Why the Russell 1000 Growth Index is better than the S&P500 Index?

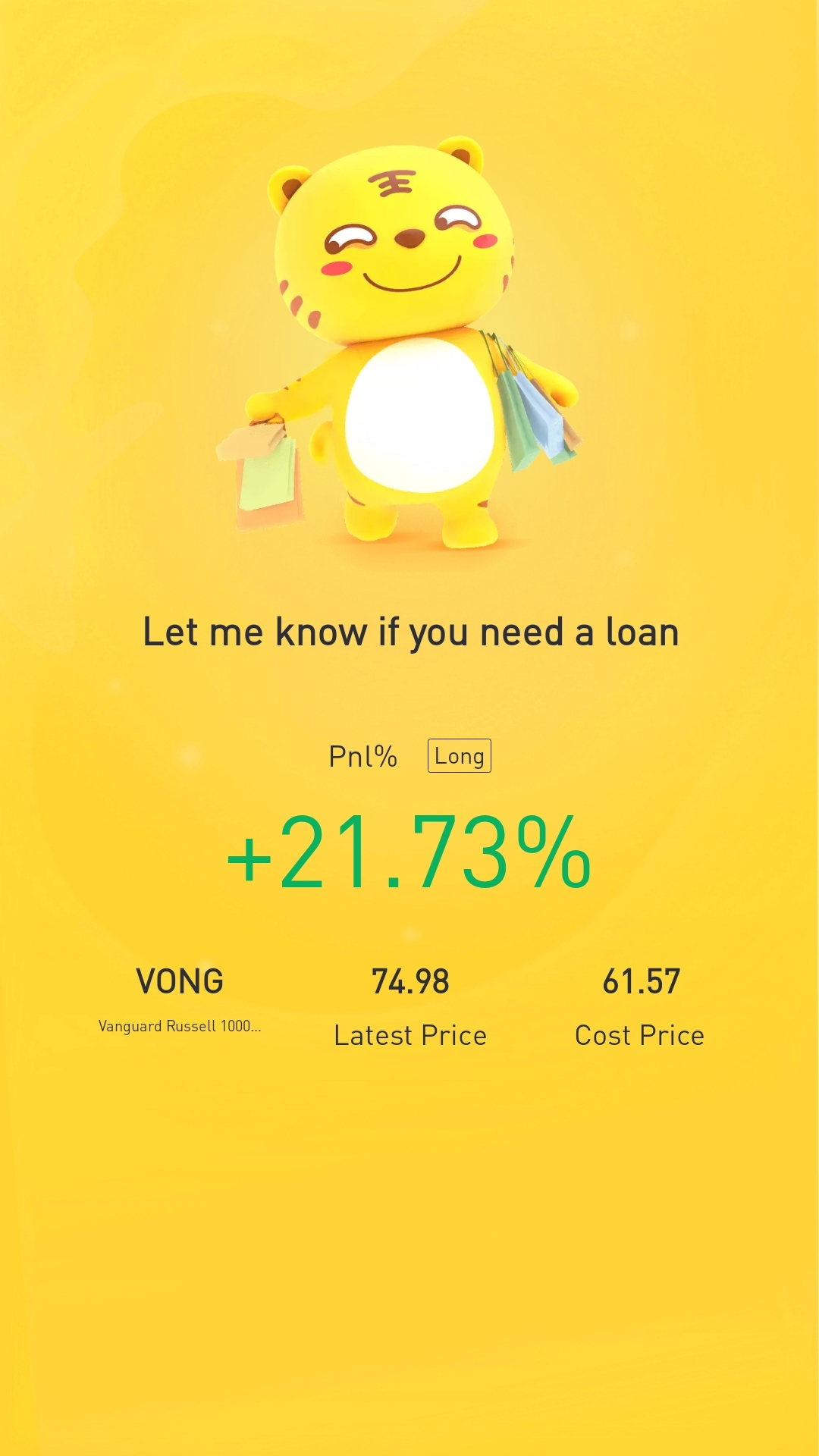

$Vanguard Russell 1000 Growth Index Fund ETF Shares(VONG)$

Here are my key takeaways:

●Rusell 1000 Growth Index has returned 19.32% annually for the past 10 years, while S&P500 has only returned 16.30%

● While the S&P500 is more diversified among sectors, Russell 1000 Growth Index has 47% in Tech Stocks. More tech stocks= More high growth

●While the Russell 1000 growth only has a 10 yeat record, I personally think that it deserves a spot in your portfolio. 1000 top companies in the US, what could go wrong?

● Buffet only made 20% a year, and if U can invest in Russell 100 Growth index which gives you 19%, you will surely be as rich as Warren Buffet

Comments by me:

Do diversify your portfolio with some #VONG!

It does not have a long track record, but I am sure it may outperform the S&P500 in the long run.

精彩评论