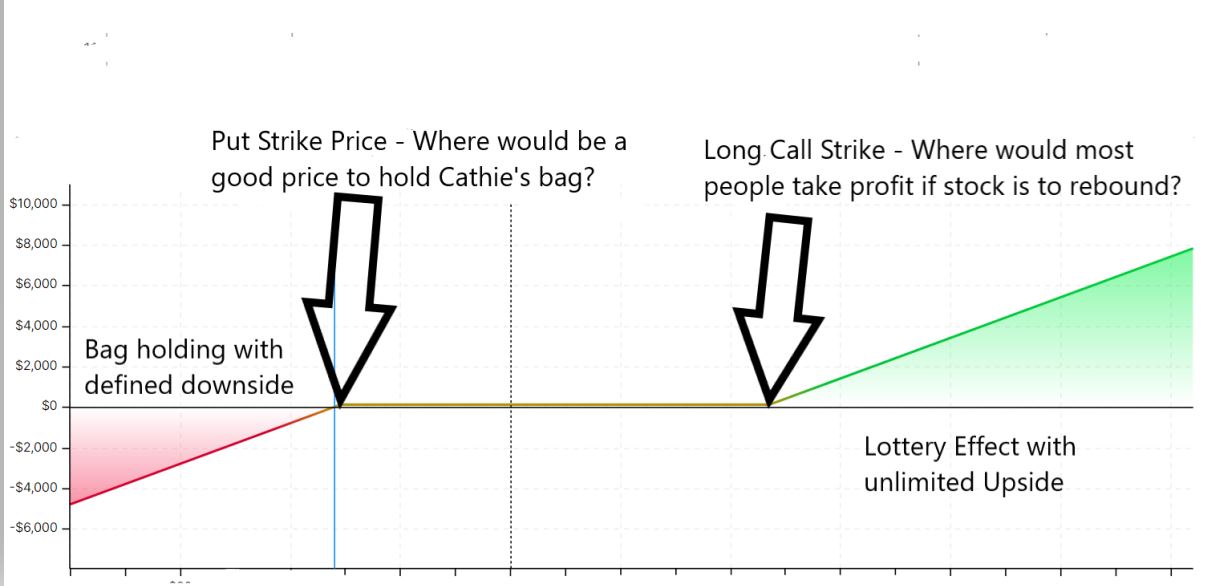

I would trade an option combo given all that has happened and about to happen going forward.

Given ARKK would most likely drop in the coming weeks and months. Where would be a good

entry price after the stock has corrected? That would be my short PUT Strike.

If ARKK is to rebound. Where is the most likely exit price where most traders would take profit? The answer is pretty obvious from the chart. That would be my long CALL Strike.

The SHORT PUT would pay for the LONG CALL and it would still be a net credit trade. It is always nice to be paid to take on a trade. Of course there is collateral to be paid upfront for the

SHORT leg of the COMBO.

1 year maturity for everything to pan out. Remember also the combo can be closed out for a

profit if prices move up. Even if the unthinkable happens and ARKK continues to tank, the worst that can happen is I would be buying ARKK at my most desired discounted price. In other

words, a price which I won't mind holding Aunt Cathie's bag. ![[开心]](https://c1.itigergrowtha.com/community/assets/media/emoji_002_kaixin.d4dce72e.png)

Profit and Loss of trade at Maturity:

精彩评论