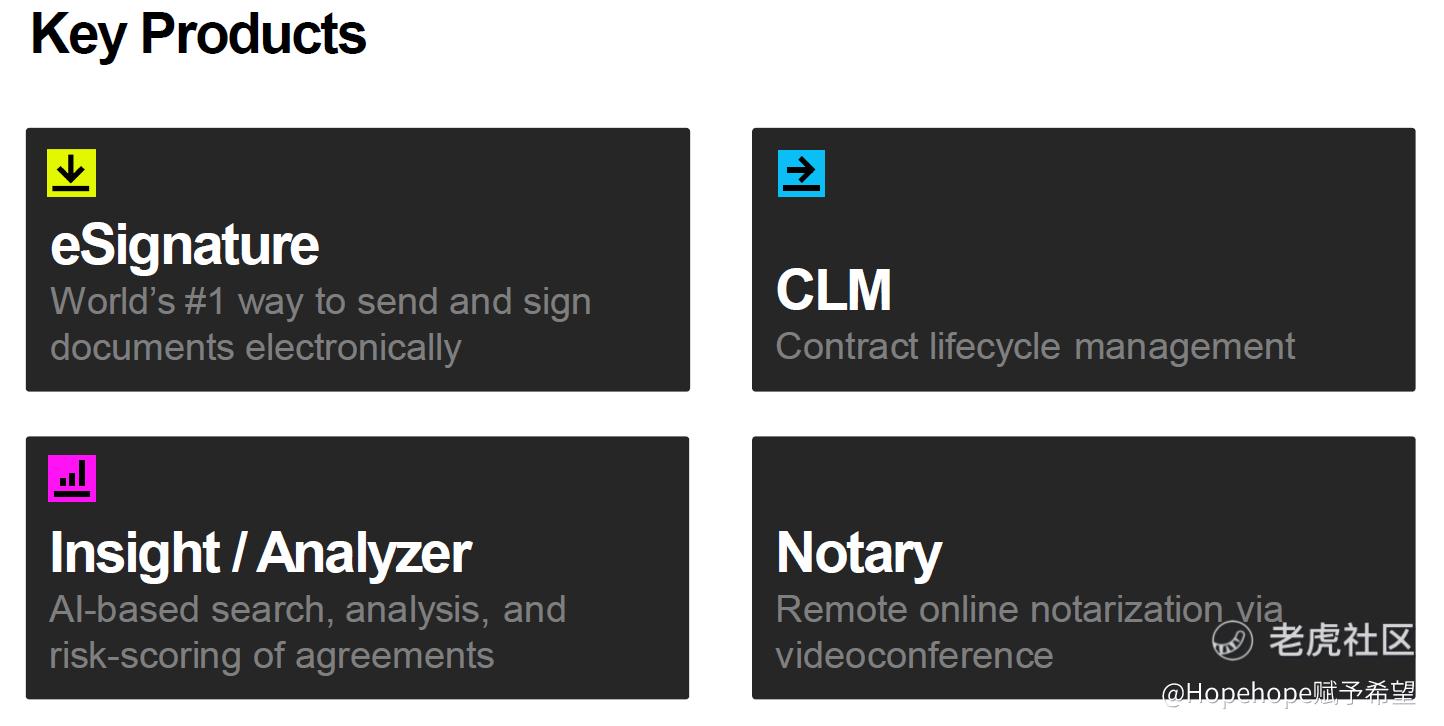

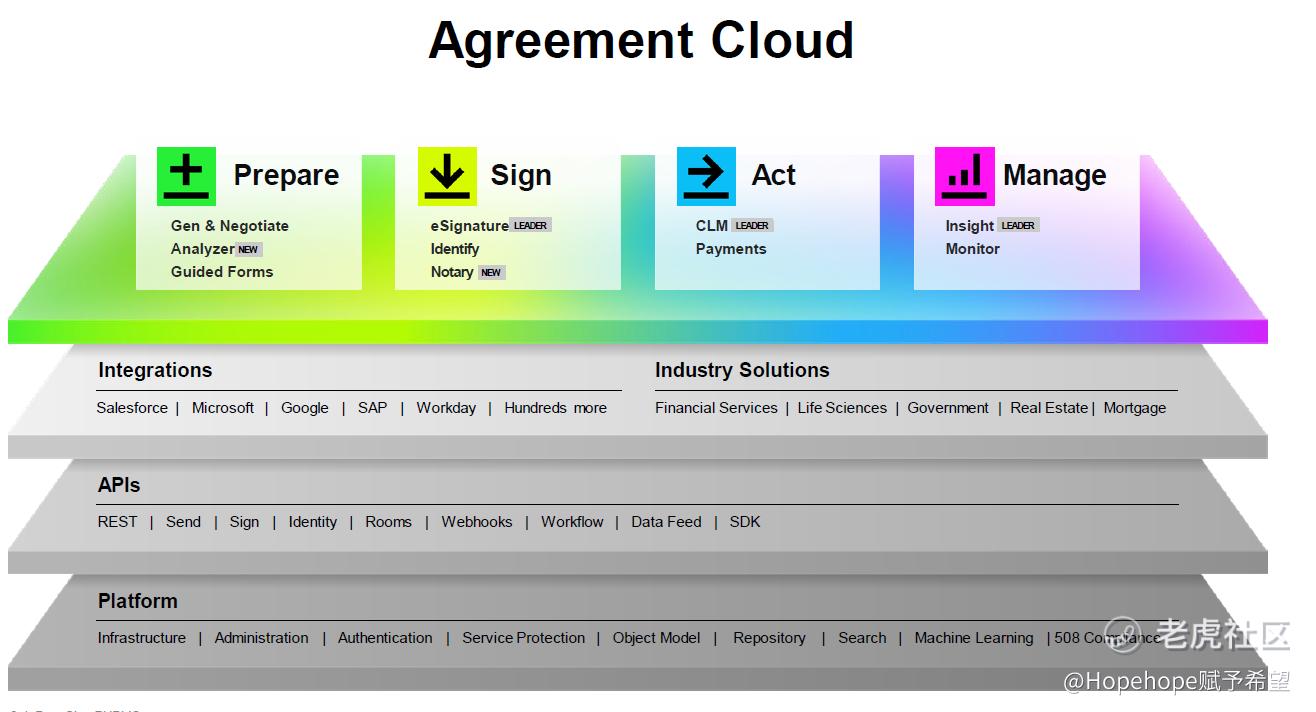

Docusign is one company that I do like its business model. It basically takes away the mundane things and to do list away from the core work. Its key products include eSignature, CLM, AI-based search of typical contracts and online notarisation without having to go down to the physical office. Isnt it incredible? Well naturally there is competitor like Adobe on the esignature business. Will they pose a threat? This is a question that we have to continue to investigate and answer in the future.

So what draws me to Docusign? Well indeed, it is the incredible price movement that saw it jumping from around 190 USD to around 310 USD recently? Am I late in the game? Well yes and no I would say. There simply isnt the need to rush into the acquisition of Docusign shares now. I would wait for pull-backs if it ever happens but should it continue to go up, I will be happy to sit out of this investment.

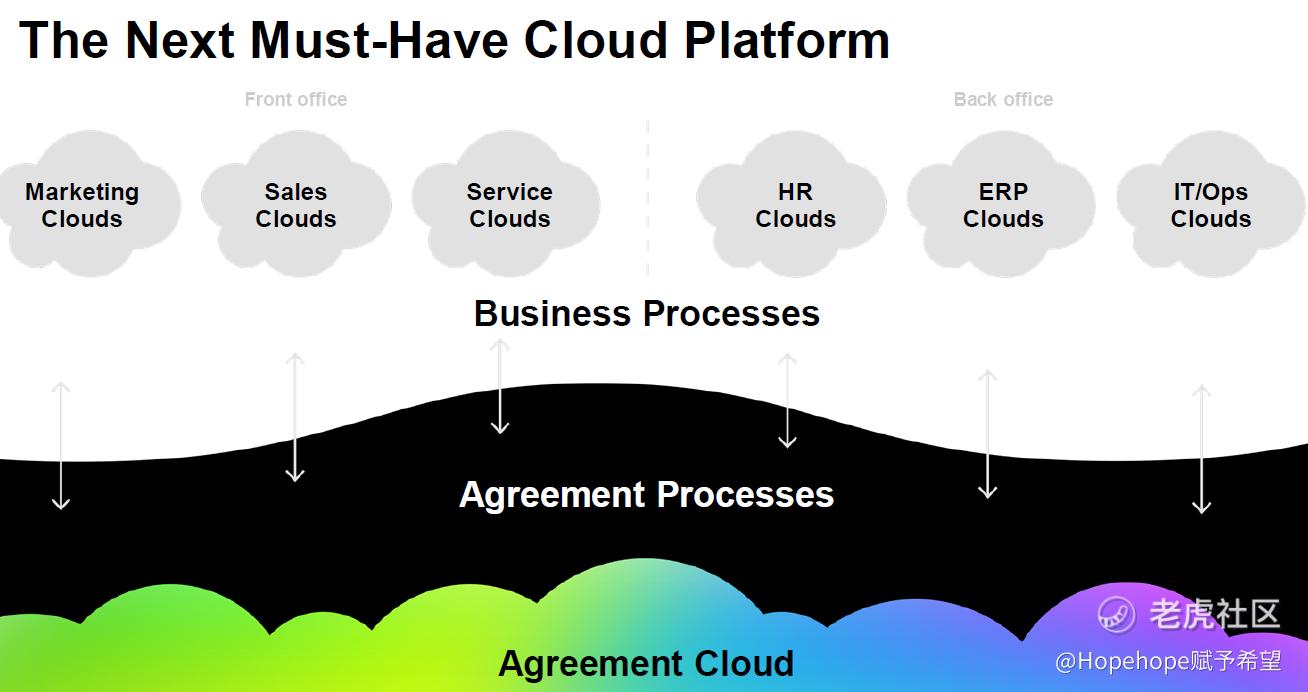

Operating its cloud platform and facilitates the management of contracts, it did score a number of corporate clients as can be seen in the following diagram:-

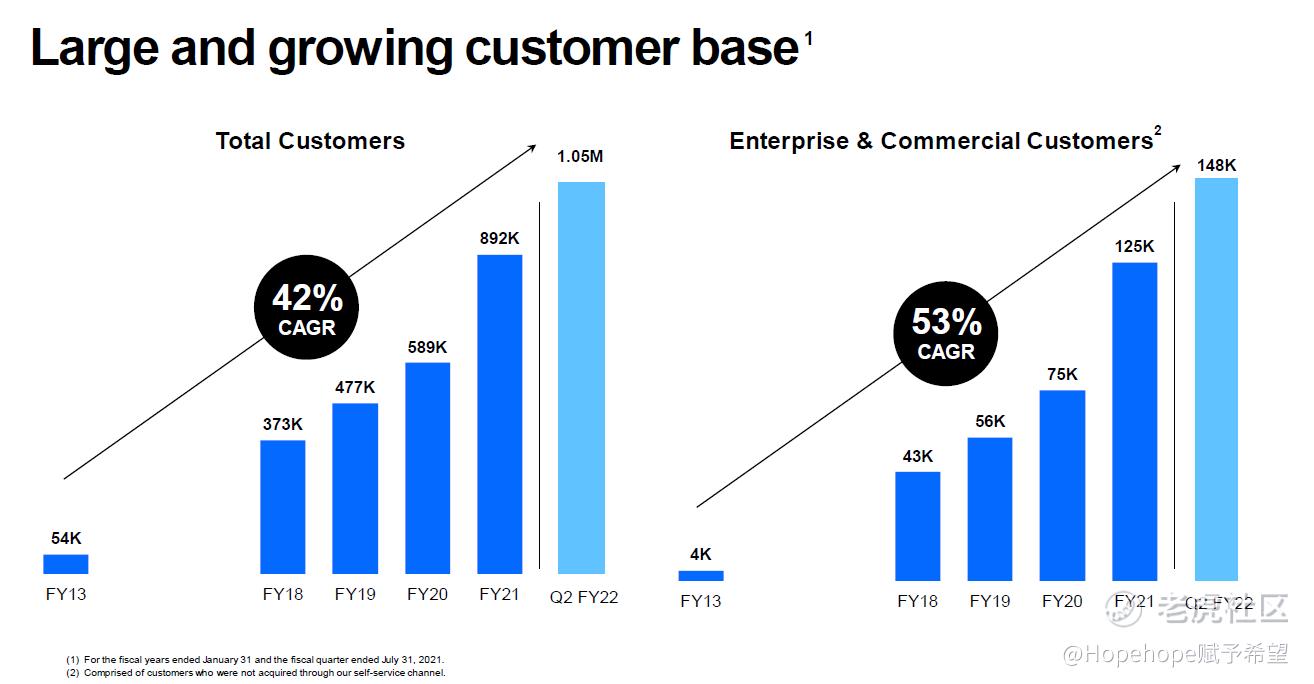

Docusign maintains that its total adddressable market is around 50 billion USD, which is many times its current yearly revenue. Given its fast growth per quarter and on annual basis, I do think this may be to a great extent true. The question is how much of this big pie that it can acquire?

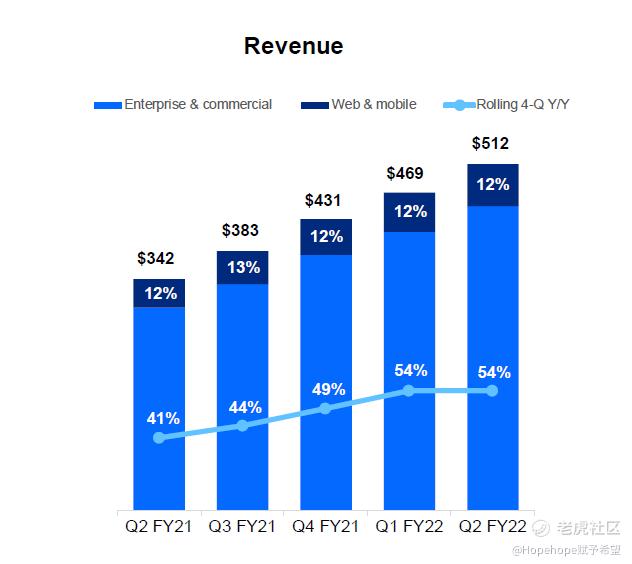

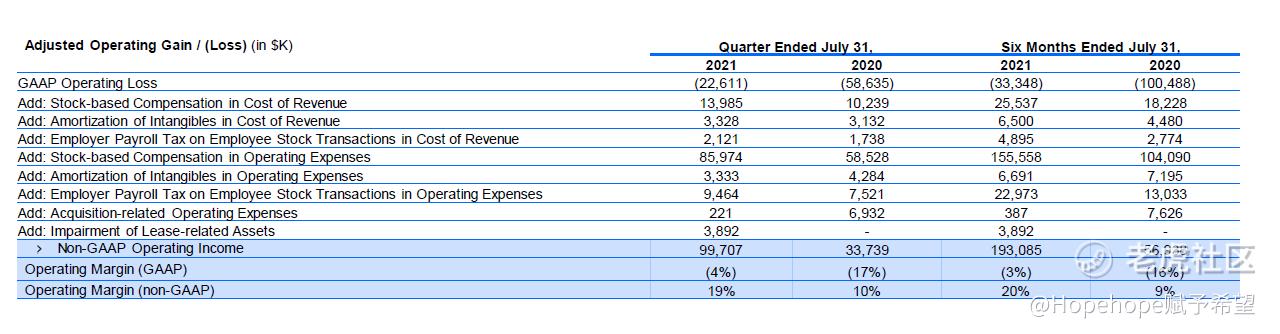

So far, its revenue is growing fast and billing is made fast too. With a high gross margin and declining operating profit, there are some attractions in this stock should the price falls in the future due to general market environment.

However, stockbased compensation being excluded from non GAAP income is not a concept that I really agree with given the growing headcount in this organisation to further expand its revenue base.

Having IPO at 38 USD if I did not remember wrongly, this stock has appreciated by over 600% in less than 3 years, which is a very good feat. At a market capitalisation of 60 billion USD, I really dont think there is a need for me to rush into this counter. Wait for price pullback would be a better game for me.

$Adobe(ADBE)$ $微软(MSFT)$ $亚马逊(AMZN)$ $Cloudflare, Inc.(NET)$

https://www.youtube.com/watch?v=A1zvlSel8Cs (short term China A50 outlook)

https://www.youtube.com/watch?v=1Gd-0oR5KEg&t=3s (short term tin price outlook)

https://twitter.com/Hopehope_G_hope

As always, the above should not be construed as any investment or trading advice.

精彩评论

I think a bit risky to buy Docusign now. Price too high