Just as the likes of e-commerce and cloud computing gaining traction in the structural growth opportunities, decarbonization has similar attributes that allow it to fall under the same category.

I attended the ESG Sustainability seminar conducted by $MANULIFE US REIT(BTOU.SI)$ ("MUST") yesterday.

It was an eye opening experience because of the limited knowledge I have on this topic yet it is one of the most pressing items we have in this world that is very much under-appreciated by investors.

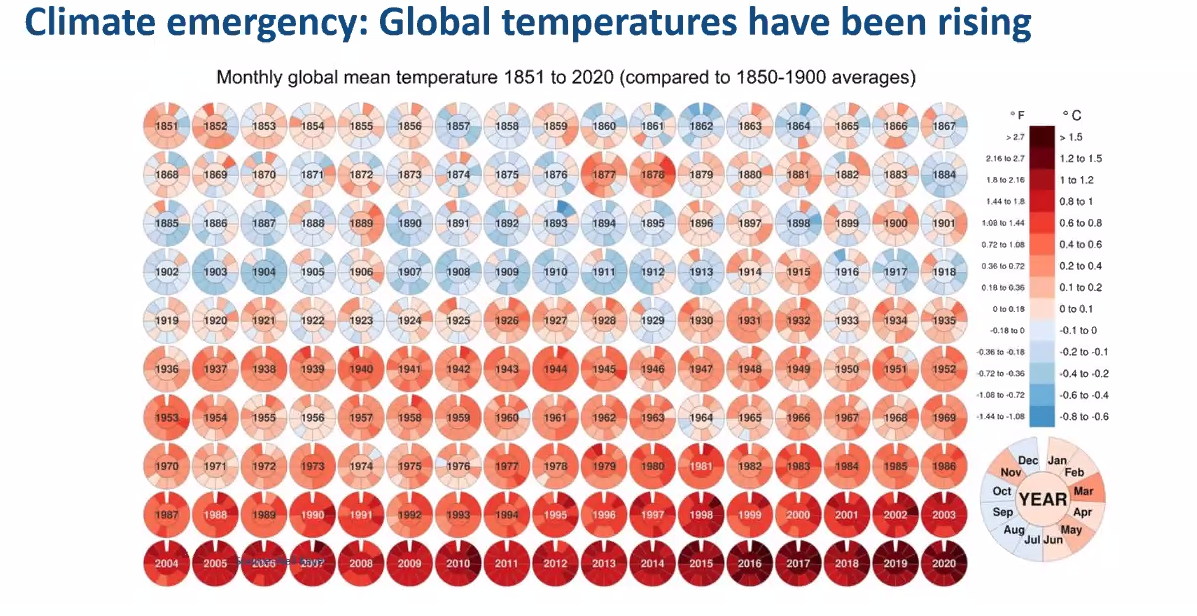

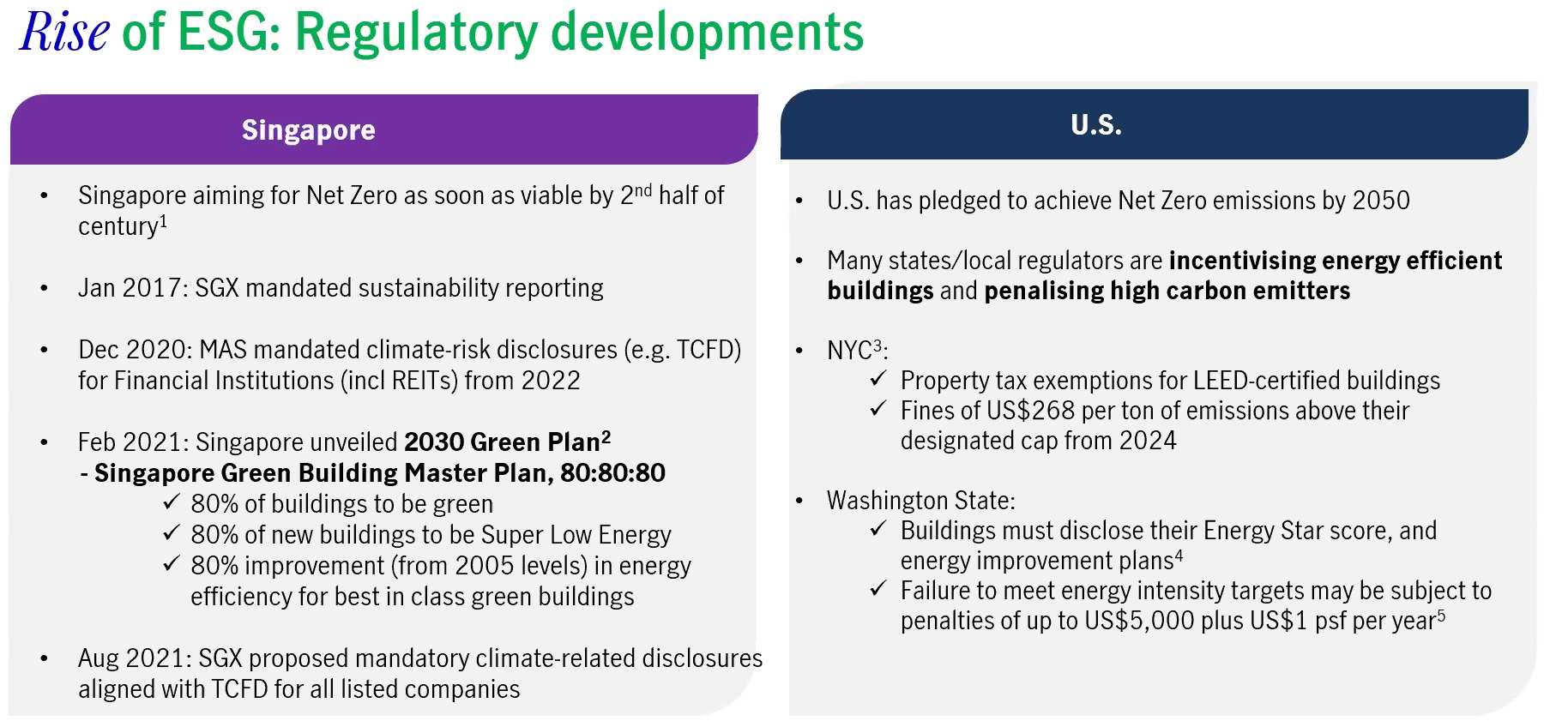

The world has known of climate change for quite a while now and as the world begins to see severe weather and temperature changes more rapidly for the past few years, it is now becoming a high priority pressing agenda which the G20 nation countries are starting to focus.

There are many nations, including major cities and respected companies who are pledging net-zero emissions.

One of them is Manulife REIT, and clearly from the way it has conducted their activities have shown just how much importance they have placed on this topic itself.

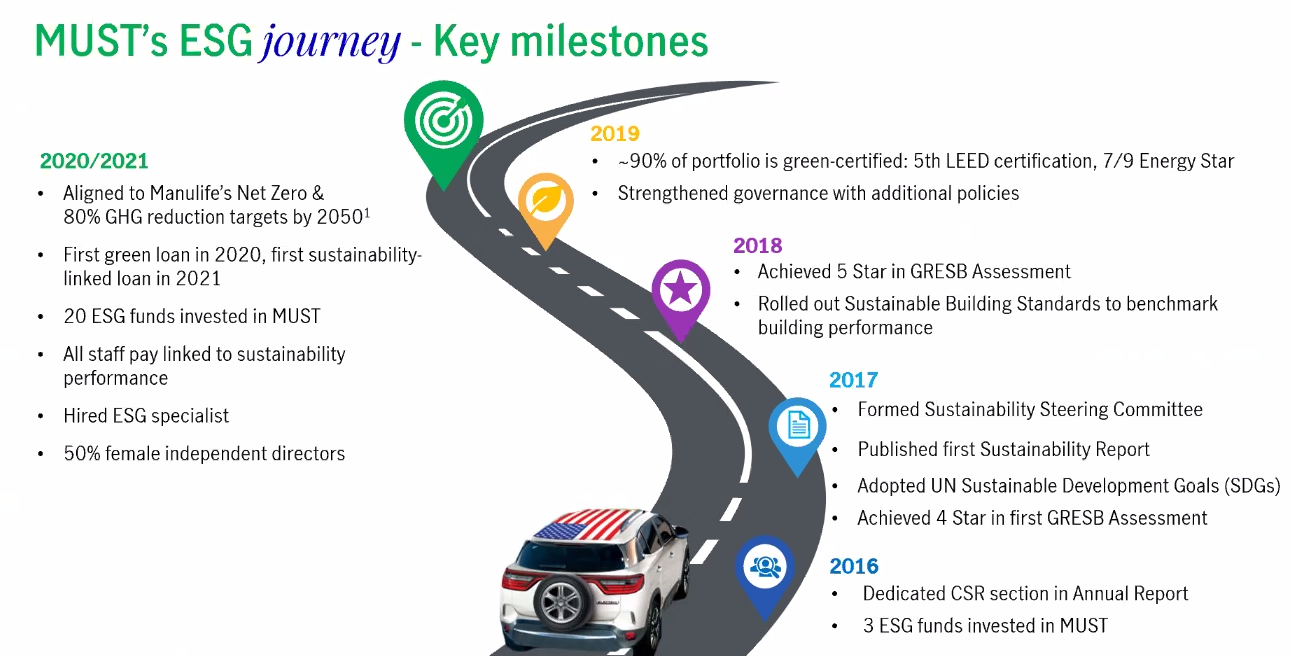

Manulife's journey started all the way as early as 2016 when they dedicated a CSR section in the annual report. In fact, they have well over 30 pages dedicated to the ESG segment in their latest 2020 annual report which is very comprehensive.

The company started to form a steering committee and since then they have rolled out frameworks and standards to comply.

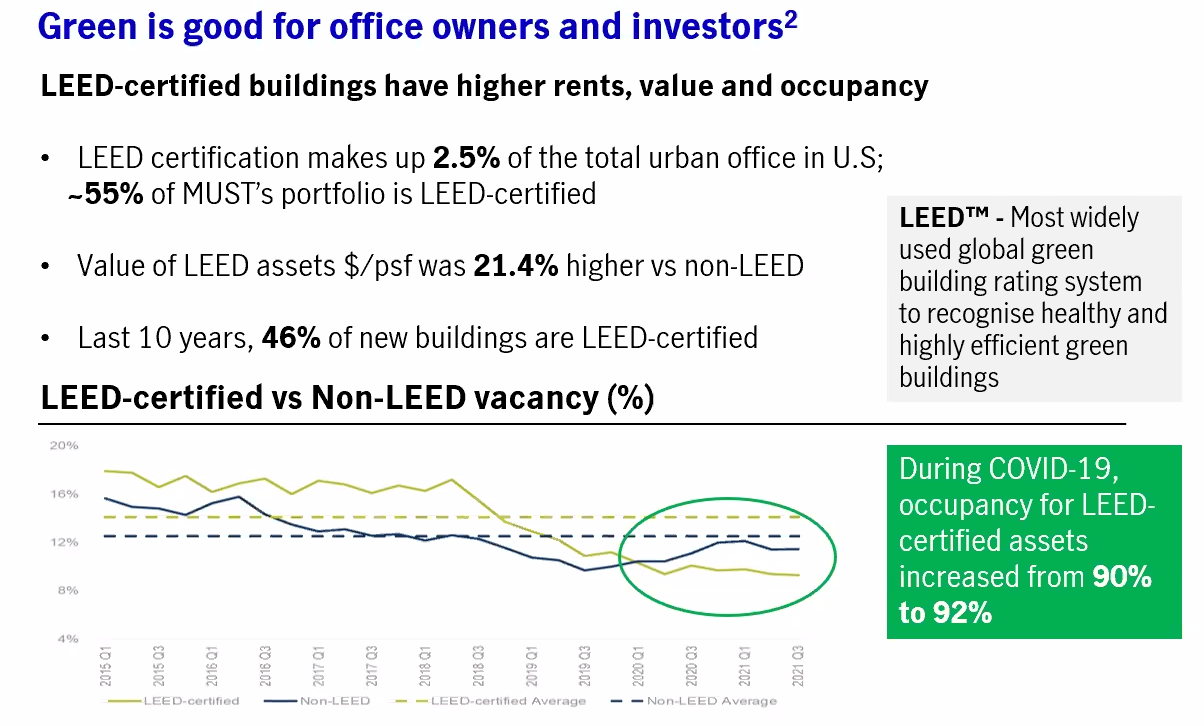

While major cities in the US have approximately 13% of the buildings that are complying to the ESG standards, 8 out of 9 MUST's properties are already in compliance.

Some, if not most of their properties are also awarded Energy and LEED Stars - a recognition which awards highly efficient green buildings.

There are evidence from the Fidelity Research that LEED-certified buildings tend to attract better quality of tenants, which corresponds to higher rents, value and occupancies over time.

In fact, in one of the studies shown, the value of LEED assets from a $ / PSF was 21.4% higher than non-LEED assets.

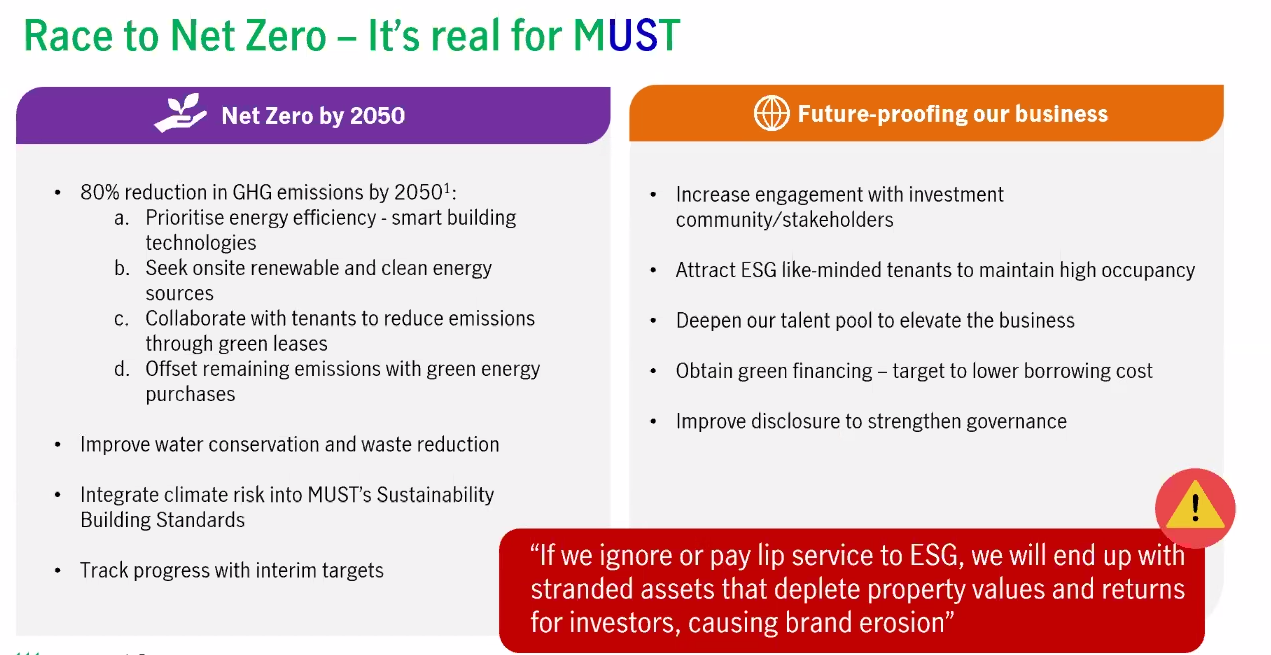

The race to net zero is now a priority for MUST, as with many other companies.

The goal is to have a 80% reduction in the GHG emissions by 2050 through prioritising energy efficiency and clean energy sources.

There are also increasing emphasis on regulatory reporting framework over time which will place importance on companies disclosing on the clean energy emissions and usage.

With this small step, we hope the world will become a much cleaner and energy efficient place to be in and investors along with our next generation can benefit from it.

精彩评论