$Palantir Technologies Inc.(PLTR)$ Of late, PLTR has been under heavy selling pressure. Not too long ago, it was a hype stock. Today its trading below $20. Are there still steam in it or its a pure value trap from now on.

To me, PLTR has a very unique business model. It has its competitive edge especially on areas which is under the government contracts. But expanding this to commercial is where the challenge is. And are they able to scale to the level which investors is looking for. Of late, certainly market analyst don't think so.

Some background and also relook at their Q3 result

Palantir Technologies is a public American software company that specializes in big data analytics. Headquartered in Denver, Colorado, it was founded by Peter Thiel,Nathan Gettings, Joe Lonsdale, Stephen Cohen, and Alex Karp in 2003. The company's name is derived from The Lord of the Rings where the magical palantíri were "seeing-stones," described as indestructible balls of crystal used for communication and to see events in other parts of the world.

The company is known for three projects in particular: Palantir Gotham, Palantir Metropolis, and Palantir Foundry. Palantir Gotham is used by counter-terrorism analysts at offices in the United States Intelligence Community (USIC) and United States Department of Defense. In the past, Gotham was used by fraud investigators at the Recovery Accountability and Transparency Board, a former US federal agency which operated from 2009 to 2015. Gotham was also used by cyber analysts at Information Warfare Monitor, a Canadian public-private venture which operated from 2003 to 2012. Palantir Metropolis is used by hedge funds, banks, and financial services firms. Palantir Foundry is used by corporate clients such as Morgan Stanley, Merck , Airbus, and Fiat Chrysler.

Palantir's original clients were federal agencies of the USIC. It has since expanded its customer base to serve state and local governments, as well as private companies in the financial and healthcare industries.

Summary of the main products

Palantir Gotham is a predictive policing system.

Palantir Metropolis (formerly known as Palantir Finance) was software for data integration, information management and quantitative analytics. The software connects to commercial, proprietary and public data sets and discovers trends, relationships and anomalies, including predictive analytics.

Palantir Apollo is a continuous delivery system that manages and deploys Palantir Gotham and Foundry. Apollo was built out of the need for customers to use multiple public and private cloud platforms as part of their infrastructure. Apollo orchestrates updates to configurations and software in the Foundry and Gotham platforms using a micro-service architecture. This product allows Palantir to provide software as a service rather than to operate as a consulting company.

Palantir Foundry was used by NHS England in dealing with the COVID-19 pandemic in England to analyze the operation of the vaccination program.

Q3 21 Result

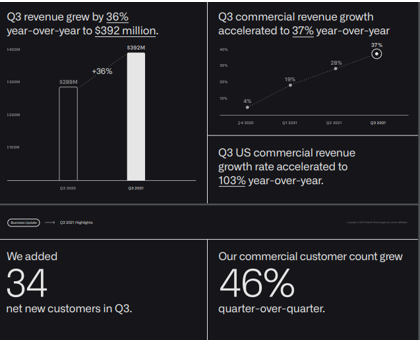

· Total revenue grew 36% year-over-year to $392 million

· Added 34 net new customers in Q3

· Commercial customer count grew 46% quarter-over-quarter

· US commercial revenue grew 103% year-over-year

· Cash flow from operations of $101 million, representing a 26% margin

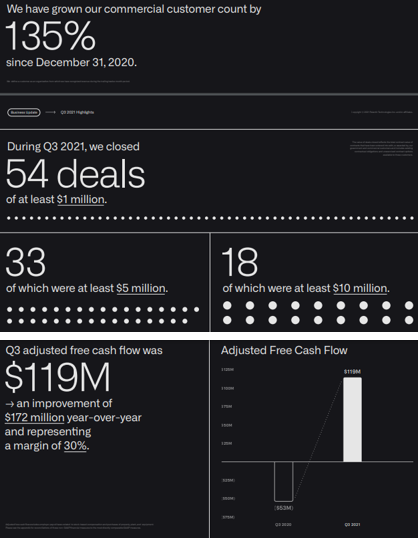

· Adjusted free cash flow of $119 million, representing a 30% margin

· Closed 54 deals of $1 million or more, of which:

o 33 deals are $5 million or more

o 18 deals are $10 million or more

· Total remaining deal value grew 50% year-over-year to $3.6 billion

· GAAP net loss per share, diluted of $(0.05)

· Adjusted earnings per share, diluted of $0.04

For Q4 2021, outlook

· $418 million in revenue.

· Adjusted operating margin of 22%.

Personally, I am positive on the long term outlook and continue to stay vested for long term. The business continued to stay relevant and have a competitive edge over others. There may be some up and down moving forward, but I see it as opportunity to accumulate more. For sure this will be part of my portfolio for capital growth. But will have to follow the business development of the company actively, as the business they are in can change very fast. My plan is to gain capital through growth stock, and progressively switch capital gain to dividend stock in preparation for retirement.

Happy investing to all and hope that you too can achieve your investment objective.

Remember, its time in market and not time the market. @TigerStars

精彩评论