faces regulatory and even ban risks, as has already been seen in major countries likeChinaandIndia. Even the SEC Chairman recentlyreferredto the Crypto industry as the "wild west" and said it requires new laws to protect investors:

Right now, we just don’t have enough investor protection in crypto. Frankly, at this time, it’s more like the Wild West.

In contrast, COIN is diversified across an ever-growing list of cryptocurrencies, thereby insulating it against any single cryptocurrency's collapse. While Bitcoin and Ethereum still make up about 50% of their trading volume, they are losing share in COIN's trading volumes and over time will likely become much less significant in their overall trading volume. Even now, however, their revenues are more tied to the volumes of exchanges rather than the current price of these cryptocurrencies, which still gives them significant insulation against a crash in Bitcoin and/or Ethereum prices.

As the aspiring "Amazon"(AMZN)of crypto assets, COIN has an immense growth runway that is really just getting started. As early movers and size leaders, COIN has the network advantage to exploit its position and achieve dominant offering and customer scale in the exchange industry that could potentially give it a moat in what is an increasingly competitive industry.

#2. Profits Even When Cryptocurrencies Are Crashing

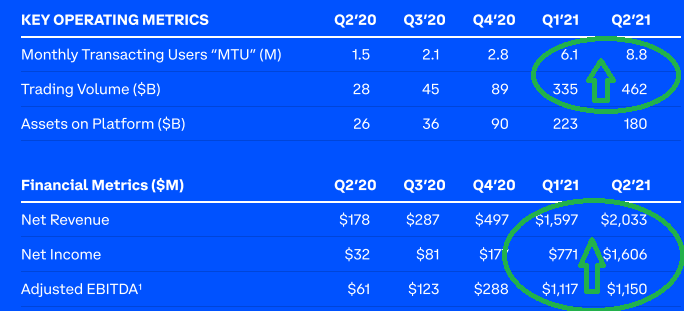

Q2 clearly demonstrated what we previously asserted: while Bitcoin's profit-loss proposition rises and falls directly with the price of Bitcoin, COIN's profits are not tied directly to rising cryptocurrency prices. Instead, it earns the majority of its profits from transaction fees, meaning that as long as there is high volume in cryptocurrencies, they will be making high profits.

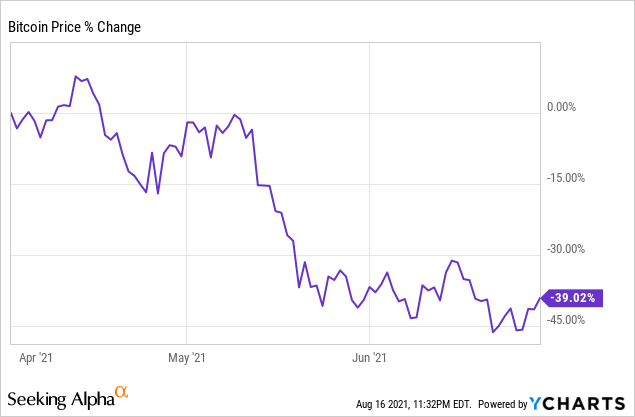

In Q2, Bitcoin's price plunged by 39%:

Meanwhile, COIN reported strong growth, with adjusted EBITDA rising sequentially and year-over-year on increased trading volume. While the dollar value of the assets on the platform declined during the quarter, that was overwhelmingly due to the declining price in cryptocurrencies and was unable to offset the company's strong growth in users, trading volume, and profits.

On top of that, unlike Bitcoin, COIN actually earns and retains significant amounts of profits. As a result, all things being equal with each passing day, COIN's intrinsic value will increase relative to Bitcoin's which is a non-cash flowing asset.

As long as cryptocurrencies are being used and exchanged, COIN is set to see its value continue growing over the long term, even if Bitcoin's price flounders.

#3. Diversifying Into Ancillary Businesses

Last, but not least, COIN's Q2 report showed that it is busy building a moat outside of its current no-moat exchange business by expanding into ancillary cryptocurrency service business.

For example, COIN isaggressively reinvestingits profits into creating the most valuable crypto ecosystem, similar to Amazon's Prime service, which will enable it to attract buyers and sellers even if its pricing is not the most attractive because the other value that it brings to the table is irresistible for most clients.

As management stated on the earnings call:

Instead of focusing on being the lowest-priced platform, we focus on providing the most value to customers through our custody, our security in storage, in addition to trade execution, which is critical for instruments like crypto. On the retail side, these services are bundled into our transaction fee. We're really competing though for these users based on the product suite. As we shared earlier, our users continue to further engage with the crypto economy in non-trading products like staking and earn. These types of services, new assets, new ways to engage with crypto are what attract users to Coinbase.

Additionally, COIN is making significant inroads into the institutional marketplace. Management sites their deep liquidity and integrated products suite along with their leadership in security and compliance. This was highlighted by management on the earnings call:

On our institutional side, we're seeing broad adoption... we now have 10% of the top 100 hedge funds measured by AUM as clients of Coinbase and engaging with the crypto economy...This is really a new theme that we're seeing, that more and more hedge funds are making the allocation of the crypto economy and engaging in multiple assets on our platform.

Moving forward, these trends should only accelerate asmanagement expectsmore than 50% of their revenue to come from sources other than transaction fees within 5 years. Businesses they are already advancing include a cryptocurrency cash-back credit card, a custody/vault business for institutions that use proprietary cybersecurity technology, and cryptocurrency loan and deposit accounts.

If it can continue to successfully execute on this initiative, it will be the dominant crypto infrastructure business and will profit from the increased use of crypto assets in the global economy. This could lead to an explosion in its revenues and profitability over the long term and richly reward investors at current prices.$Coinbase Global, Inc.(COIN)$

精彩评论