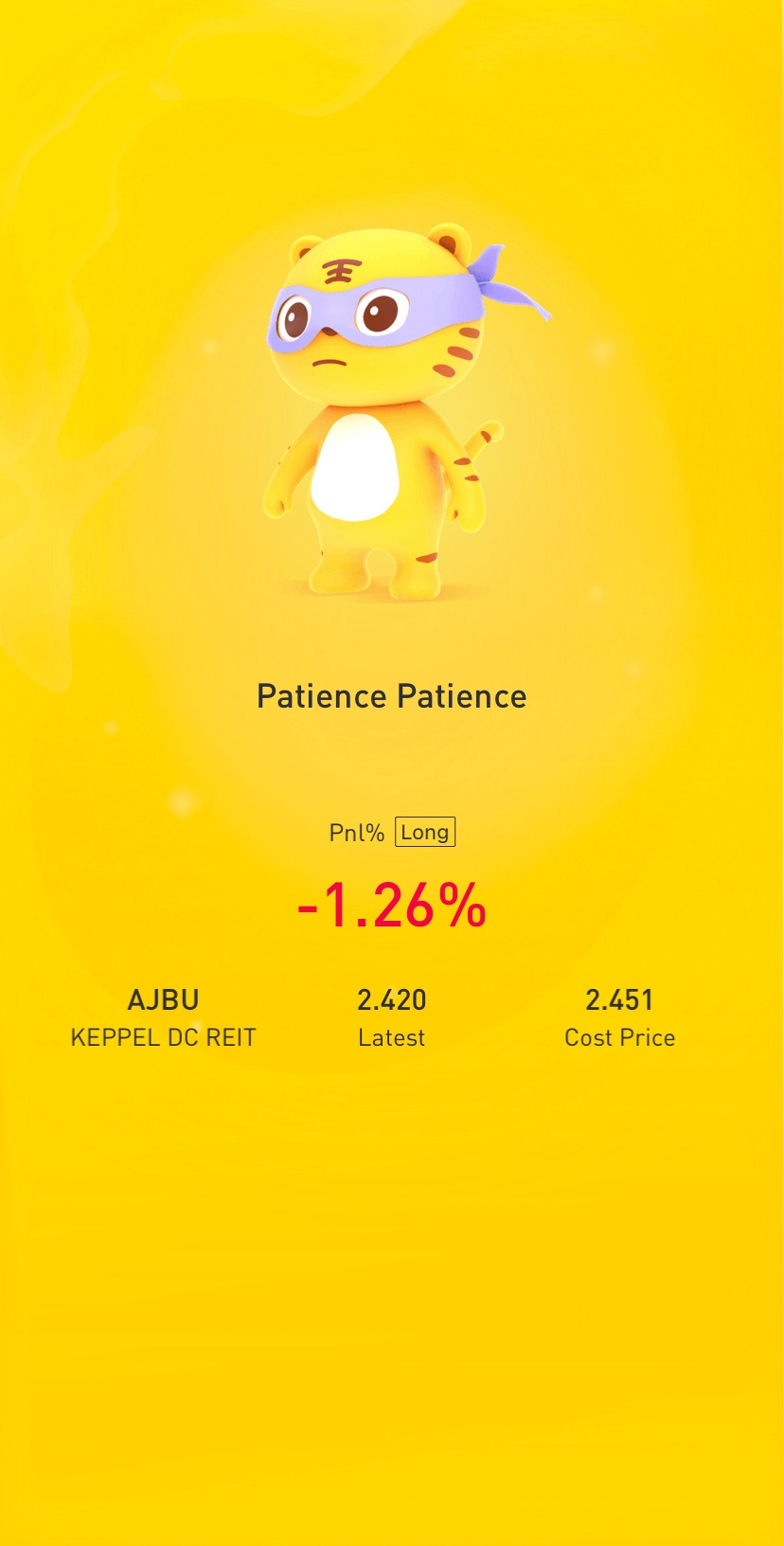

$KEPPEL DC REIT(AJBU.SI)$So… the relationship between how attractive REITs is compared to high quality bonds such as those issued by treasury… the result of tapering and raising of interest rates are:

1) Fed tapers bond buying -> bond yield rises because less buyers, so yields go up to attract more buyers.

2) Bonds guarantee capital, so safer than REITs, more people buy bonds instead of REITs.. REITs price drops

3) Feds raise interest rates -> Debt servicing becomes more expensive.. REITs borrow to finance their property acquisition.. so rising interest means more income needed to pay down the interest..means less overall income for distribution to shareholders means drop in dividends payout and REITs becomes less attractive

So… with the upcoming tapering and the potential rise of interest rates by the feds.. will we see adecline in REITs prices? ![[Thinking]](https://c1.itigergrowtha.com/community/assets/media/emoji-061-thinking.eba47008.png)

精彩评论